- Unchained Daily

- Posts

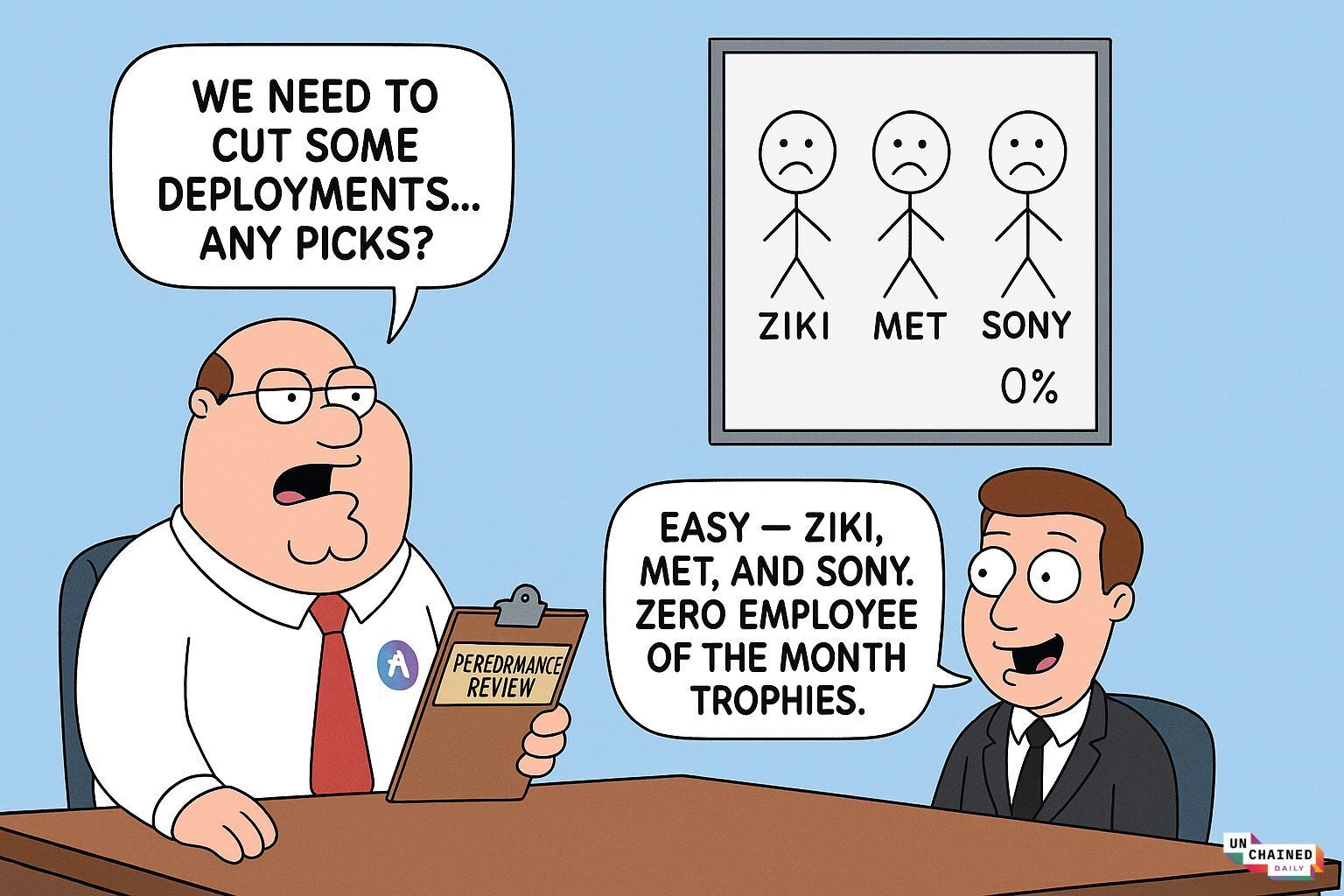

- Aave DAO Rethinks Multichain Expansion Strategy

Aave DAO Rethinks Multichain Expansion Strategy

Plus: 🪐 Astria Network shuts down, 📺 Kalshi partners with CNN.

Hi! In today’s edition:

🏦 Aave considers winding down several low revenue multichain deployments

🪐 Astria Network shuts down its Celestia based shared sequencer

📺 Kalshi partners with CNN to integrate prediction market data

🎧 Bits + Bips breaks down market volatility and Vanguard’s crypto shift

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

Aave DAO Rethinks Multichain Expansion Strategy

The Aave DAO is considering a governance proposal to scale back its multichain strategy by winding down some of its lowest‑revenue deployments on certain chains.

The temp‑check proposal “Focussing the Aave V3 Multichain Strategy,” authored by ACI, calls for a complete wind-down of Aave V3 instances on zkSync, Metis, and Soneium.

Each of these deployments generates between $3,000 to $50,000 in yearly revenue. By contrast, Aave’s largest deployment on the Ethereum mainnet brings in $142 million and represents the majority of protocol revenue.

“Over time the multichain expansion strategy has seen mixed results…it has not been the total success which it was hoped to be,” noted ACI.

Also, the proposal aims to establish a “clear $2,000,000 annual revenue floor for new instance deployments.”

