- Unchained Daily

- Posts

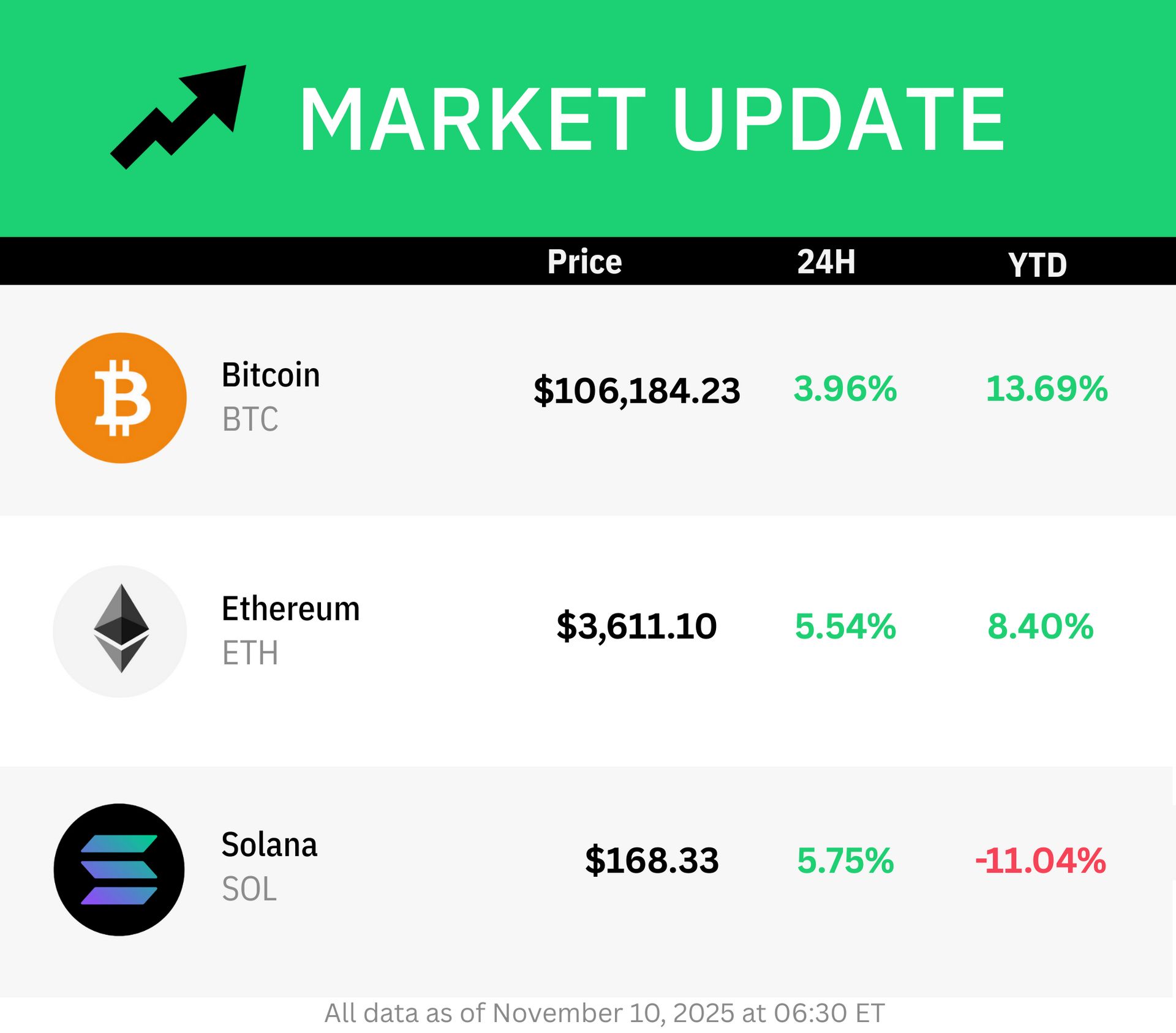

- Bitcoin Breaks $106K as Senate Ends Historic Shutdown

Bitcoin Breaks $106K as Senate Ends Historic Shutdown

Plus: 💵 Fed says stablecoins could lower rates, 🇺🇸 Trump plans $2,000 tariff payments, 🧾 CZ denies WLFI ties, ⚖️ MEV trial ends in mistrial, 💼 Ledger eyes IPO.

