- Unchained Daily

- Posts

- Bitcoin Breaks Higher as Shorts Unwind and ETF Demand Roars Back

Bitcoin Breaks Higher as Shorts Unwind and ETF Demand Roars Back

Plus: 🚀 Bitcoin rips higher as shorts burn and ETF inflows surge

Hi! In today’s edition:

🚀 Bitcoin breaks out as $600 millions in shorts are wiped out

🧠 Why holding gold and bitcoin together has historically worked better

🎧 How Venezuela shows why bitcoin and stablecoins matter for everyday people

Today’s newsletter is brought to you by Fuse!

FUSE ENERGY HITS A $5B VALUATION FOLLOWING A $70M SERIES B

Fuse Energy is a $400M ARR utility powering 200,000+ homes, and has recently announced a $70M series B at a blockbuster $5B valuation.

This comes after the recent beta launch of The Energy Network, a new digital layer engineered to scale our grids and save billions in costs.

And now, it’s just building momentum:

$170M raised to date

$5B valuation

Beta live on Solana

Landmark SEC no-action letter secured

Planning listings for early 2026

A new foundation for the grid is coming.

Check out their announcement here and follow Fuse on X for updates.

Why Gold and Bitcoin Work Best Together

As investors worry about rising debt and a weaker dollar, Bitwise analysts Juan Leon and Mallika Kolar looked at how gold and bitcoin actually behave when markets fall and recover. Their conclusion: holding both has historically worked better than choosing one.

In major market selloffs over the past decade, gold consistently softened losses, while bitcoin often fell harder alongside stocks. But when markets rebounded, the roles flipped. Bitcoin tended to lead recoveries, often posting outsized gains, while gold rose more steadily.

The problem, the analysts note, is timing. No one reliably knows when a downturn ends or a recovery begins. Trying to switch between assets at the perfect moment is unrealistic.

Instead, Bitwise found that portfolios holding both gold and bitcoin across full market cycles delivered a stronger balance of protection and upside than traditional portfolios or those holding just one of the two. Gold helped absorb shocks. Bitcoin powered rebounds. Historically, the combination produced better risk-adjusted returns than either asset alone.

