- Unchained Daily

- Posts

- BlackRock’s $9 Trillion Bet on Stablecoins

BlackRock’s $9 Trillion Bet on Stablecoins

Plus: 💰 Ripple plans $1B XRP treasury, 🦾 CZ pressures Coinbase, 🪙 Uniswap adds Solana swaps, 🐋 Inside the $192M ‘legal’ whale trade.

Hi! In today’s edition:

• 💵 BlackRock revamps fund to back stablecoin issuers

• 🪙 Ripple leads $1B raise for new XRP treasury

• 🦾 CZ calls on Coinbase to list more BNB Chain projects

• 🌉 Uniswap adds Solana swaps through Jupiter API

• 🐋 The $192M whale trade that broke markets — legally

By Tikta

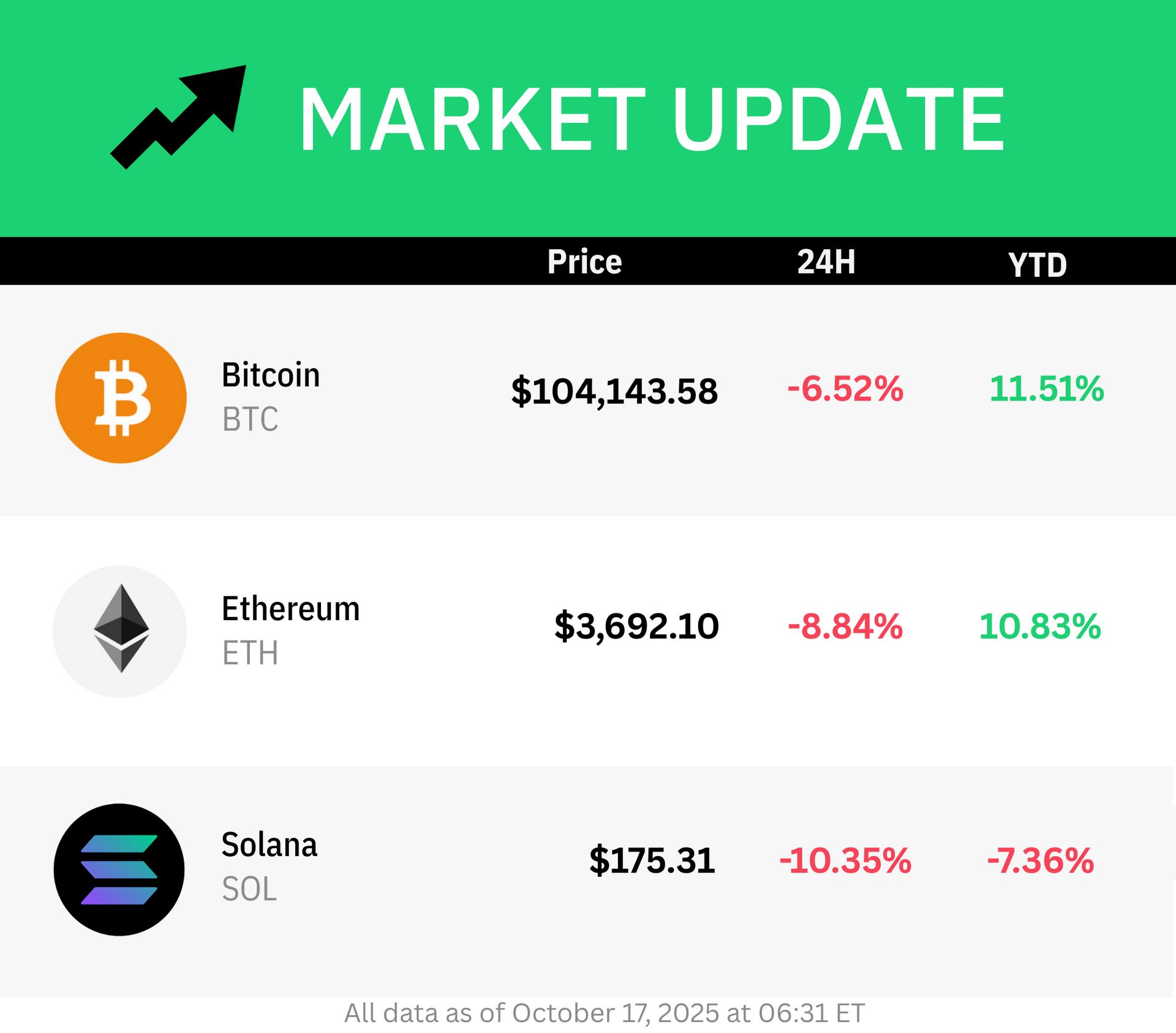

BlackRock Redesigns Money Market Fund for Stablecoins

Investment manager BlackRock has redesigned one of its flagship treasury funds to cater directly to stablecoin issuers.