Moreover, it calls for increasing the reserve factor for underperforming instances like Polygon and BNB Chain that generate less than $3 million in revenue.

So far, all voting on the temperature check has been unanimously in favor of implementing the proposal.

Tune in to Unchained On Air today for 2 shows!

At 3pm ET, Uneasy Money hosts Kain Warwick, Taylor Monahan, and Luca Netz discuss Hyperliquid’s HIP-3 upgrade, Kalshi’s launch of tokenized prediction contracts, instant unstaking from Coinbase, Infinex’s sonar token sale, and more.

Then, at 4pm ET, guest host Christine Kim, host of the Ready for Merge podcast, chats with Ethereum Core Developer Preston Van Loon to discuss today’s Fusaka upgrade.

Celestia Project Astria Network Shuts Down

Astria Network, a Celestia-based project developing a shared sequencer for rollups, has shut down its development firm and sunset its shared sequencer network.

“The Astria network has been intentionally halted, block number 15,360,577 is the last block,” wrote the Astria team in a post on X.

The decision to shut down was made official by co-founder Josh Bowen last month, while some users were clued into signs of the project’s difficulties when Astria shared plans to shut down its Celestia validator in August.

Astria raised a combined $18 million across seed and strategic rounds, including $5.5 million in April 2023 from investors like 1kx, Delphi Ventures, and Figment Capital, followed by a $12.5 million round led by dba and Placeholder VC.

The network aimed to replace centralized sequencers with a permissionless, shared system for multiple rollups, offering features like lazy sequencing, fast CometBFT confirmations, and atomic cross-rollup composability.

Kalshi Partners With CNN to Integrate Prediction Market Data

Major broadcasting network CNN has partnered exclusively with prediction market platform Kalshi to integrate its real-time data into CNN's television, digital, and social media programming.

Kalshi's prediction market data, covering politics, current events, culture, and weather, will appear on CNN broadcasts via a live data ticker and API access.

CNN's chief data analyst Harry Enten will lead the integration, using the data for on-air analysis, fact-checking, and reporting across TV and CNN's streaming service.

“Kalshi’s data will serve as a powerful complement to CNN’s reporting,” said Kalshi in a statement, recalling how the platform called the New York City Mayoral election eight minutes after polls closed and hours before the media.

The news comes as Kalshi announced a $1 billion raise at an $11 billion valuation, saying its weekly trading volumes surpass $1 billion.

Bits + Bips: Vanguard’s Crypto U-Turn, Tether/MSTR FUD & Picking Future Winners

A brutal selloff and a rotation into value. But then Vanguard comes in to send bitcoin soaring.

Monday’s selloff rattled the entire market—Bitcoin, equities, commodities, you name it.

But beneath the volatility, something more structural may be happening.

In this week’s Bits + Bips, Austin Campbell, Ram Ahluwalia, Chris Perkins, and B+B OG previous host Alex Kruger break down one of the most confusing macro weeks of the year. They debate why high-beta assets snapped, whether a rotation into quality is underway, why institutions seem unfazed even as retail stays skittish, and share initial thoughts on Vanguard finally allowing clients to buy crypto.

The crew also unpacks Strategy’s chaotic comments about selling BTC, the Clarity Act’s political hurdles, the CME outage that exposed systemic fragility, and the never-ending debate over Tether—profitability, reserves, and what institutions actually want from a stablecoin issuer.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🚀 SEC Chair Paul Atkins said the agency plans to unveil a fast-track “innovation exemption” for crypto within a month and aims to roll out new rules next year to make it easier for companies to go public, signaling a sharp break from the prior administration’s tougher climate.

🧊 Strategy CEO said the firm’s new $1.4 billion cash pile can fund nearly two years of dividends and interest without touching its roughly $59 billion bitcoin stash, and hinted it may lend some coins in the future if markets tighten and traditional finance keeps adopting BTC.

📊 Meanwhile, Strategy Chairman Michael Saylor acknowledged the company is in talks with index giant MSCI over a possible removal from its benchmarks—a move JPMorgan warned could spark almost $9 billion in outflows—while noting that bitcoin’s drop has amplified pressure on the firm’s BTC-linked stock.

👥 Binance named co-founder Yi He as co-CEO alongside Richard Teng, formalizing her long-running leadership role as the exchange pushes into new markets, products, and compliance upgrades.

🇷🇺 Russia’s central bank signaled a potential softening of its strict crypto rules, saying it is working with the Finance Ministry on allowing everyday citizens—not just elite “qualified investors”—to access digital assets if it finalizes a friendlier framework by year-end.

💶 Ten major European banks, including ING and BNP Paribas, created a new company called Qivalis to release a euro-backed stablecoin in late 2026, aiming to challenge the U.S. lead in digital payments and seeking a key electronic-money licence from the Dutch central bank.

🧮 Bank of America shifted its stance on digital assets by telling its 15,000+ Merrill and Private Bank advisers they can now recommend a 1%–4% crypto allocation and will begin formally covering four bitcoin ETFs starting January 2026, opening the door for mainstream portfolio inclusion.

📊 Kraken moved deeper into tokenized finance by buying Backed Finance—the second-largest public-stock tokenization platform with 23% market share—to bring its 60+ on-chain stocks and ETFs into Kraken’s exchange as the $20 billion firm prepares for a 2026 IPO.