- Unchained Daily

- Posts

- Bitcoin Stuck in a Fragile Trading Range, Glassnode Warns

Bitcoin Stuck in a Fragile Trading Range, Glassnode Warns

Plus: 📈 Coinbase expands into stocks and prediction markets, 🔥 Hyper Foundation proposes a major HYPE supply reduction, 🕵️ Binance offers rewards to expose fake listing agents, 🧪 Solana tests post-quantum signatures.

Hi! In today’s edition:

📉 Bitcoin remains stuck in a fragile trading range

🏦 Coinbase launches stock trading and prediction markets

🔥 Hyper Foundation proposes removing $1 billion in HYPE from supply

🕵️ Binance offers up to $5 million to expose fake listing agents

🧪 Solana deploys post-quantum signatures on testnet

🏛️ Why Trump’s WLFI may not qualify as DeFi under U.S. law

Today’s newsletter is brought to you by Walrus!

Decentralized data is the future — that’s why Unchained stores its media library on Walrus.

With lightning-fast performance, unparalleled reliability, and granular access controls, your data is secure and dependable, no matter what.

By Tikta

Bitcoin Remains Trapped in ‘Fragile Range’: Glassnode

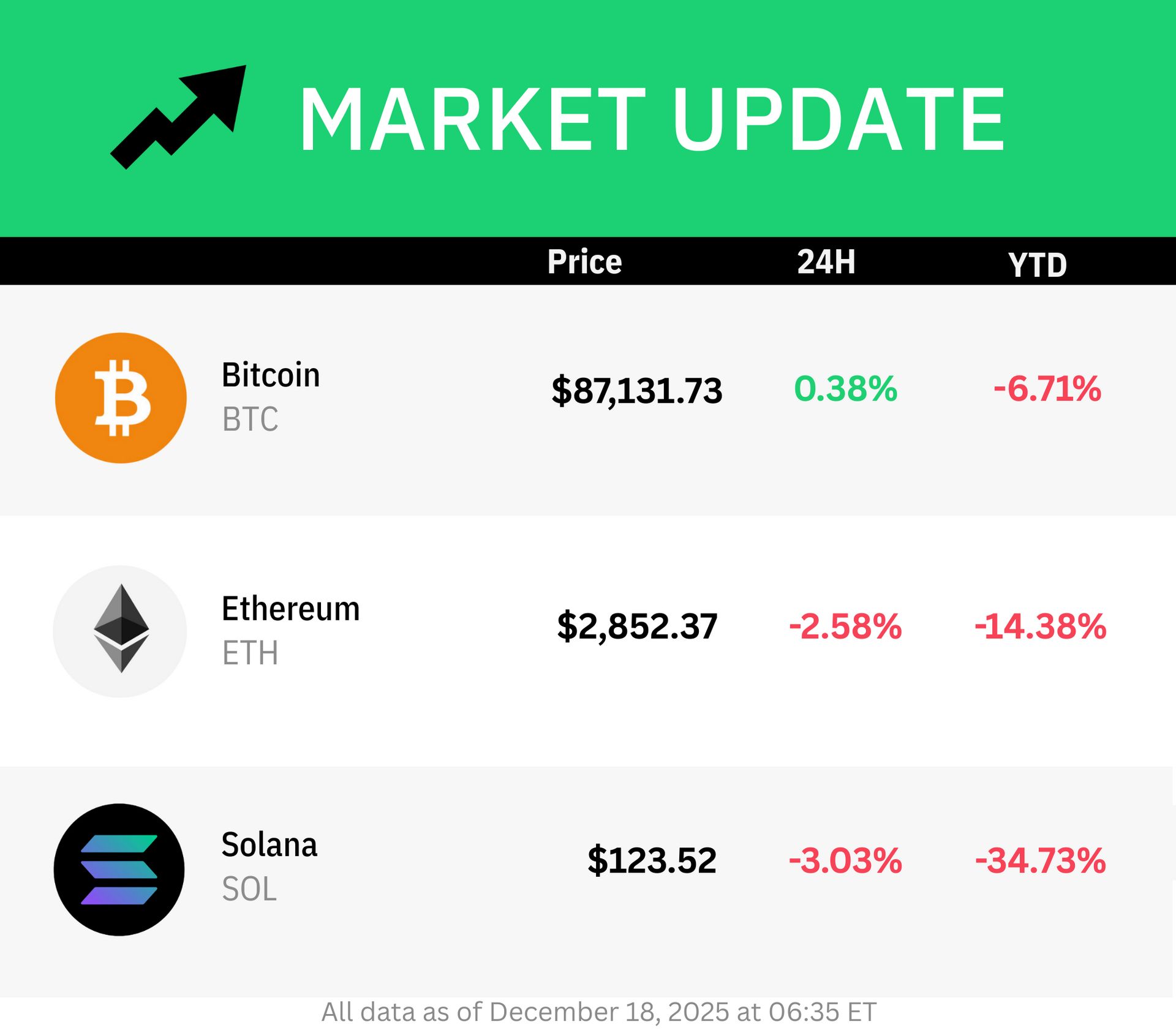

Bitcoin hasn’t had the best year, losing 13% year-to-date after effectively erasing all its 2025 gains in the last two months.

Onchain analytics firm Glassnode said the road to recovery is weighed down by heavy overhead supply, rising loss realization and fading demand.

