- Unchained Daily

- Posts

- Bitcoin Slides to $82K as Liquidations Rip Through Markets

Bitcoin Slides to $82K as Liquidations Rip Through Markets

Plus: 💳 Coinbase launches ETH-backed loans, 🪙 MegaETH caps pre-deposits at $250M, 📈 Kalshi hits $11B valuation.

Hi! In today’s edition:

📉 Bitcoin sinks below $82K in broad market rout

💳 Coinbase launches ETH-backed loans up to $1M

🪙 MegaETH opens $250M pre-deposit window

📈 Kalshi hits $11B valuation after massive raise

🎧 Hyperliquid crash fallout on Uneasy Money

🎙️ Ethereum Interop Layer explained on Unchained

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

Bitcoin Sinks Below $82,000 Amid Risk Asset Rout

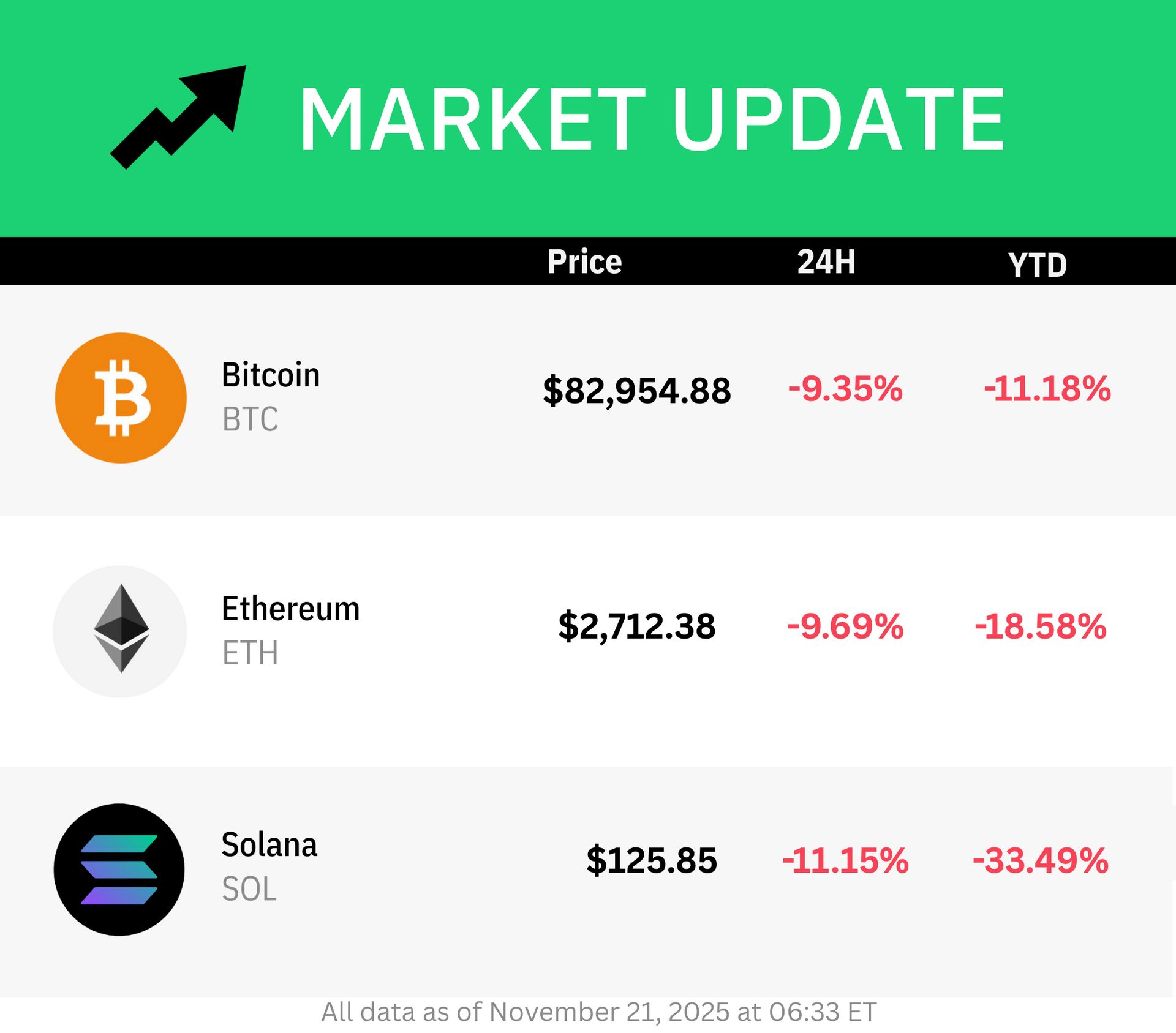

Bitcoin dropped 10% to a six month low of $81,868 on Friday, following a major reversal across indices on Wall Street.

The selloff triggered $2 billion worth of liquidations across major crypto exchanges, with 406,526 traders liquidated over the last 24 hours.

Bitwise head of research André Dragosch said bitcoin’s “max pain” zone likely sits between $84,000 and $73,000 — the institutional cost bases for BlackRock’s IBIT ETF and MicroStrategy’s average bitcoin holdings.

The max pain zone signals potential market capitulation where institutional investors might be at their largest losses, often leading to a market reset.

“Bitcoin’s Mayer Multiple has retraced toward the lower bound of its long-term range, signalling a slowdown in momentum,” noted onchain analytics firm Glassnode.

“Historically, such compressions have aligned with value-driven phases where price consolidates and demand begins to step in.”

Meanwhile, Alliance DAO co-founder QwQiao warned that the next crypto downturn could be harsher than traders assume because many inexperienced buyers piled into coins and ETFs, predicting the market might need to tumble another ~50% before a healthier rebound.

In addition, blockchain data shows this sell‑off created huge performance gaps among major institutions, with one fund still sitting on a $6.15 billion gain from its 649,870 bitcoin while big bets on ether and solana—like Bitmine’s 3.56 million ETH and Forward Industries’ 6.83 million SOL—ended up tens of billions and hundreds of millions in the red, respectively.

