- Unchained Daily

- Posts

- Crypto Bills Collapse in Congress. What Comes Next?

Crypto Bills Collapse in Congress. What Comes Next?

Plus, ⚖️ Crypto bills stall in House, 🔍 Polymarket cleared, 🌀 Roman Storm trial begins, 🪙 Cantor plots $4B BTC deal.

Hi! In today’s edition:

⚖️ Crypto bills stall after GOP revolt

🕵️ DOJ and CFTC close Polymarket case

🌀 Prosecutors say Roman Storm laundered $600M

💼 Cantor close to $4B bitcoin SPAC deal

📈 ETH breaks $3K amid treasury inflows

On the podcast:

🎧 Bits + Bips on GENIUS Act, macro and bitcoin ATHs

🎙️ Unchained: Pump.fun’s $600M ICO w/ Haseeb Qureshi and Joe McCann

These sponsors keep the newsletter free for you. We'd appreciate it if you could check out their products!

Access up to $1M without selling your Bitcoin

Instant liquidity. No selling. No fees. No early penalties. Backed by your BTC.

Discover a multi-currency wallet that’s easy, quick, and secure, and now SOC 2 Type 2 compliant–one of the highest standards for data security and operational integrity, affirming our commitment to ensuring that your data is protected.

By Tikta and Steve Ehrlich

Crypto Bills Stall in House After Failed Procedural Vote

Landmark crypto legislation faced a major setback in the U.S. House of Representatives during “Crypto Week” after a key procedural vote failed – the motion to advance three key crypto bills was defeated with 196 votes in favor and 223 against.

The main bills in question were the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), the Digital Asset Market Clarity (Clarity) Act and the Anti-CBDC Surveillance State Act.

Several House Republicans, including members of the House Freedom Caucus, voted "no" due to concerns over how the GENIUS Act addressed central bank digital currencies (CBDCs) and the lack of opportunity to amend the bill.

“Americans do not want a government-controlled Central Bank Digital Currency. Republicans have a duty to ban CBDC,” said Rep. Marjorie Taylor Greene on X.

Greene was among the twelve Republicans who voted no, as was Rep. Ann Paulina Luna, who said she voted against the rule because it would’ve allowed the crypto bill to come to the floor with a “back door” to a CBDC, according to Punchbowl News’ Laura Weiss.

Some legislators also voiced frustration with House Speaker Mike Johnson for not permitting amendments, contributing to the bill's failure.

All scheduled votes on the crypto bills were canceled for the day. No further votes were expected until at least the following day, though lawmakers signaled intentions to try again soon.

“If you’re going to declare a ‘crypto week’ maybe make sure your entire caucus is on board first? Idk, just a thought,” said the Democrats' House Financial Services Committee on X.

DOJ and CFTC Drop Investigations Into Polymarket: Report

The U.S. Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC) have officially closed their investigations into Polymarket, the blockchain-powered prediction market platform, Bloomberg first reported.

Both agencies recently notified Polymarket that the criminal and civil probes, which sought to determine if the company allowed U.S. users to place bets despite a previous agreement to block Americans, have ended with no further action taken and no charges filed.

Investigations ramped up during the 2024 U.S. elections, a time when Polymarket saw significant use by bettors speculating on political outcomes. The scrutiny included an FBI raid of CEO Shayne Coplan's residence in November 2024.

The CFTC’s concerns dated back to 2022, when Polymarket paid a $1.4 million fine and agreed to restrict U.S. traders after the CFTC found it operated as an unregistered binary options market.

Prosecutors Claim Roman Storm Made Millions From Dirty Money Laundromat

Prosecutors argued that Tornado Cash co-creator Roman Storm made millions of dollars in profits from operating the crypto mixer, which they described in court as a "giant washing machine for dirty money" used by some of the world's biggest hackers, including North Korea's Lazarus Group.

In their opening statements at the criminal trial, reported by Inner City Press, prosecutors argued that Storm was aware his platform was used to launder money for sanctioned entities.

“The defendant chose to remove the switch that could have controlled the washing machine. He was running the whole laundromat,” reportedly said Assistant US Attorney Kevin Mosley.

“He had the keys to the front door. He was doing business with criminals. That is a crime. He cleaned $600 million for North Korea.”

He went on to claim that Storm cashed out a few months later, selling millions of dollars’ worth of crypto through someone else’s account.

Mosley also told the jury that Storm marketed Tornado Cash as a washing machine for laundering money, presenting a T-shirt worn by the developer at a tech conference that had a washing machine and a Tornado Cash logo on it, as evidence.

Storm’s lawyers argued that he had nothing to do with the hacks, making the case for Tornado Cash simply being a privacy protocol freely available to everyone.