The new vehicle, called the BlackRock Select Treasury Based Liquidity Fund (BSTBL), is a revamp of the BlackRock Liquid Federal Trust Fund.

The fund now invests exclusively in short-term U.S. Treasury securities and overnight repurchase agreements, making it a highly secure and liquid reserve option for issuers of U.S. dollar-pegged stablecoins.

BSTBL is the first major asset management product explicitly designed to comply with the GENIUS Act, a new U.S. law signed by President Donald Trump in 2025 that established the first national framework for stablecoins.

Ripple Labs Leads $1 Billion Raise for XRP Treasury Firm: Report

XRP-issuer Ripple Labs is leading a fundraising effort seeking at least $1 billion to establish a new digital asset treasury (DAT) for XRP, according to a report from Bloomberg.

The planned round will be via a special purpose acquisition company (SPAC), and Ripple will contribute some of its own XRP holdings to this new treasury.

The new firm would be the largest XRP treasury established so far if successfully completed.

The report comes after Ripple's own announcement earlier in the day, saying it had completed the $1 billion acquisition of GTreasury, a treasury management software company.

Ripple called the acquisition a “watershed moment for treasury management” and shared plans to tap into the global repo market via prime broker Hidden Road.

CZ Urges Coinbase to ‘List More BNB Chain Projects’

Binance founder Changpeng Zhao (CZ) has urged Coinbase to list more projects from the BNB Chain on its exchange.

“Binance has listed several Base projects. Don't think Coinbase has listed a single BNB Chain project yet. And it's a more active chain,” said Zhao on X.

Coinbase added BNB to its roadmap as a pre-listing step, with actual trading contingent on sufficient infrastructure and market-making support.

Some members of the crypto community suggested the move to list a competitor’s token was done just to make a point, after Binance was accused of charging projects exploitative listing fees.

Uniswap Web Integrates Solana Trading Through Jupiter API

Uniswap's web app has launched support for the Solana network, meaning users can now trade Solana tokens without leaving the app.

Instead, users can connect their Solana wallets and swap Solana tokens directly within the Uniswap Web App, alongside Ethereum and over a dozen other networks.

The integration, powered by the Jupiter API, aims to reduce fragmentation in decentralized finance (DeFi) by allowing users to manage tokens across different ecosystems from one place.

“This launch is the first phase of Solana support in Uniswap apps,” said Uniswap.

“Next up, we’re exploring bridging, cross-chain swaps, and full Uniswap Wallet support, making it easier to move across chains without leaving Uniswap apps.”

Why the Black Friday Whale’s $192 Million Crypto Trade Was Legal

When the crypto markets plunged last Friday — just minutes after President Donald Trump announced sweeping new 100% tariffs on Chinese imports — investors were stunned. In less than 30 minutes, more than $19 billion in long positions were liquidated, wiping out weeks of steady gains across the digital assets market.

However, somebody who shorted the market on Hyperliquid made off with $192 million in pure profit.

Rumors are swirling about whether anyone had advance knowledge of Trump’s announcement, so they would know just the right time to put on these sizable positions. But while reporters and investigators around the world are working to identify this pseudonymous trader or traders, here’s the ironic part of the whole episode — they likely did not commit insider trading.

So how can a $192 million trade that looks suspicious be perfectly legal?

⚠️ The Financial Stability Board warned that weak and inconsistent crypto regulations worldwide are letting companies shop for lenient jurisdictions, creating gaps in oversight that could trigger systemic financial risks if left unchecked.

💳 Coinbase launched a new business payments platform that lets companies send and receive USDC stablecoins with instant cash‑out, bookkeeping integrations, and interest on balances, signaling a deeper push into corporate crypto finance.

🌞 Daylight, a blockchain project focused on decentralized energy infrastructure, raised $75 million through a mix of equity and project finance, aiming to build a global network that rewards users for connecting energy devices like solar panels and batteries.

💰 A16z crypto invested $50 million in Jito, a Solana-based staking protocol, in what the foundation called the largest single investment it has ever received, cementing a long-term alignment between the investor and the project.

📊 Figment acquired U.K.-based Rated Labs to strengthen its staking data services for institutional clients, marking a key step in its $200 million acquisition strategy to expand its footprint across major blockchain networks like Ethereum and Solana.

🏦 Cantor Fitzgerald could earn around $25 billion from its early Tether investment if the stablecoin issuer succeeds in raising $15 billion at a $500 billion valuation, a deal that would rank among Wall Street’s most lucrative private bets.

$19B liquidated on Friday

$200M liquidated on Tuesday

Only $135M liquidated today

Incredible progress, well done everyone

— フ ォ リ ス (@follis_)

4:15 PM • Oct 16, 2025