- Unchained Daily

- Posts

- BlockFills Freezes Withdrawals as Market Turbulence Deepens

BlockFills Freezes Withdrawals as Market Turbulence Deepens

Plus: 📈 UNI surges on BlackRock’s DeFi move before reversing.

Hi! In today’s edition:

🚨 BlockFills pauses withdrawals as liquidity concerns resurface

📈 UNI jumps on BlackRock DeFi integration, then reverses

🎙️ Nic Carter questions Bitcoin’s narratives and ETF influence

🎙️ Parker White explores a possible Bitcoin ‘Big Short’

Today’s newsletter is brought to you by Adaptive Security!

In crypto, the biggest losses don’t start with malware — they start with trust: a “founder” on a deepfake call asking for an urgent transfer, a cloned vendor voice “confirming” new banking details, or a perfectly-written email/DM that looks internal and reroutes funds.

Adaptive Security helps teams catch these AI-powered attacks before money moves:

Deepfake + social engineering simulations across channels

AI Content Creator that turns new threats, policies, or compliance needs into interactive, multilingual training in minutes

Trusted by Fortune 500s, Adaptive is backed by NVIDIA and OpenAI.

BlockFills Halts Withdrawals as Market Stress Spreads

Another sign of strain is flashing across crypto markets.

Institutional trading and lending platform BlockFills has paused client deposits and withdrawals and limited certain trading activity, according to company statements and reports. The Chicago based firm, backed by investors including Susquehanna and CME Ventures, handled roughly $60 billion in trading volume last year and serves more than 2,000 institutional clients, including hedge funds and asset managers.

The company said the move was temporary and aimed at protecting both clients and the firm amid volatile market conditions. Customers are still able to open and close spot and derivatives positions, but access to funds remains restricted while the company works to restore liquidity.