Cantor Fitzgerald SPAC Nears $4 Billion Bitcoin Deal With Adam Back: Report

Wall Street giant Cantor Fitzgerald is reportedly in the final stages of a landmark deal involving its special purpose acquisition company (SPAC), Cantor Equity Partners 1, and renowned bitcoin pioneer Adam Back, co-founder and CEO of Blockstream.

The transaction is poised to be one of the largest institutional bitcoin acquisitions to date, according to a report from the Financial Times.

Cantor Equity Partners 1, which raised $200 million in a January IPO, would acquire 30,000 BTC, worth over $3 billion.

In exchange, Blockstream and Back are expected to receive shares in the newly formed entity, which will be renamed BSTR Holdings after the deal’s completion.

The SPAC also plans to raise up to $800 million from external investors to finance additional bitcoin purchases, potentially pushing the total value of the deal above $4 billion.

The deal would sharply increase Cantor Fitzgerald’s exposure to bitcoin, building on the firm’s earlier $3.6 billion crypto venture with SoftBank and Tether in April.

Ethereum Finally Crosses $3,000. Here’s Why It Could Go Higher

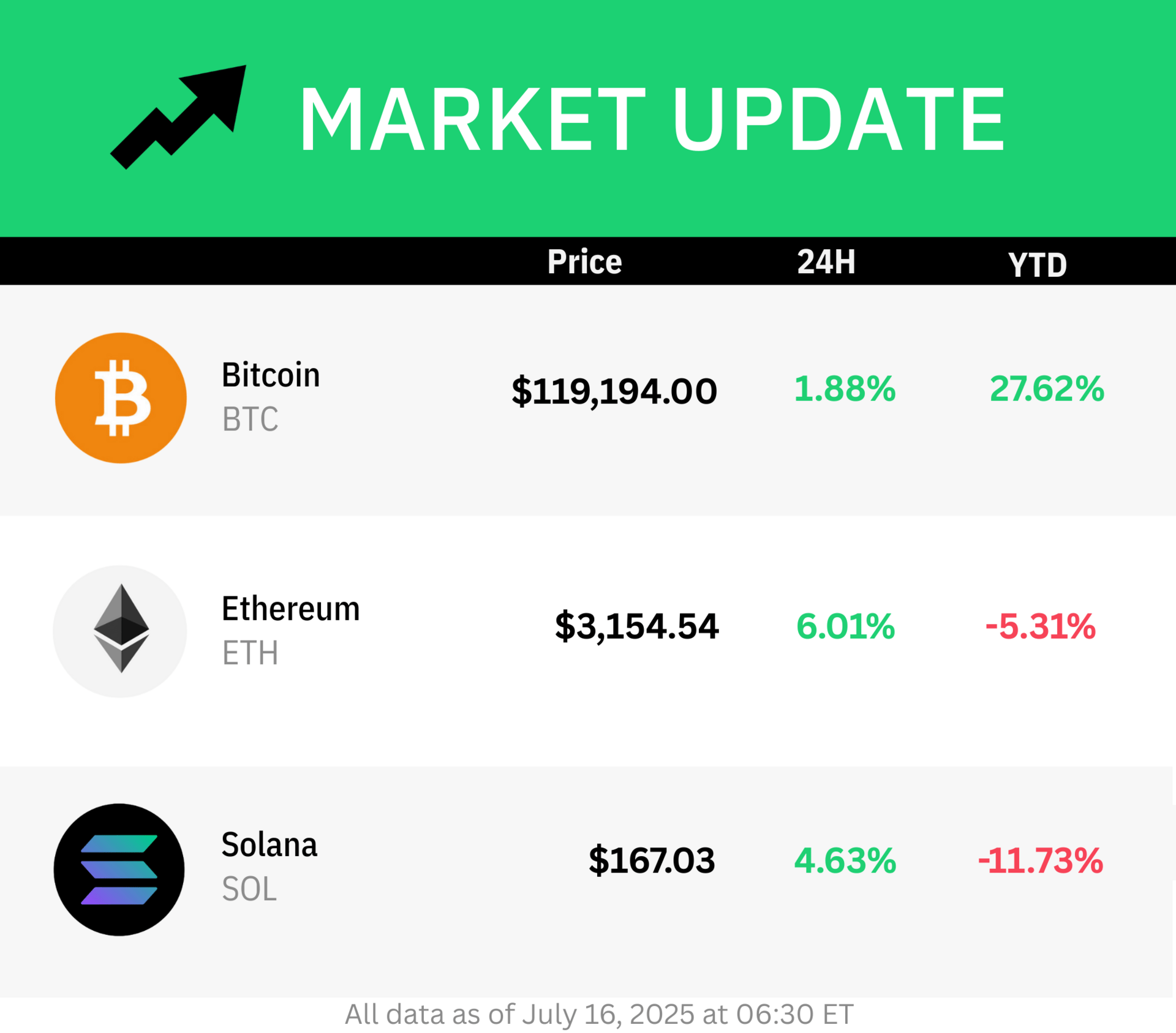

While bitcoin (BTC) is consolidating after a torrid last week that saw it breach $120,000 for the first time and set a new all-time high above $123,000, ether (ETH), the world’s second-largest cryptocurrency, appears poised to unlock a new level of gains.