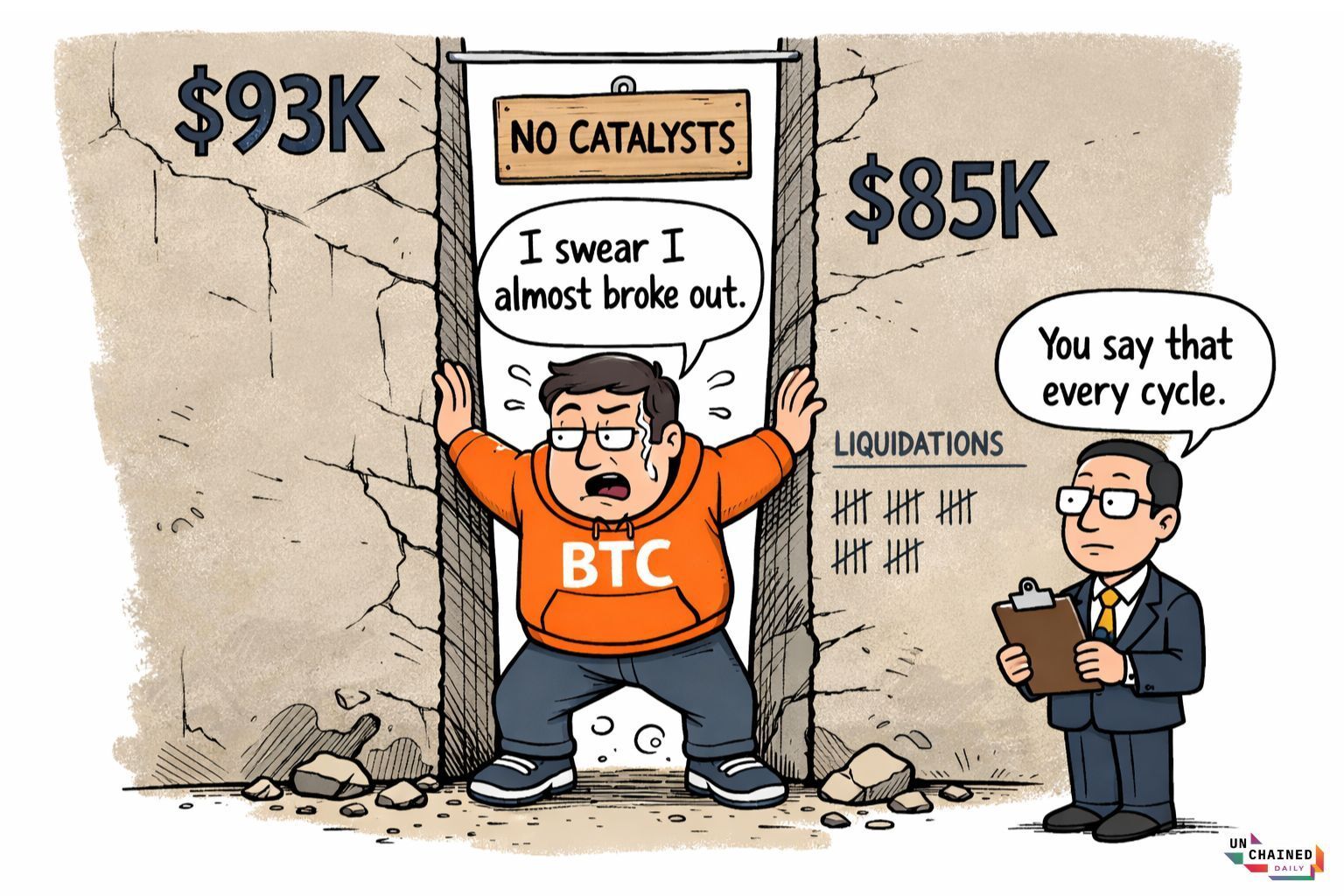

“Bitcoin remains confined within a structurally fragile range, with recent rejection near $93k and a gradual drift lower toward $85.6k highlighting persistent overhead supply,” Glassnode wrote.

The analysts concluded that a leg higher would require either seller exhaustion or a renewed influx of liquidity capable of absorbing supply.

Bitcoin has seen more than six large liquidation events this year, with total yearly liquidations exceeding tens of billions. Unlike previous cycles, the negative price action comes in a year that has been devoid of major catalysts like the FTX collapse in 2022 and the ICO bubble bursting in 2018.

TUNE IN for back-to-back shows of Unchained On Air and Bits + Bips: The Interview

12pm ET ➡️ Laura Shin x Figment Capital’s Dougie DeLuca

12:30pm ET ➡️ Laura Shin x Steven Ehrlich

1:00pm ET ➡️ Steven Ehrlich x Figure’s Mike Cagney

1:30pm ET ➡️ Steven Ehrlich x Jason Brett

Coinbase Launches Stock Trading and Prediction Markets

Crypto exchange Coinbase announced expansions into stock trading and prediction markets as part of its "everything exchange" strategy.

The exchange’s head of consumer products, Max Branzburg, announced the expansion into 24/7 commission-free trading for stocks and ETFs at a San Francisco event called System Upgrade.

Branzburg also announced a partnership with Kalshi for prediction markets, which begins today for select international users, with U.S. availability planned later.

Perpetual futures for stocks will follow early next year, and will be initially available outside the U.S.

The move positions Coinbase to compete more directly with popular retail broker Robinhood and diversify revenue beyond crypto amid market volatility.

Hyper Foundation Proposes Removing $1B HYPE Tokens From Supply

The Hyper Foundation has proposed a validator vote to treat all HYPE tokens in Hyperliquid's Assistance Fund as permanently burned, effectively removing them from both circulating and total supply.

The move targets around 37 million HYPE tokens, valued at around $1 billion, which equates to over 13% of the circulating supply.

