- Unchained Daily

- Posts

- Bitcoin Rallies to $93,000 After U.S. Attack on Venezuela

Bitcoin Rallies to $93,000 After U.S. Attack on Venezuela

Plus: 🧠 Vitalik says the blockchain trilemma is solved, 🏦 Aave Labs floats revenue sharing, 🇦🇷 Coinbase pauses peso rails.

Hi! In today’s edition:

🚀 Bitcoin bounces hard and $94,000 becomes the line in the sand

🧠 Ethereum’s founder says the hardest problem is solved

🏦 Aave governance drama cools with a revenue olive branch

🇦🇷 Coinbase pulls back on peso support in Argentina

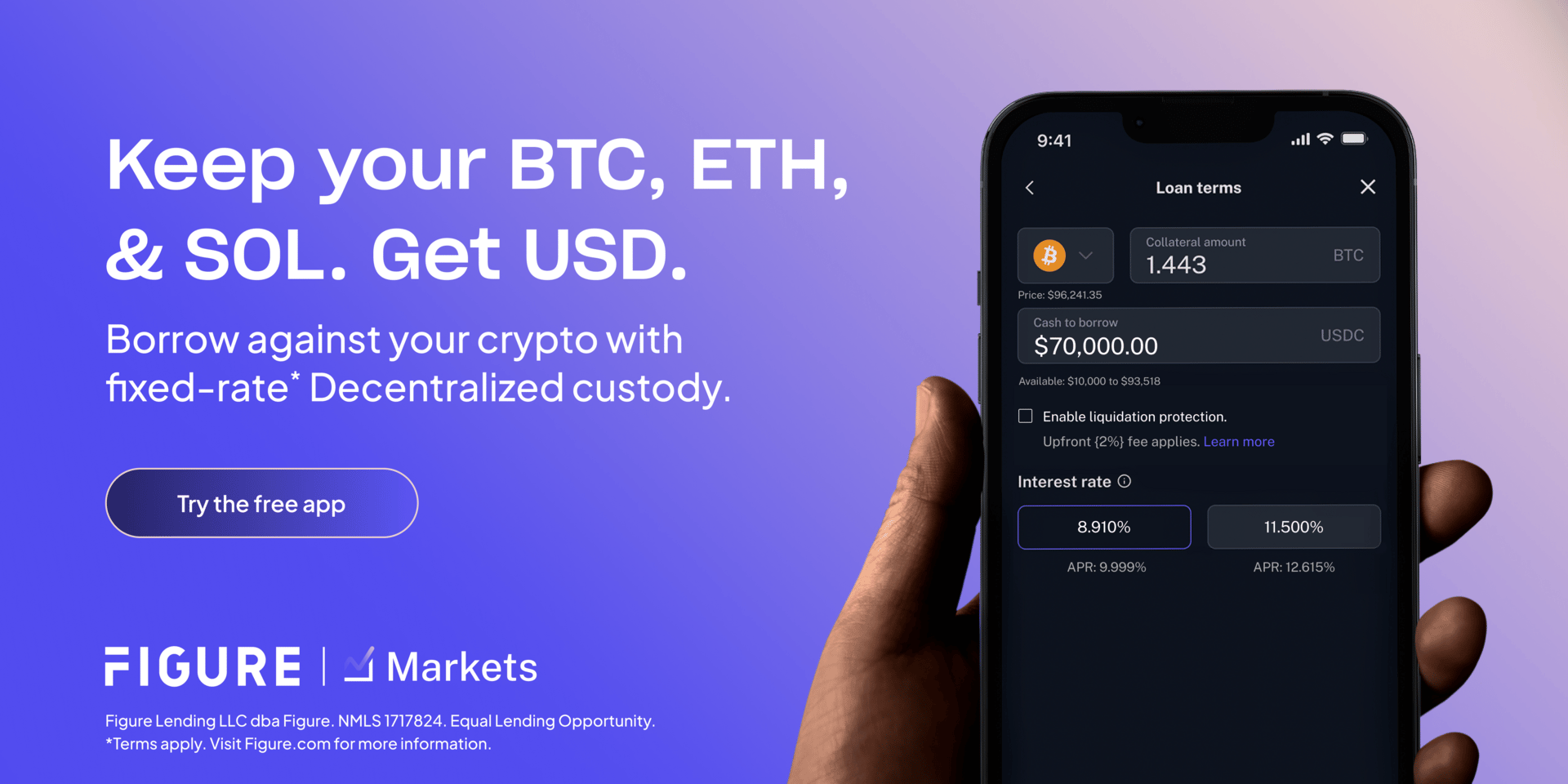

Today’s newsletter is brought to you by Figure!

We all know the mantra: Not your keys, not your coins. But managing self-custody while trying to access leverage is a headache.

Figure bridges this gap for their Crypto Backed Loans with decentralized MPC custody. Your assets sit in a segregated wallet where you retain ownership—no opaque "commingled funds" risks here.

They are also tackling the biggest anxiety in lending: flash crashes. Their Liquidation Protection for BTC and ETH specifically protects you from getting wiped out during large price drops.

You get the best of both worlds:

Safety: Institutional-grade MPC custody.

Access: Borrow at just 8.91% on Crypto Backed Loans.

Yield: Earn up to 9% APY on cash, backed by real-world assets (HELOCs) with Democratized Prime.

Sleep better knowing your assets (and your upside) are protected.