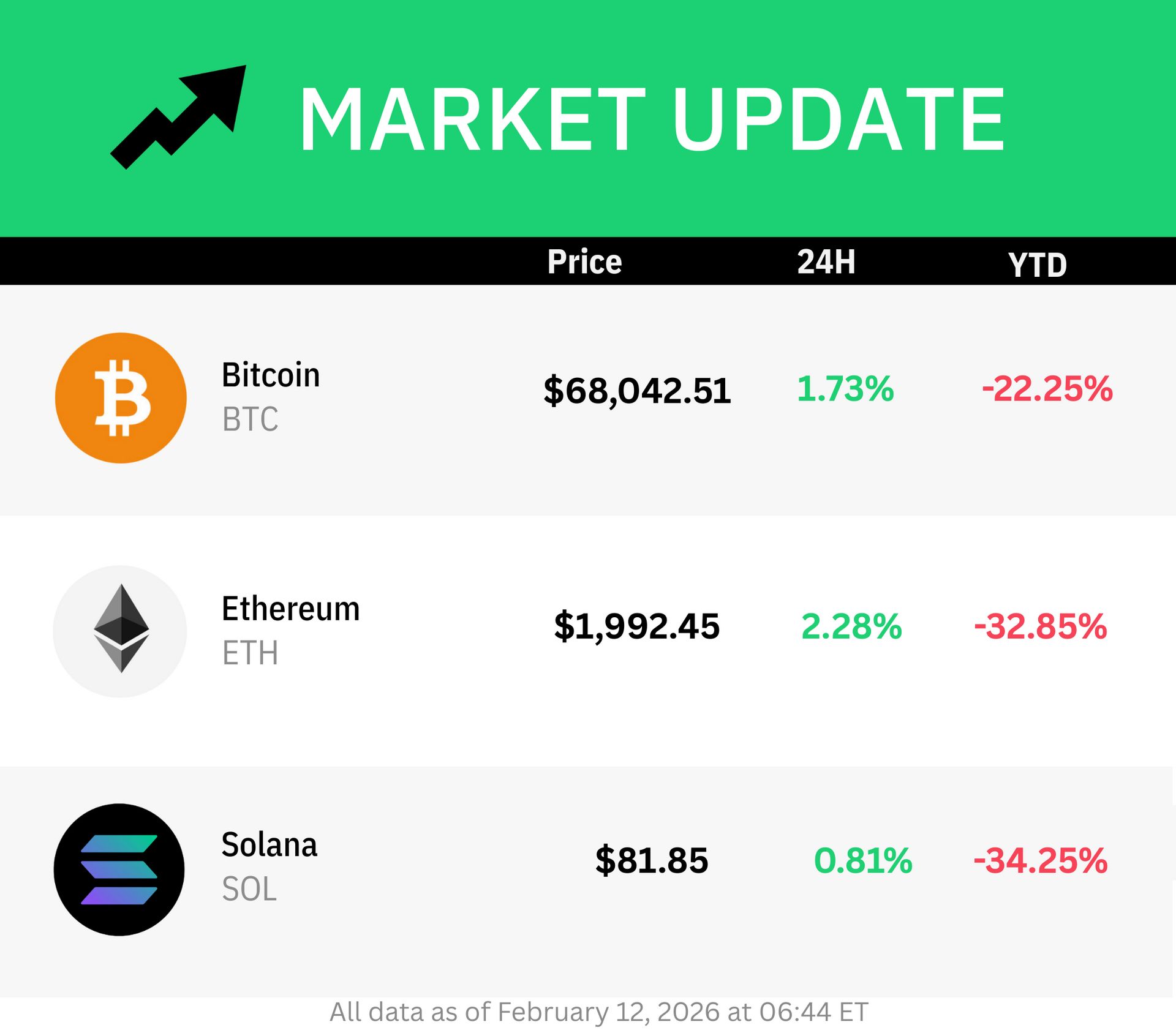

The timing is unsettling. Yesterday, bitcoin plunged below $66,000 after touching $60,000 during last week’s selloff, deepening a drawdown of roughly 45% from its October peak.

For many market participants, the decision evokes uncomfortable memories of 2022, when a cascade of platforms froze withdrawals before collapsing. Whether this proves to be precautionary or something more serious will be closely watched in the days ahead.

UNI Spikes on BlackRock DeFi Move, Then Gives It All Back

Uniswap’s UNI token erupted higher Tuesday after news that BlackRock’s tokenized Treasury fund, BUIDL, will be tradable through UniswapX in partnership with Securitize. The move marks the first time the world’s largest asset manager is plugging one of its tokenized funds directly into DeFi trading infrastructure. BlackRock also disclosed it purchased an undisclosed amount of UNI as part of a strategic investment in the ecosystem.

Traders reacted instantly. In a fifteen minute surge, UNI ripped from $3.29 to $4.36, a near vertical move that briefly put the token up more than 30% intraday. But the excitement faded just as quickly. As of this morning, UNI has erased almost the entire move, changing hands near $3.37.

BUIDL, which holds roughly $2.4 billion in assets, will remain limited to whitelisted institutional participants, with trading routed through a request for quote system and settled onchain. The episode underscores both growing institutional interest in DeFi rails and the market’s current fragility, where even major headlines struggle to sustain momentum.

Bits + Bips: Could BlackRock Someday Feel Compelled to ‘Fire’ Bitcoin Core Devs?

As OGs distribute their holdings to institutional newcomers and foundational Bitcoin narratives lose credibility, Nic Carter argues the token-focused VC model has reached its end, and boring, cash-flowing businesses are all that remain.

Bitcoin slid toward $60,000 on Feb. 5 in a brutal, cross-asset selloff that hit gold, equities, and crypto alike. With leverage unwinding and basis trades breaking, long-time bitcoin holders are distributing to institutional buyers who, by 13F data, are mostly underwater. The mood across digital assets is bleak.

Against that backdrop, Nic Carter of Castle Island Ventures argues that key Bitcoin narratives have quietly failed—and warns that developers’ inaction on quantum risk could open the door to institutional control. If devs don’t act, Carter says ETF giants like BlackRock will.

