- Unchained Daily

- Posts

- Bitcoin Drops to $93K as Liquidations Spike

Bitcoin Drops to $93K as Liquidations Spike

Plus: 💼 Scaramucci puts $100M into Trump-backed miner, 🎓 Harvard triples IBIT stake, ⚠️ Yala’s BTC stablecoin depegs.

Hi! In today’s edition:

• 🔻 BTC wipes YTD gains in liquidation cascade

• 💰 Mooch’s family doubles down on Trump-linked mining giant

• 🏛️ Harvard quietly becomes a major IBIT whale

• 🧨 Yala stablecoin collapses as liquidity evaporates

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

By Tikta

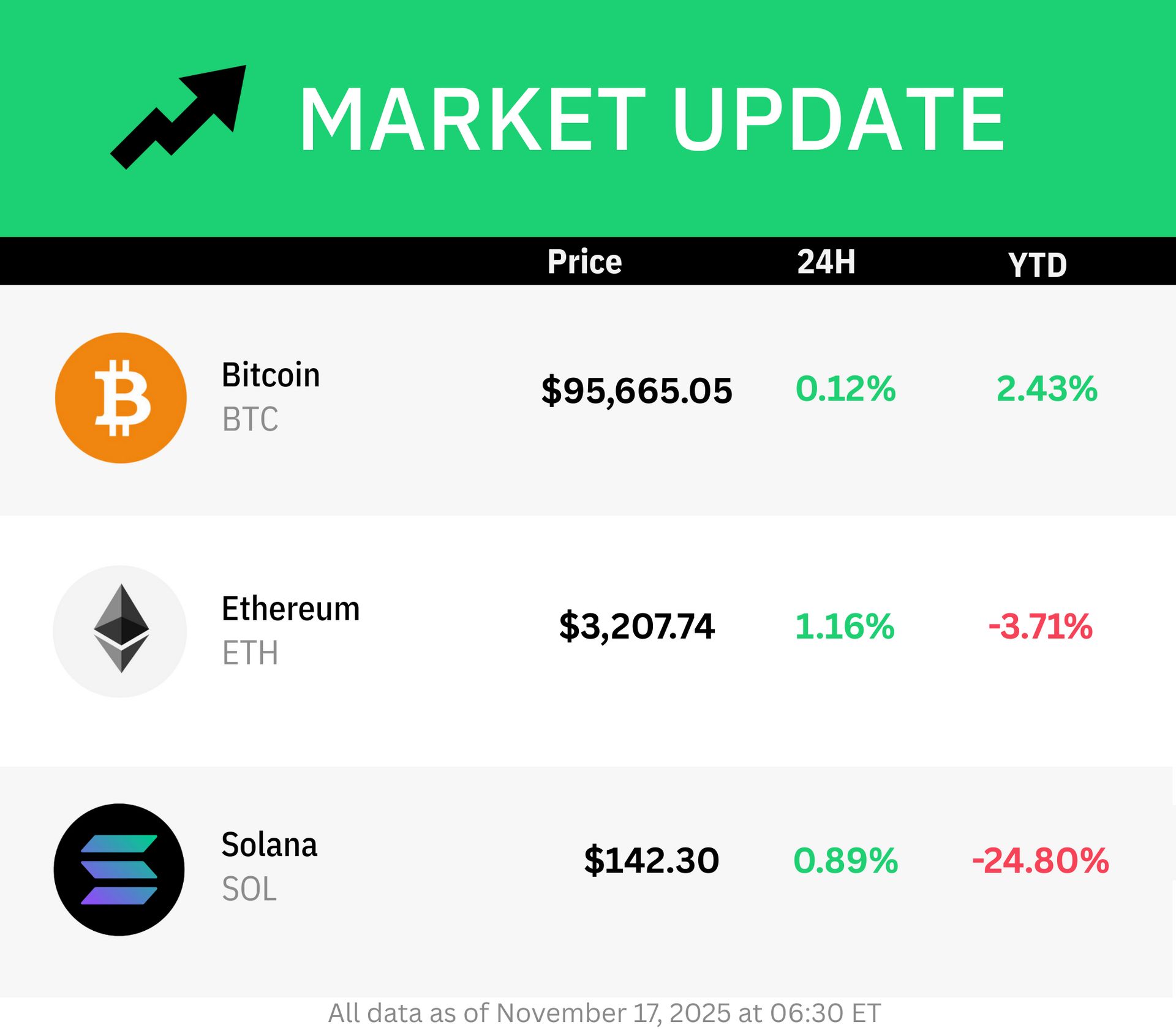

Crypto Liquidations Top $500 Million as Bitcoin Dips to $93,000

Bitcoin has erased the entirety of its gains year-to-date as the digital asset dropped to a low of $92,971 late on Sunday.

The negative price action was accompanied by $580 million worth of liquidations across crypto exchanges, with the single largest liquidation order on a $29.98 million BTC/USD position on Hyperliquid.

“Bitcoin had a death cross today,” said crypto analyst and Into The Cryptoverse CEO Benjamin Cowen on X, noting that prior death crosses marked local lows in the market.

“Of course, when the cycle is over, the death cross rally fails. The time for Bitcoin to bounce if the cycle is not over would be starting within the next week.”

Market intelligence platform Santiment shared a similar thesis on a potential price reversal, pointing to bitcoin’s social dominance hitting a four-month high.

“During Friday's dip below $95K, discussion rates hit a 4-month high, signaling severe retail panic & FUD.”

Additionally, BitMine chairman Tom Lee suggested crypto’s slump likely stemmed from one or more trading firms suffering hidden losses, creating an opening for aggressive traders to trigger liquidations, though he argued the downturn should pass within two months and does not derail the broader move toward an “ETH supercycle.”