By Tikta

Bitcoin Rallies to $93,000 After U.S. Attack on Venezuela

Bitcoin surged to an intraday high of $93,169 late Sunday, extending a $5,000 rally since Friday as geopolitical tensions escalated following U.S. military action in Venezuela.

Despite a volatile weekend across global markets, crypto prices stabilized and moved higher, defying the typical risk-off reaction associated with major geopolitical events.

The move triggered approximately $75 million in hourly liquidations, largely from traders holding leveraged short positions.

Market participants are now closely watching the $94,000 level, which many see as a key technical threshold.

“If $94K can be reclaimed with legitimate volume this week, it would mark a meaningful change in trend and open a technically valid path toward $100K and beyond,” crypto futures trader Ardi wrote on X.

“This level decides the next leg. All eyes on this week.”

Ethereum’s Vitalik Buterin Says Blockchain Trilemma ‘Has Been Solved’

Ethereum co-founder Vitalik Buterin has claimed the blockchain trilemma – balancing decentralization, security, and scalability – has been solved through live implementations of ZK-EVMs and PeerDAS.

“The trilemma has been solved - not on paper, but with live running code, of which one half (data availability sampling) is on mainnet today, and the other half (ZK-EVMs) is production-quality on performance today - safety is what remains,” said Buterin in a post on X.

PeerDAS, introduced on the Ethereum mainnet with the recent Fusaka upgrade, lets validators sample data availability randomly instead of downloading full blocks, mimicking BitTorrent's efficiency with consensus.

ZK-EVMs enable fast transaction verification without revealing underlying data, reaching production-quality performance. Buterin expects that by 2030, further gas limit increases will enable ZK-EVMs to become the primary way to validate blocks on the network.

Aave Labs Proposes Off-Protocol Revenue Sharing With Token Holders

Aave Labs has proposed sharing non‑protocol revenue with AAVE token holders as a concession after the recent governance blow‑up over fees, branding, and IP control.

In a governance forum post, founder Stani Kulechov said that Aave Labs will put forward a formal proposal to distribute revenue generated outside the core lending protocol to AAVE holders.

The upcoming proposal is expected to define structures, DAO oversight, and risk safeguards, although concrete mechanics and timelines are yet to be finalized.

Tensions between Labs and the Aave community flared when community members noticed interface and swap fees going to Labs rather than the DAO treasury.

“If this marks the beginning of a more open and constructive posture, it is welcome,” noted Marc Zeller, long‑time Aave ecosystem figure and founder of major DAO delegate Aave‑Chan Initiative (ACI).

Zeller, who had been vocally critical of Labs’ handling of a governance vote to transfer control of brand assets, noted that roughly $500 million in AAVE market capitalization had been erased after the dispute went public.

“A clearer willingness to discuss substance is the right direction,” said Zeller.

Coinbase Halts Peso-Based Rails in Argentina

Crypto exchange Coinbase is halting Argentine peso fiat rails, which include bank and local payment links, for its Argentine users as of Jan. 31.

It comes less than a year after Coinbase received regulatory approval to enter the Argentine market.

Coinbase told users the move follows an internal review of performance and long‑term viability of its Argentina product, framing it as a deliberate pause rather than a permanent exit.

“At Coinbase we are continuously reevaluating the products we offer to ensure the most efficient experience possible for our community,” said Coinbase in an email to users.

The pause lands as Argentina’s central bank considers rules that would let traditional banks offer crypto trading and custody.

🎯 Blockchain trackers flagged three newly created Polymarket wallets that placed perfectly timed bets on Nicolás Maduro’s removal hours before it happened, earning about $630,000 from wagers focused only on Venezuela-related outcomes in what many observers view as a strong insider-trading signal.

🔥 Ethereum’s network activity reached a record high at the end of 2025, with daily transactions surpassing the 2021 NFT boom as lower fees, scalability upgrades, and institutional use cases drove a surge in active and new addresses.

🏛️ SEC Commissioner Caroline Crenshaw exited the agency after her term expired, leaving the regulator with an all-Republican, three-member commission as the outspoken crypto critic who opposed bitcoin ETFs departed amid industry and political pressure.

⛓️ Bitfinex hacker Ilya Lichtenstein was released from prison after serving just 14 months of a five-year sentence under a sentencing reform law, drawing backlash as tens of thousands of stolen bitcoin remain unrecovered despite most funds being seized by authorities.

🇮🇷💣 Iran’s defense export agency is accepting cryptocurrency to pay for missiles, tanks, and drones as a way to bypass international sanctions, marking one of the first known cases of a state openly using crypto for weapons sales to foreign buyers.

🧑💻 Hundreds of crypto wallets across Ethereum-compatible blockchains were quietly drained in small amounts in an attack with losses topping $100,000, while investigators have yet to identify how attackers are gaining access or stopping further thefts.

⛏️ Turkmenistan has legalized crypto mining and exchanges under a new law that treats digital assets as property rather than money, aiming to attract foreign investment while tightly controlling the sector through central bank licensing and anti–money-laundering rules.

📊 BitMine chairman Tom Lee urged shareholders to approve a massive increase in authorized shares, arguing it would enable fundraising, deals, and future stock splits as the company pivots from bitcoin mining to holding ether as its primary treasury asset.

⚡ Bitcoin miner Bitfarms exited Latin America by selling its final Paraguay site for up to $30 million, completing a regional withdrawal and shifting its business toward powering artificial intelligence and high-performance computing with North American energy infrastructure.