Hi! In today’s edition:

💰 Bitcoin tops $106K as Senate votes to reopen government

🇺🇸 Trump proposes $2,000 tariff-funded payments, which might be bullish for crypto

💵 Fed governor says stablecoin boom could cut rates

🧾 CZ denies any link to Trump or WLFI post-pardon

⚖️ MEV brothers’ $25M case ends in mistrial

💼 Ledger considers IPO after profits surge

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

By Ayesha Aziz and Tikta

Bitcoin Climbs Above $106,000 on Senate Shutdown Vote

The price of bitcoin rose past $106,000 for the first time in nearly a week after the U.S. Senate voted 60-40 on legislation to end the 40-day government shutdown. The longest federal impasse in American history weighed heavily on digital asset markets, with bitcoin falling below $100,000 multiple times since August.

ETH jumped over 7% to trade above $3,600, while XRP and Solana each posted roughly 6% gains. The funding bill must still pass the House before reaching President Trump for signature.

Spot bitcoin ETFs shed more than $2.1 billion over eight trading days during the shutdown, while ethereum funds lost $579 million. Crypto stocks also took losses, with Coinbase dropping 9% and Strategy falling 8% last week.

Senate Democrats agreed to support procedural funding motions after moderate members brokered a bipartisan deal, sidelining extended health subsidy negotiations that had stalled progress.

Trump Unveils $2,000 Tariff Payment Plan for Americans

President Donald Trump announced plans to distribute $2,000 payments to most Americans using tariff revenue, excluding high earners. The proposal comes as the Supreme Court weighs arguments on his sweeping tariff policies, with prediction markets placing approval odds at just 21-23%.

Roughly 85% of U.S. adults would qualify based on COVID-era stimulus distribution patterns, according to The Kobeissi Letter. Investment analysts expect portions of the funds to flow into asset markets, potentially lifting bitcoin and stock prices short-term.

Experts warned the stimulus will balloon national debt and fuel long-term inflation. Bitcoin analyst Simon Dixon noted recipients must deploy funds into assets or watch purchasing power erode through inflation and debt servicing. Market analyst Anthony Pompliano said stocks and bitcoin typically rally following government stimulus measures, despite underlying concerns about currency devaluation.

It’s Macro Monday ➡️ Bits + Bips is streaming at 4:30pm ET!

Hosts Austin Campbell and Chris Perkins weigh in on the biggest news in crypto x macro (DATs, a bleeding market, and more) along with two guests: Blockworks’ Felix Jauvin and Hivemind’s Matt Zhang.

Fed Governor Says Stablecoin Surge May Push Rates Lower

Federal Reserve Governor Stephen Miran stated that stablecoin expansion could drive down the neutral interest rate over the next five years. Speaking at the BCVC summit in New York, the Trump-appointed official said dollar-pegged tokens are applying downward pressure on r-star, the rate that neither stimulates nor restrains economic activity.

Fed research projects the stablecoin market could surge from its current $310 billion market cap to $3 trillion within five years. Miran argued this growth boosts demand for U.S. Treasury bills and liquid dollar assets from international buyers, prompting the central bank to lower rates accordingly.

He praised the GENIUS Act for establishing clear guidelines and consumer protections, calling the regulatory framework crucial for broader adoption. The legislation mandates U.S. issuers maintain reserves backed one-to-one with safe, liquid dollar assets. Banking groups and the International Monetary Fund have warned that stablecoins could compete with traditional financial services for customers.

CZ Denies Ties to Trump and WLFI After Pardon

Binance founder Changpeng “CZ” Zhao denied any business ties or financial connections to the Trump family, following his pardon by the President last month.