Coinbase Launches Ether-Backed Loans

Crypto exchange Coinbase has launched ether-backed loans for eligible U.S. users, allowing them to borrow up to $1 million in USDC without selling their ETH holdings.

The loan product operates through the Morpho lending protocol on Coinbase’s layer 2 network Base, which enables onchain execution of loans with Coinbase serving as a user-friendly access point.

Borrowers must maintain a loan-to-value ratio below 86% to avoid liquidation due to ETH price volatility.

Data from Dune shows that onchain lending across the Base ecosystem has topped $1.27 billion, driven by increased activity from both institutional and retail borrowers.

There is currently around $800 million in loans outstanding, with more than 13,300 wallets holding active borrow positions.

MegaETH to Open Pre-Deposit Window Capped at $250 Million

MegaETH will open a pre-deposit window for its USDm stablecoin on Nov. 25, ahead of its mainnet launch.

The pre-deposit will be capped at $250 million, and operates on a first-come, first-served basis with no individual deposit limits.

The USDm stablecoin is powered by Ethena Labs using the USDtb framework and is designed to offset sequencer costs on the Ethereum-secured layer 2 MegaETH network.

“USDm going live under Ethena’s whitelabel stack plus a hard cap on deposits is exactly the kind of controlled rollout you want for something this size,” noted X user @RizkyanaMaryll.

Participants will be required to have completed KYC verification during MegaETH's recent token sale, which attracted a $1.39 billion bid.

Kalshi Hits $11B Valuation After $1B Raise: Report

Prediction market platform Kalshi has raised $1 billion in a funding round that valued the company at $11 billion, as per a report from TechCrunch.

The funding round was led by returning investors Sequoia Capital and CapitalG, with participation from Andreessen Horowitz, Paradigm, Anthos Capital and Neo.