Favorite macro day of the week 👉️ Bits + Bips is LIVE at 2:30pm ET!

Hosts Austin Campbell, Ram Ahluwalia, and Chris Perkins discuss the biggest news in crypto x macro (takeaways from the Cantor conference, market action, D.C. and market structure legislation, and more). Patrick Witt, Executive Director of the President’s Council of Advisors for Digital Assets, joins as a guest!

Scaramucci Family Invested Over $100 Million in Trump Family’s Bitcoin Mining Firm

The Scaramucci family has invested more than $100 million in Bitcoin mining company American Bitcoin, backed by the sons of former U.S. President Donald Trump, according to a report from Fortune.

The investment came through Solari Capital, an investment firm founded by Anthony Scaramucci's son, AJ Scaramucci. Solari led a $220 million financing round in American Bitcoin in July, prior to the firm's public listing via a reverse merger.

Being publicly listed also means facing quarterly reporting requirements — but American Bitcoin’s latest results delivered an upside surprise, with strong profitability.

In its latest 10-Q filing, the company reported $64.2 million in Q3 revenue, up from $11.6 million in the same period last year. The firm reported a profit of $3.5 million, reversing a net loss of $1.6 million in Q3 2024.

“Has my Dad and Don Sr. [Donald Trump], have they had their fair share of back and forth? Of course they have,” AJ Scaramucci told Fortune, “but Bitcoin transcends politics.”

Harvard Ups Bitcoin ETF Stake to $443 Million

Harvard University has tripled its stake in BlackRock's iShares Bitcoin Trust (IBIT) to around $443 million, according to its latest 13F filing.

The ivy league’s endowment fund now holds 6.8 million shares in IBIT, which is now its biggest position.

“It's super rare/difficult to get an endowment to bite on an ETF- esp a Harvard or Yale, it's as good a validation as an ETF can get,” noted Bloomberg ETF analyst Eric Balchunas on X.

IBIT remains the world’s largest spot Bitcoin ETF with nearly $75 billion in net assets, reflecting a year of strong demand from institutional investors despite the recent volatility in bitcoin’s price.

Yala Protocol’s Bitcoin Stablecoin Depegs

Bitcoin-native liquidity protocol Yala’s YU stablecoin de-pegged across all networks on Sunday, trading as low as 55% below its $1 value.

“We’re aware of the recent community concerns and are actively looking into them. More updates coming soon,” said the Yala team on X.

The depeg comes a day after X account YAM warned of potential red flags on Yala, while noting that YU had low liquidity on several Ethereum Virtual Machine (EVM) networks.

YU also experienced a major depeg event in September when attackers minted 120 million unauthorized YU tokens on the Polygon network, then sold millions across Ethereum and Solana for USDC, netting $7.6 million.

At the time, the Yala team disabled key protocol functions to limit damage and assured users that bitcoin deposits remained secure.

We’re now live on Base.

If you’re already spending time onchain, you’ll find us there too.

Unchained now has a mini-app on the Base App (currently in beta), where you can stream episodes directly.

🏗️ BlackRock’s $2.5 billion BUIDL fund, which tokenizes U.S. Treasury–backed money‑market assets, was approved as collateral on Binance and expanded to BNB Chain, marking its eighth supported blockchain as institutions push for yield-bearing, price‑stable onchain assets.

🌀 U.S. prosecutors told the judge in the Tornado Cash case that they had already presented enough evidence to uphold Roman Storm’s conspiracy conviction, arguing he actively helped design features that enabled criminals to use the mixing service and that his request for acquittal should be denied.

🦾 Ethereum DAT BitMine, which controls more than $11 billion in ETH, appointed former HSBC banker and venture investor Chi Tsang as CEO to steer the company as it tries to position itself as a Wall Street–Ethereum bridge during a period of falling token prices.

🧾 BitMEX co‑founder Arthur Hayes appears to be offloading some of his crypto holdings, moving more than $1.6 million in ETH and nearly $850,000 in smaller tokens to major trading firms before selling an additional $2.45 million in assets roughly an hour earlier.

🧑⚖️ CZ’s attorney pushed back on claims that Trump’s October pardon involved any backroom dealmaking, saying media speculation linking Binance, World Liberty Financial, and the USD1 stablecoin to influence‑buying was baseless, while noting Zhao had already served his four‑month sentence and paid a $50 million penalty.

🌍 A senior European Central Bank official warned that a mass redemption of dollar‑based stablecoins—now above $300 billion—could force the ECB to rethink interest‑rate plans, since rapid selling of the U.S. government bonds backing those tokens might spill over into Europe’s economy and inflation.

🚨🐾 Security firm GoPlus cautioned that several early x402‑themed projects showed dangerous flaws such as unlimited token creation, trapped‑fund mechanics, and replayable signatures, citing past exploits and flagging newer tokens like FLOCK, U402, and PENG as high‑risk for unsuspecting users.

🇯🇵 Japan’s top financial regulator is considering reclassifying major cryptocurrencies as financial products and replacing the country’s steep income‑style tax—currently up to 55%—with a flat 20% capital‑gains rate by 2026, alongside new rules to curb insider trading on token‑related information.

🤖 Tether was reported to be considering a massive $1.16 billion investment in German startup Neura Robotics — valued up to $11.6 billion — as the stablecoin giant continues using its multibillion‑dollar profits to branch into AI, robotics, energy, and other non‑crypto sectors.

The Defiant: Starknet Token Outperforms as TVL Climbs

Ignas | DeFi Research: The Great Rotation: BTC won. What Happens to ETH, SOL and Alts?