Aside from getting a boost from bitcoin’s recent surge and bullish momentum in Washington, D.C., on a couple of key pieces of legislation setting the rules on stablecoins and broader market rules, ether is benefiting from its own crop of crypto treasury companies such as Sharplink (SBET) and Bitmine (BMNR), which have accumulated $866.8 million and $503.8 million worth of the asset, respectively. Additionally, with the crypto treasury company trend just getting started, many more are likely to be on the way.

Currently priced at around $3,150, ether is quickly making up ground on other major digital assets like bitcoin and solana (SOL). It is up almost 90% over the past three months, dwarfing the relative performance of the other two assets.

So what technical signals (and growing market confidence) are fueling talk of a breakout to $4,000 and beyond?

Bits + Bips: Who Wins If the GENIUS Act Passes, and Is Bitcoin’s Rally Over?

Bitcoin’s ripping, banks eye stablecoins as Congress nears the finish line, and Pump.fun reignites ICOs. But now what?

Bitcoin broke its all-time high. Meanwhile, stablecoin legislation is about to pass. And the macro picture is a powder keg.

In this episode of Bits + Bips, Steve Ehrlich, Ram Ahluwalia, and Noelle Acheson are joined by Austin Campbell to break down what’s really driving markets, and what could break them. From the GENIUS Act reshaping stablecoins to tariffs putting pressure on the Fed, to the Pump.fun ICO and memecoin mania, nothing is off limits.

And with crypto ripping, is it time to ride the rally, or take some risk off the table?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Pump.fun Raised $600M. What Does This Mean for DeFi, Solana & Social Media?

What if crypto’s next big narrative isn’t DeFi, but financial entertainment?

The weeks leading up to Pump.fun’s ICO were contentious: accusations that it was extractive, debates over decentralization, and outrage over allocations.

In the end, the company pulled off the third-largest ICO in crypto history, raising $600 million in 12 minutes.

The day of, Solana barely flinched under the load, and onchain platforms like Hyperliquid and Raydium left CEXes looking outdated.

In this episode of Unchained, Haseeb Qureshi of Dragonfly and Joe McCann of Asymmetric join Laura to break down:

Whether this marks the return of ICOs

The objections to the small ($10 million) airdrop to creators

How Pump.fun’s ambitions could reshape memecoins, and maybe Solana itself

And why TikTok might not need to worry just yet

Listen to the episode on Apple Podcasts, Spotify,Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

📢 Crypto-backed political group Fairshake has raised $141 million for the 2026 U.S. elections, aiming to support pro-crypto candidates after helping flip key races last year.

🪙 Citigroup revealed it’s weighing the launch of its own stablecoin and expanding into tokenized deposits, as the Wall Street giant deepens its push into digital finance.

🦈 Peter Thiel’s Founders Fund took a 9.1% stake in BitMine, backing its aggressive Ethereum-buying spree that pushed the miner’s ETH treasury past $500 million amid growing institutional interest in Ethereum over Bitcoin.

💥 BigONE lost $27 million in a targeted cyberattack on its hot wallet after a third-party breached the exchange’s internal systems, though private keys remained safe and user losses will be fully reimbursed.

🪂 Ethereum layer 2 Linea confirmed it will launch its long-awaited token by month’s end, but the announcement landed amid declining interest in layer 2 tokens, many of which have flopped post-airdrop.

🕹️🔄 Fantasy.top, a once-hyped crypto social game, is ditching the Blast blockchain for Coinbase’s Base after a 93% collapse in revenue and mass user exit, highlighting a broader retreat from once-buzzy SocialFi platforms.

🛡️ DeFi platform Arcadia lost $3.5 million in a targeted exploit involving its automated trading tool, prompting urgent warnings for users to cut off app permissions to avoid further losses.

🌐 SharpLink became the largest public holder of ether after a $156 million buying spree pushed its stash to 280,706 ETH, surpassing even the Ethereum Foundation’s own treasury.

📈 Bitcoin miner MARA led a $20 million investment into asset manager Two Prime and quadrupled its BTC allocation to the firm, signaling a shift toward actively earning yield on bitcoin rather than just holding it.

🏦 Dakota, a stablecoin-powered neobank founded by a former Coinbase exec, raised $12.5 million to scale its international business banking services using crypto to speed up money transfers.

non religious me asking god for a 10x in crypto

— naiive (@naiivememe)

7:46 PM • Jul 15, 2025

Big crypto returns often mean big tax hits.

Lumida Wealth helps offset these gains and reduce taxes using direct indexing and long/short strategies.

We can offset tax liabilities and keep you positioned for more growth.