- Unchained Daily

- Posts

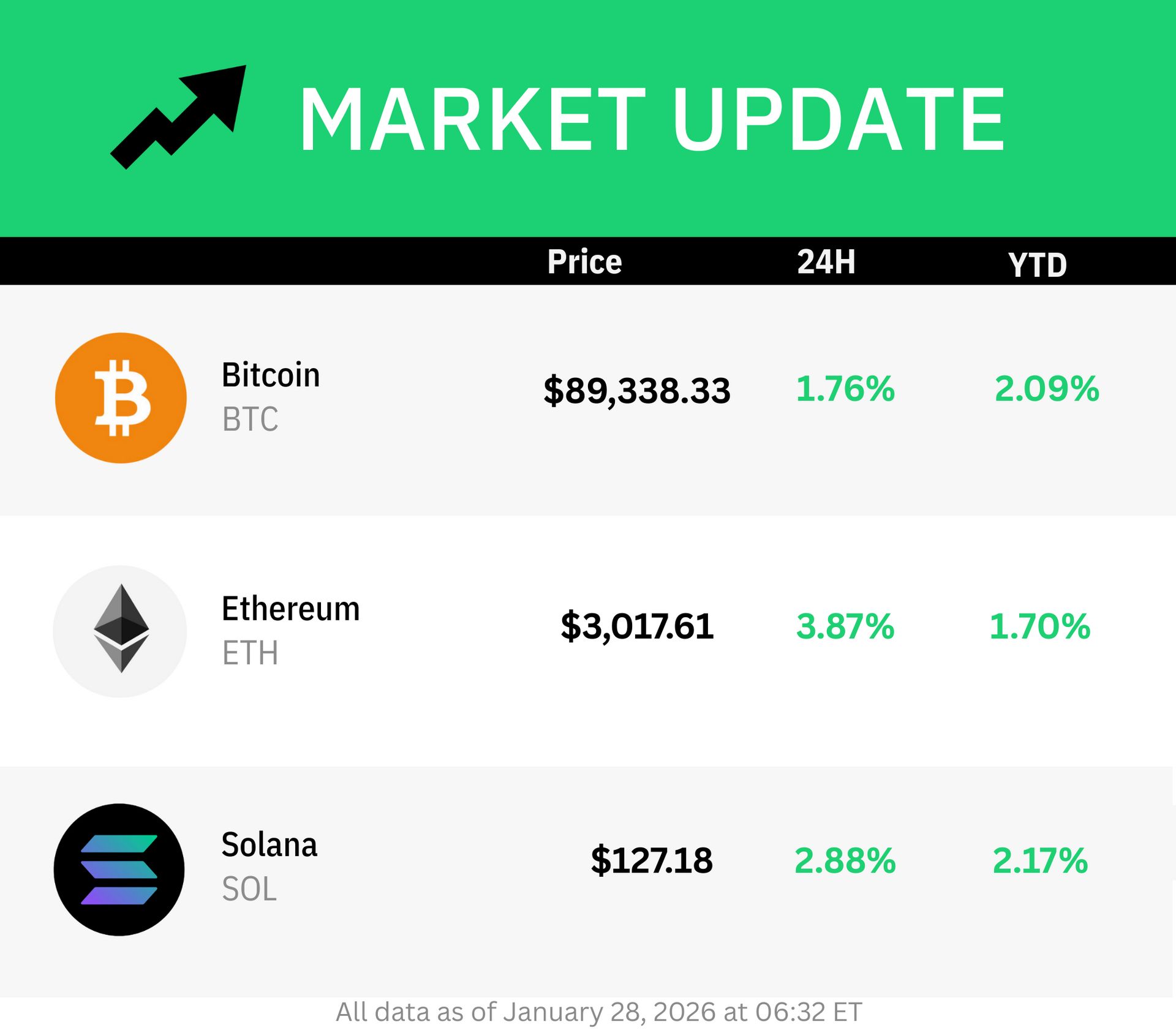

- Bitcoin Holds Its Footing as Macro Risks Rise

Bitcoin Holds Its Footing as Macro Risks Rise

Plus: 🏦 Tether amasses a central bank scale gold reserve.

Hi! In today’s edition:

🌍 Bitcoin finds firmer footing as macro risks collide with a cleaner market structure

🏦 Tether quietly amasses roughly 140 tons of gold and launches a U.S. regulated stablecoin

Today’s newsletter is brought to you by Fuse!

FUSE ENERGY HITS A $5B VALUATION FOLLOWING A $70M SERIES B

Fuse Energy is a $400M ARR utility powering 200,000+ homes, and has recently announced a $70M series B at a blockbuster $5B valuation.

This comes after the recent beta launch of The Energy Network, a new digital layer engineered to scale our grids and save billions in costs.

And now, it’s just building momentum:

$170M raised to date

$5B valuation

Beta live on Solana

Landmark SEC no-action letter secured

Planning listings for early 2026

A new foundation for the grid is coming.