The new valuation marks a significant increase from just two months earlier, when Kalshi raised $300 million at a $5 billion valuation.

It also boosts the firm closer to its main competitor Polymarket, which has a reported valuation target of $12 billion to $15 billion.

News of Kalshi’s latest capital raise comes shortly after the firm warned it may need to liquidate $650 million in assets if a Massachusetts court grants the state’s attorney general’s request to halt its sports prediction market operations there.

Uneasy Money: Hyperliquid’s Dilemma After 10/10: Protect Itself or Its Users?

The crew contrasts the new ICO meta with the previous boom, breaks down the Hyperliquid “FUD” after the Oct. 10 crash and explores Ethena’s black swan risk.

In this episode of Uneasy Money, hosts Kain Warwick, Luca Netz and Taylor Monahan explore how the recent ICO boom compares with the 2017 era.

They share stories of some of the big names from the past, including Kain’s struggles after raising 30,000 ETH at the cycle top. Plus Luca shares what it takes for founders to thrive in crypto.

They also unpack the “FUD” surrounding Hyperliquid following the infamous Oct. 10 crypto crash. Moreover, they discussed what Multicoin’s investment in Ethena revealed about Kyle Samani, and potential black swan risks facing the project.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

ETH’s HTTP Moment? How Ethereum Interop Layer Hopes to Fix L2 Fragmentation

The Ethereum Foundation just announced Ethereum Interop Layer. Two of the protocol’s developers explain how it is different from other interoperability protocols and how it could unlock Ethereum’s HTTP moment.

The rise of Ethereum layer 2s has created a need for interoperability. While several solutions have emerged over the years, Ethereum Interop Layer promises to be trustless.

At Ethereum Devconnect, the EF’s developers Yoav Weiss and Marissa Posner join Unchained to explain why trustlessness is necessary for interoperability.

They also delve into how EIL differs from NEAR Intents and how it could unlock new use cases and spark an explosion of activity on Ethereum.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🏛️ Mike Selig, a senior crypto policy lawyer at the SEC, moved a step closer to becoming head of the U.S. commodities regulator after a Senate committee advanced his nomination, signaling Washington may soon have a CFTC chief steeped in digital‑asset rules as lawmakers debate expanding the agency’s authority.

🧾⚖️ Rep. Warren Davidson rolled out the “Bitcoin for America Act,” pitching it as a way for individuals and companies to pay federal taxes in bitcoin while channeling those funds into a government‑run Bitcoin reserve that he argues would strengthen U.S. finances.

📉 MSCI’s possible removal of companies holding mostly crypto on their balance sheets (DATs) could force index-tracking funds to dump as many as 38 names — including big Bitcoin-heavy firms — creating major selling pressure as the index shifts back toward traditional business fundamentals.

🕵️ Former FTX prosecutor Danielle Sassoon testified that she never promised immunity to Ryan Salame’s partner, pushing back against claims that her team tricked him into a plea deal as the last criminal cases from FTX’s 2022 collapse near their conclusion.

📊 A new report shows SEC enforcement actions dropped about 30% under Chair Paul Atkins compared to the Gensler era, reflecting a regulatory pivot that deprioritized crypto cases while Congress works on a digital-asset market-structure bill that could reshape oversight.

💱 Citi and global payments network Swift tested a system that let regular bank money move in lockstep with blockchain-based funds using smart contracts and bridging software, showing old-school banking rails and crypto tech can settle transactions at the same moment.

🏦 Tokenization firm Securitize teamed up with Plume Network’s Nest protocol to put big‑name investment products—from managers like Apollo, Hamilton Lane, VanEck, and BlackRock—onto blockchains, while Solv Protocol pledged $10 million to boost the liquidity of Nest’s digital asset vaults.

🌎 Tether invested in Parfin — a Brazil- and Argentina-focused digital-asset infrastructure firm — to push USDT deeper into Latin America’s financial system as institutions across the region increasingly adopt stablecoins for payments, remittances and protection against inflation.