Bitcoin Breaks Out as Shorts Burn and ETF Flows Surge

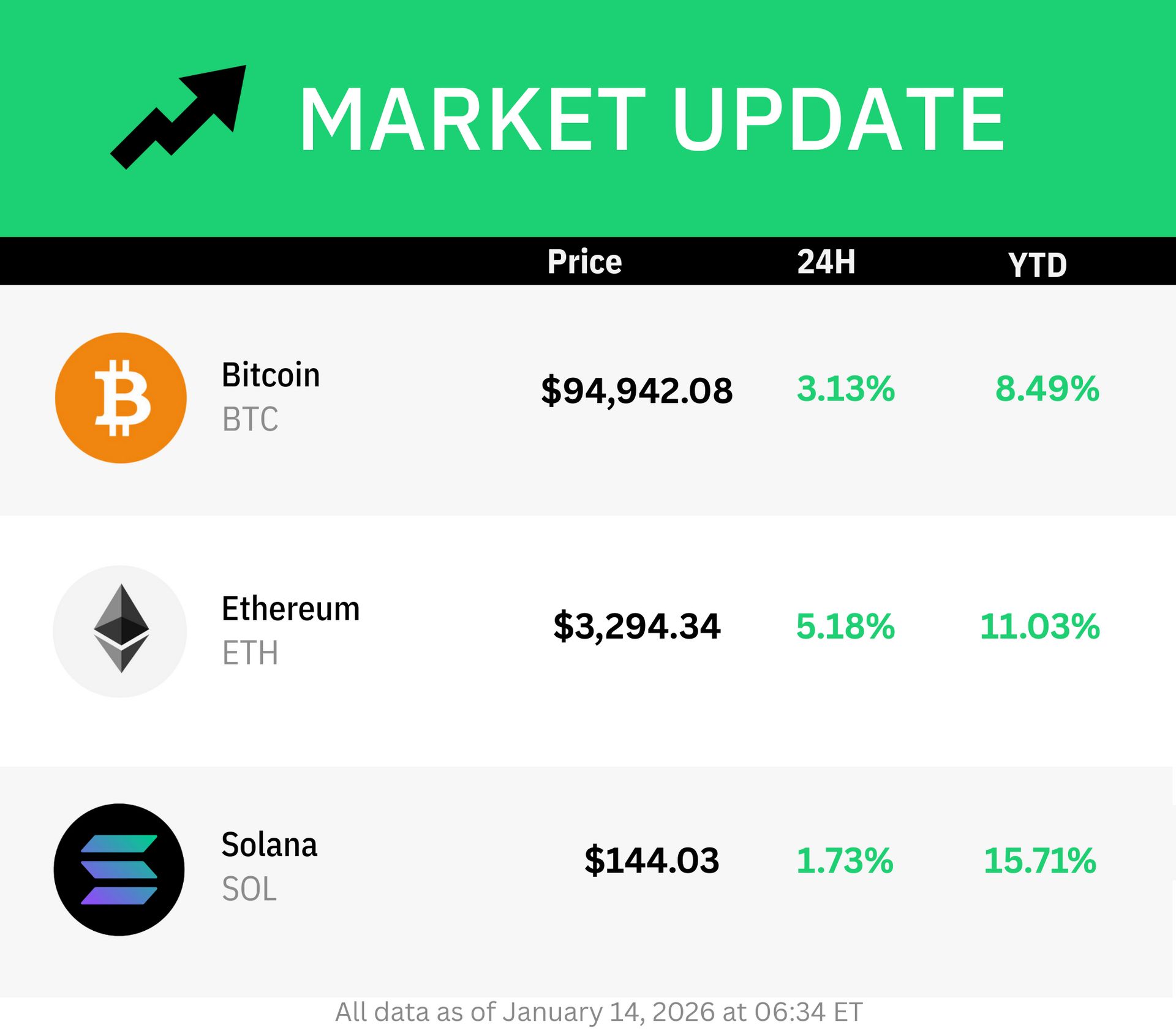

Bitcoin surged to $96,348 on Tuesday, its highest level since November, fueled by a wave of positive catalysts that flipped market sentiment and triggered a massive short squeeze.

One of the biggest drivers was softer-than-expected U.S. inflation data, which bolstered hopes for interest rate cuts later this year. That, paired with renewed political uncertainty around the Federal Reserve, pushed investors toward alternative assets like bitcoin and gold. As QCP Capital put it, the “Goldilocks environment” of stable inflation and resilient jobs data has reopened the door to risk assets.

The rally forced traders betting against bitcoin to unwind their positions rapidly. In the last 24 hours, over $600 million in short positions across crypto were liquidated, including $290 million in BTC shorts, according to CoinGlass.

At the same time, institutional appetite came roaring back. U.S. spot bitcoin ETFs brought in $754 million in a single day, the highest inflow since October 7. Fidelity’s fund led with $351 million, followed by Bitwise and BlackRock.

While geopolitical concerns remain, especially in Venezuela and Iran, QCP believes the market has priced in much of the uncertainty, and further escalation may even be viewed as a “buy-the-dip” opportunity.

Bitcoin’s breakout comes after weeks of underperformance, and with ETF inflows rising and macro headwinds easing, traders are once again eyeing a run toward the $100,000 level—as long as momentum holds.

Bitcoin was trading at $95,000 at 5:30 am ET.

How Venezuela Shows Why Bitcoin, Crypto and Stablecoins Help Everyday People

A $60 billion rumor dominates conversations in the crypto space in the fallout of Maduro’s capture. Is Venezuela a secret Bitcoin giant?

Amid several years of economic challenges, Venezuela boasts a long and intriguing relationship with crypto. Following the capture of President Nicolas Maduro by the U.S. government, these crypto ties have again been brought into focus.

In this Unchained podcast episode, Ledn cofounder Mauricio Di Bartolomeo and Economic Inclusion Group President Jorge Jraissati join Laura Shin to unpack this history, including the plausibility of the Latin American country sitting on a $60 billion Bitcoin stash.

Mauricio details how the hums of Bitcoin mining rigs became the sound of freedom for Venezuelans. Jorge says post-Maduro Venezuela will “demand” a crypto-powered economy.

Will the crypto industry shape the future of Venezuela? And what does such a future look like?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

📅 The Senate Agriculture Committee pushed its crypto market structure bill hearing to Jan. 27, setting Jan. 21 for releasing the long-awaited text as lawmakers prepare to debate amendments and unresolved issues like ethics rules and regulator oversight before sending it to the full Senate.

🇺🇦🚫 Ukraine ordered internet providers to block Polymarket as part of a broader online gambling crackdown, citing unlicensed operations and concerns over war-related betting, adding the prediction platform to a growing list of countries where access is restricted.

⛽ ETHGas launched its GWEI token to let users vote on how Ethereum’s transaction capacity is allocated, pitching a new system that treats blockspace like a reservable resource to reduce congestion and unpredictable fees for apps.

🎬 Polymarket gained mainstream exposure after its betting odds were shown during the Golden Globes broadcast, with the platform correctly predicting most award winners and highlighting how prediction markets are creeping into pop culture.

💳 Polygon Labs moved deeper into regulated payments by acquiring Coinme and Sequence for $250 million, aiming to bundle cash-to-crypto access, wallets, and blockchain tools into a single system that helps businesses move and manage digital dollars and tokenized assets.

📈 A Kraken-backed shell company filed for a $250 million Nasdaq IPO to acquire crypto-related businesses, giving the exchange another pathway into public markets as it moves closer to launching its own long-anticipated stock listing.

📉 Strive shares slid about 12% after investors approved its acquisition of Semler Scientific and a surprise reverse stock split, despite the deal creating a combined company holding nearly 13,000 bitcoin and ranking it among the largest corporate holders.