Check out their announcement here and follow Fuse on X for updates.

Bitcoin Finds Firmer Ground as Macro Stress Meets a Healthier Market

Two very different analyses are converging on the same conclusion: Bitcoin may be better positioned than it looks.

In an essay, Arthur Hayes pointed to mounting stress in Japan. The yen has weakened at the same time that long-term Japanese government bond yields have risen, a combination that signals deeper structural problems.

Hayes argues this could force U.S. intervention, with the Treasury and the Federal Reserve stepping in to stabilize markets. If that happens, it would likely involve injecting fresh liquidity, which could ease pressure on U.S. bond yields and provide short-term support for risk assets, including bitcoin.

At the same time, a new report from Coinbase Institutional and Glassnode suggests the crypto market itself is in better shape than during past downturns. The sharp drawdown in late 2025 flushed out excessive leverage, reducing the risk of cascading liquidations.

Large investors are now favoring options for protection rather than heavy borrowing, and onchain data shows long-term holders are gradually redistributing coins instead of panic selling.

Put together, the picture is more nuanced than recent price swings suggest. Macro risks are real, but bitcoin is entering this phase with a cleaner structure, less leverage, and investors behaving more defensively.

That combination may not spark an immediate rally, but it does suggest a market that can absorb shocks rather than unravel when they arrive.

Crypto taxes stressing you out? You don’t have to figure it out alone.

We’ve partnered with Crypto Tax Girl, a crypto-focused tax firm that’s been helping investors since 2017, to give readers $100 off personalized, one-on-one crypto tax help.

Their team can handle everything from transaction calculations to full tax returns — but pre-April 15 spots are limited, so don’t wait!

Tether Quietly Builds a Central Bank–Scale Gold Position

As gold pushes to new all-time highs above $5,300 an ounce and the U.S. dollar slides to four-year lows, one of crypto’s largest companies has been steadily accumulating the metal.

Tether now holds around 140 tons of gold, worth roughly $23–24 billion, chief executive Paolo Ardoino told Bloomberg. The bullion is stored in a fortified facility in Switzerland, and Ardoino says the company continues to buy one to two tons per week, funded by profits from its stablecoin business.

Tether’s approach increasingly resembles that of a central bank. Ardoino has said he expects the company to become one of the world’s largest gold holders outside of governments, and believes geopolitical rivals to the U.S. will eventually pursue gold-backed alternatives to the dollar.

This is not a passive reserve strategy. Tether plans to actively trade its gold, moving into territory traditionally dominated by large banks. The company has already hired experienced gold traders as it looks to generate additional returns while remaining heavily exposed to physical metal.

In a market where the dollar is weakening and investors are seeking assets with no counterparty risk, Tether’s growing gold position highlights how capital inside crypto is increasingly converging with traditional safe havens.

In related news, on Tuesday Tether launched USAT, a new U.S.-regulated stablecoin issued by federally chartered crypto bank Anchorage Digital, creating a GENIUS Act–compliant alternative to USDT for institutions that require full cash-and-Treasury backing under U.S. oversight.

Today on Uneasy Money

Kain Warwick, Taylor Monahan, and Luca Netz examine the viral agentic AI tool that exposed users to serious security risks, allegations that seized U.S. government crypto was improperly accessed, Ethereum’s early push toward post-quantum security, and how Hyperliquid’s perps model is reshaping DeFi market structure.

⛓️ Citrea, a Bitcoin layer 2 built by Chainway Labs, launched its mainnet using zero-knowledge proofs to process transactions off Bitcoin while settling securely back onchain, alongside a new dollar-linked stablecoin aimed at enabling BTC-backed lending and structured financial products.

🇬🇧🚫 U.K. banks increasingly blocked or capped customer transfers to crypto exchanges in 2025 despite regulatory progress, with industry surveys showing nearly half of attempted transactions delayed or rejected, pushing some crypto firms to deprioritize the British market altogether.

🔗 Tokenization firm Securitize hired former Nasdaq and NYSE executive Giang Bui to help public and private companies issue regulated assets on blockchains, as the company prepares to launch onchain versions of stocks in early 2026.

🇯🇵🏦 Laser Digital, the crypto arm of Japanese banking giant Nomura, reportedly applied for a U.S. national trust bank charter to offer custody, settlement, and crypto trading nationwide under federal supervision without taking retail deposits.

🤖 Ethereum is preparing to activate ERC-8004 on mainnet, a new standard designed to let AI agents securely interact, build reputations, and transact onchain, laying groundwork for a decentralized economy where software agents act as independent economic participants.

🦄💳 Crypto payments startup Mesh reached a $1 billion valuation after raising $75 million from major venture firms, betting that its infrastructure—which lets consumers pay with any crypto while merchants receive instant stablecoin settlement—can reduce the friction of today’s fragmented payment systems.