The Assistance Fund automatically converts Hyperliquid's trading fees into HYPE tokens, accumulating them in a system address without a private key, making them already inaccessible without protocol changes.

That means no burn transaction would be required, and instead, a “yes” vote would create binding social consensus to exclude these tokens forever.

The governance vote runs through December 24 and the outcome will be based on a stake-weighted consensus.

How the Crypto Market Structure Law Would Expose that Trump’s WLFI Isn’t DeFi

By Jason Brett

Since September 2024, President Trump’s sons, Donald Jr., Eric, and Barron, have been building their DeFi project, World Liberty Financial, alongside long-time Trump ally Steve Witkoff’s sons, Zach and Alex Witkoff, and inking deals with top crypto firms such as Kraken, Aster Exchange, and Bithumb.

The market cap of its WLFI token is at $3.52 billion, and its stablecoin USD1 was used as the settlement asset for a $2 billion investment by Abu Dhabi’s MGX into Binance, one of the largest stablecoin-funded crypto deals to date. USD1 has its own market cap of $2.7 billion, which is ranked 6th among stablecoins worldwide by market capitalization.

However, as our reporting shows, the WLFI project is structured in a way that it is highly unlikely to fit the definition of “decentralized” finance in a long-awaited market structure bill, which could create problems between the White House, Congress, and the broader industry.

So if WLFI isn’t really DeFi under the law, what happens when Congress forces the issue—and will Trump make an exception for his own project?

Binance Offers $5 Million Reward for Information on Fake Listing Agents

Crypto exchange Binance has launched a new whistleblower program offering rewards of up to $5 million to combat fraudulent token “listing agents.”

The reward is for verifiable tips that expose individuals or entities falsely claiming to act as intermediaries claiming they can secure token listings on the exchange for a fee.

As part of the crackdown, Binance has published an internal blacklist of people and firms accused of impersonating Binance or soliciting paid listing deals.