In an interview with Fox News, Zhao said that he never negotiated any deals with Trump, his sons, or their associated crypto venture World Liberty Financial, nor did he expect the pardon to occur.

“I did not know when or if it was going to happen… There was no indication of how far it went along, etc. Then, it happened one day,” said Zhao.

The pardon has triggered scrutiny from lawmakers, with some like Democratic Rep. Maxine Waters suggesting there might have been political favors or “pay-to-play” schemes.

Mistrial Declared After ‘MEV Brothers’ Accused of $25 Million Exploit

The trial of two MIT-educated brothers, accused of fraud and money laundering related to a $25 million Ethereum exploit, has ended in a mistrial after the jury was unable to reach a verdict.

Anton and James Peraire-Bueno were accused of using maximal extractable value (MEV) bots to manipulate blockchain transactions, allegedly tricking users into trades and extracting millions in just 12 seconds.

Prosecutors argued that the brothers engaged in a "bait and switch" scheme, defrauding users by posing as legitimate MEV-Boost validators.

The defense countered that their actions were akin to "stealing a base in baseball," asserting that no fraud or conspiracy occurred, and that their actions were simply exploiting the system as designed.

The fact that jurors remained deadlocked after the three-week trial has sparked debate within the crypto community about the legal boundaries of MEV activities.

“MEV is ugly, but Ethereum's protocol allows it,” wrote Coin Center Executive Director Peter Van Valkenburgh in an X post last week.

“If that's something that bothers you, then work towards changes to that protocol, don't make a golem of the SDNY prosecution to do your dirty work, that golem will come right back on you in short order.”

Ledger Considers IPO as 2025 Profits Soar: Report

Paris-based crypto hardware wallet firm Ledger is considering a New York initial public offering (IPO) or a private fundraising initiative, according to a report from the Financial Times.

Ledger CEO Pascal Gauthier told FT that “the money is in New York today for crypto, it's nowhere else in the world.”

The report also notes that Ledger’s revenues had already hit “triple-digit millions of dollars” in 2025, ahead of the major holiday shopping season.

The hardware wallet market is valued at around $263 million, with demand driven in part by heightened security concerns associated with leaving crypto on centralized exchanges.

Ledger currently secures about $100 billion worth of bitcoin for its customers and was valued at $1.5 billion in its 2023 funding round.

📈 Acting CFTC chair Caroline Pham confirmed she’s working with major exchanges like CME and Coinbase to launch leveraged spot crypto trading, signaling a proactive regulatory move to expand oversight using existing laws despite Congress’s delay on new crypto rules.

📉 Lantern Ventures, a London crypto hedge fund founded by ex-Alameda Research members, is winding down, returning investor funds, exploring a sale or conversion into a family office, and likely cutting staff from its once $600 million operation.

💷 The Bank of England proposed new rules for British pound–based stablecoins, requiring issuers to hold at least 40% of their reserves at the central bank and the rest in short-term government debt, while capping personal holdings at about $26,000 to limit financial risks.

🐉 Crypto exchange Bybit is reportedly exploring buying South Korean rival Korbit to strengthen its foothold in Asia’s fast-growing crypto market, though Korbit—owned by gaming giant Nexon’s parent company NXC and SK Planet—denied that any sale talks were taking place.

🇯🇵 Japan’s Financial Services Agency proposed a new system forcing crypto custody and trading service providers to register with regulators and restricting exchanges to work only with approved firms, following a $312 million hack in 2024 that exposed security flaws in outsourced operations.

💰 Strategy raised $715 million through a euro-denominated preferred stock offering listed in Luxembourg, planning to use the proceeds to buy more bitcoin even as its stock price slid alongside recent crypto market volatility.

💳 Stripe-backed blockchain project Tempo made its first investment—a $25 million stake in infrastructure startup Commonware—to deepen collaboration on open-source blockchain tools aimed at improving payment systems and developer accessibility.

Our Network: ON-377: Stablecoins

On-Chain Mind: MSTR: Is the Bear Market Already Here?

DL News: Why crypto’s biggest firms are jumping on the neobank trend