The panel then widens the lens: declaring the token-centric VC model dead, debating whether AI now rivals the industrial revolution, and stress-testing it all across topics ranging from Solana vs. Hyperliquid to Japan’s political shift and MrBeast’s fintech play.

Could a Non-Crypto Hedge Fund Have Pulled a Bitcoin ‘Big Short’?

Parker White walks through his viral theories on Bitcoin’s struggling price.

What happened to Bitcoin on Feb. 5? And why does the apex crypto continue to underperform?

DeFi Development Corp investment chief Parker White has some theories. In this Unchained podcast episode, Parker walks Laura Shin through them as they gain traction on X.

At the center of it all is a non-crypto Hong Kong fund and another fund that may be executing a ‘Big Short’-style trade using derivatives. Here’s why Parker is so convinced.

Listen to both these episodes on Apple Podcasts, Spotify, Fountain, Podcast Addict,Pocket Casts, Amazon Music, or on your favorite podcast platform.

Figure is giving away $25,000 in USDC!

Deposit into Democratized Prime, earn ~9% APY hourly—and every $1 you keep in for 25 days is 1 entry.

🧾 Strategy is preparing to issue additional perpetual preferred shares, including a new product called “Stretch” with an 11.25% reset dividend, designed to reduce stock volatility while giving investors structured exposure to digital assets, as the company continues funding bitcoin purchases through a mix of common and preferred equity.

🐋 Trend Research, led by trader Jack Yi, fully exited its ethereum long position, closing what was once Asia’s largest ETH bet worth $2.1 billion at peak exposure and ending the trade with a massive $869 million loss, leaving its monitored onchain wallets completely empty.

📊 Tether plans to sharply increase its U.S. Treasury bill purchases in 2026, aiming to rank among the top 10 global buyers as its USDT stablecoin grows, with current holdings already exceeding $122 billion in T-bills — more than Germany — accounting for over 83% of its reserves.

🔄 Sonic, a layer 1 blockchain, abandoned its reliance on transaction fees alone and shifted to a vertically integrated model, planning to own key trading, lending and payment applications so that revenues flow directly to its S token, while replacing airdrops with revenue-funded buybacks and recycling gas fees to attract users more efficiently.

🔥 House Democrats sharply criticized SEC Chair Paul Atkins for scaling back crypto enforcement, arguing during a congressional hearing that dismissing high-profile cases tied to firms connected to President Trump has weakened investor confidence and damaged the regulator’s credibility amid a broader $1 trillion crypto market downturn.

🚔 Peer-to-peer Bitcoin exchange Paxful was ordered to pay $4 million in criminal fines after admitting it facilitated money laundering and prostitution-related transactions, with prosecutors reducing an originally proposed $112 million penalty due to the company’s inability to pay.

📜 The UK Treasury selected HSBC’s Orion blockchain platform to pilot the issuance of digital government bonds, aiming to speed up settlement and modernize debt markets by testing tokenized gilts within a regulatory sandbox overseen by the Financial Conduct Authority.

🏦 Danske Bank, Denmark’s largest financial institution, began offering Bitcoin and Ethereum exchange-traded products (ETPs) through its digital banking platforms, reversing an eight-year crypto ban while allowing clients price exposure without holding tokens directly, though the bank continues to label such investments as high risk.

🛡️₿ Binance’s SAFU emergency reserve fund acquired 4,545 BTC worth about $304.58 million, completing its $1 billion bitcoin accumulation plan and bringing total holdings to 15,000 BTC valued at roughly $1.005 billion.

💰 Birch Hill, a newly launched institutional onchain credit firm, raised $2.5 million in pre-seed funding led by ParaFi Capital and Castle Island Ventures to build blockchain-based lending infrastructure that prioritizes capital preservation and real-time collateral monitoring, with its first strategies launching on Morpho and plans to expand to other decentralized lending protocols.

DL News: Ethereum investors rush to pile onto $72bn staking bet despite price slump

We Are Not Onboarding Institutions (for Now) by Elijah, from Variant Fund

ERC-8004 and the Early Market for Onchain AI Agent Identity, by Elton, researcher at Allium Labs