The blacklist includes BitABC, Central Research, May/Dannie, Andrew Lee, Suki Yang, Fiona Lee, and Kenny Z — all identified through an in-house audit.

The exchange has also formalized a stricter listing framework and explicitly stated that it does not authorize any third parties to handle or broker listings.

“Anyone claiming to be able to help you with a Binance listing is a scammer,” said Binance founder Changpeng Zhao on X.

“I recently had a country President asking about a listing. I told them I can't help,” he added.

The development comes amid reports that Binance is considering a return to the U.S. market, with Zhao potentially reducing his majority stake in the firm.

Solana Deploys Post-Quantum Signatures on Testnet

The Solana Foundation has partnered with Project Eleven to test quantum-resistant transactions on a production-like testnet.

Project Eleven conducted a full quantum threat assessment on Solana's infrastructure, including user wallets, validator identities, and risks like "harvest now, decrypt later" attacks.

The team prototyped a functioning testnet with post-quantum signatures, showing no major performance trade-offs despite the higher computational demands of these algorithms.

The pilot demonstrates that end-to-end post-quantum digital signatures are practical and scalable for the network.

“Quantum computers aren't here yet, but Solana Foundation is preparing for the possibility,” said the Solana Foundation in a post on X.

Experts predict varied timelines for cryptographically relevant quantum computers capable of breaking elliptic curve signatures used by major blockchain networks today.

Ethereum co-founder Vitalik Buterin has warned elliptic curves could fail before 2028, while Blockstream CEO Adam Back doesn’t see risks materializing for another 40 years.

Decentralized data is the future — that’s why Unchained stores its media library on Walrus. With lightning-fast performance, unparalleled reliability, and granular access controls, your data is secure and dependable, no matter what.

📜 The U.S. Federal Reserve withdrew 2023 guidance that had discouraged uninsured banks from crypto activities and Fed membership, a policy that had previously helped justify rejecting Custodia Bank’s master account application.

🔑 The U.S. SEC issued guidance saying broker-dealers must directly control crypto private keys to meet customer protection rules, clarifying that holding exclusive access, strong security policies, and contingency plans is required when handling tokenized stocks or bonds.

🇮🇳 India’s antitrust regulator approved Coinbase’s acquisition of a minority stake in CoinDCX, clearing a key regulatory hurdle for the U.S. exchange’s return to one of the world’s fastest-growing crypto markets following its earlier exit and recent reopening.

🇺🇸 Binance is reportedly weighing ways to restart Binance US, including fresh funding that could shrink founder Changpeng Zhao’s stake, as his control has reportedly blocked the exchange’s expansion across several U.S. states.

🏛️ Reports said Plume was seeking U.S. regulatory approval to let users buy blockchain tokens linked to real-world assets like businesses and oil wells, even as Federal Reserve economists warned such tokenization could spread crypto-related shocks, and disclosures showed Plume advising the SEC’s crypto task force while partnering with the Trump-linked World Liberty project.

💳CFTC acting chair Caroline Pham is set to join crypto payments firm MoonPay as chief legal and administrative officer, where she would run global legal operations and lead U.S. policy and regulatory strategy.

🛠️ Coinbase announced “Custom Stablecoins,” a new service allowing partners to issue their own branded digital dollars backed by assets like USDC, with projects such as R2, Flipcash, and Solflare planning launches in the coming months.

🔐 DTCC chose the privacy-focused Canton Network to tokenize a portion of U.S. Treasury securities it safeguards, deepening its push into blockchain infrastructure with Digital Asset—a firm backed by major Wall Street players—and taking a leadership role in setting standards for tokenized finance.

🏗️ JPMorgan moved its JPM Coin tokenized deposit system from its private Kinexys blockchain onto Coinbase’s public Base network, aiming to better support institutional payments, collateral, and margin settlement on open blockchains.

Ready for Merge is a podcast for investors, builders, and operators who want to stay informed on Ethereum and Bitcoin protocol development. Hosted by ChristineD. Kim, former host of Infinite Jungle and Mapping Out Eth.2.0, each episode breaks down core developer debates, protocol upgrades, and governance tradeoffs—without hype.

Listen now on:

Beware the Lofty Promises of TradFi Firms Embracing Tokenization by Omid Malekan, Adjunct Professor at Columbia Business School

DL News: A $100tn TradFi giant just gave crypto a huge boost. ‘Never seen anything move as quickly’