- Unchained Daily

- Posts

- Crypto Capitulation Pushes Markets to the Brink

Crypto Capitulation Pushes Markets to the Brink

Plus: 📉 Markets see historic liquidations, 🏦 Strategy absorbs massive bitcoin losses.

Hi! In today’s edition:

📉 Crypto markets enter capitulation as liquidations top $2.6 billions

🏦 Strategy reports a $12.4 billion loss as bitcoin slides

🎙️ Charts flash oversold as we wonder if the bottom is in

Today’s newsletter is brought to you by YO (Yield Optimizer)!

Remember when DeFi meant 15 browser tabs, three stressful bridges, and checking Discord every hour to make sure you weren't getting rugged?

YO (Yield Optimizer) just retired that struggle.

Think of it as the "Easy Mode" button for DeFi. Whether you hold BTC, ETH, USD, EUR, or even GOLD, YO automatically routes your assets into the best risk-adjusted strategies across all chains.

It’s not just an aggregator; it’s an engine that continuously rebalances your portfolio using Exponential’s Risk Ratings (so you don't have to do the due diligence math).

100+ Integrations: Unmatched diversification.

Zero Bridging Stress: Cross-chain yield in one click.

Total Transparency: See exactly where the yield comes from.

Stop farming. Start optimizing.

YO just launched $YO Rewards, where you earn base yield plus additional $YO rewards. For the first campaign, you’ll earn a 14% reward rate on any yoVault!

Crypto Capitulation Deepens as Prices Slide to Multi-Year Lows

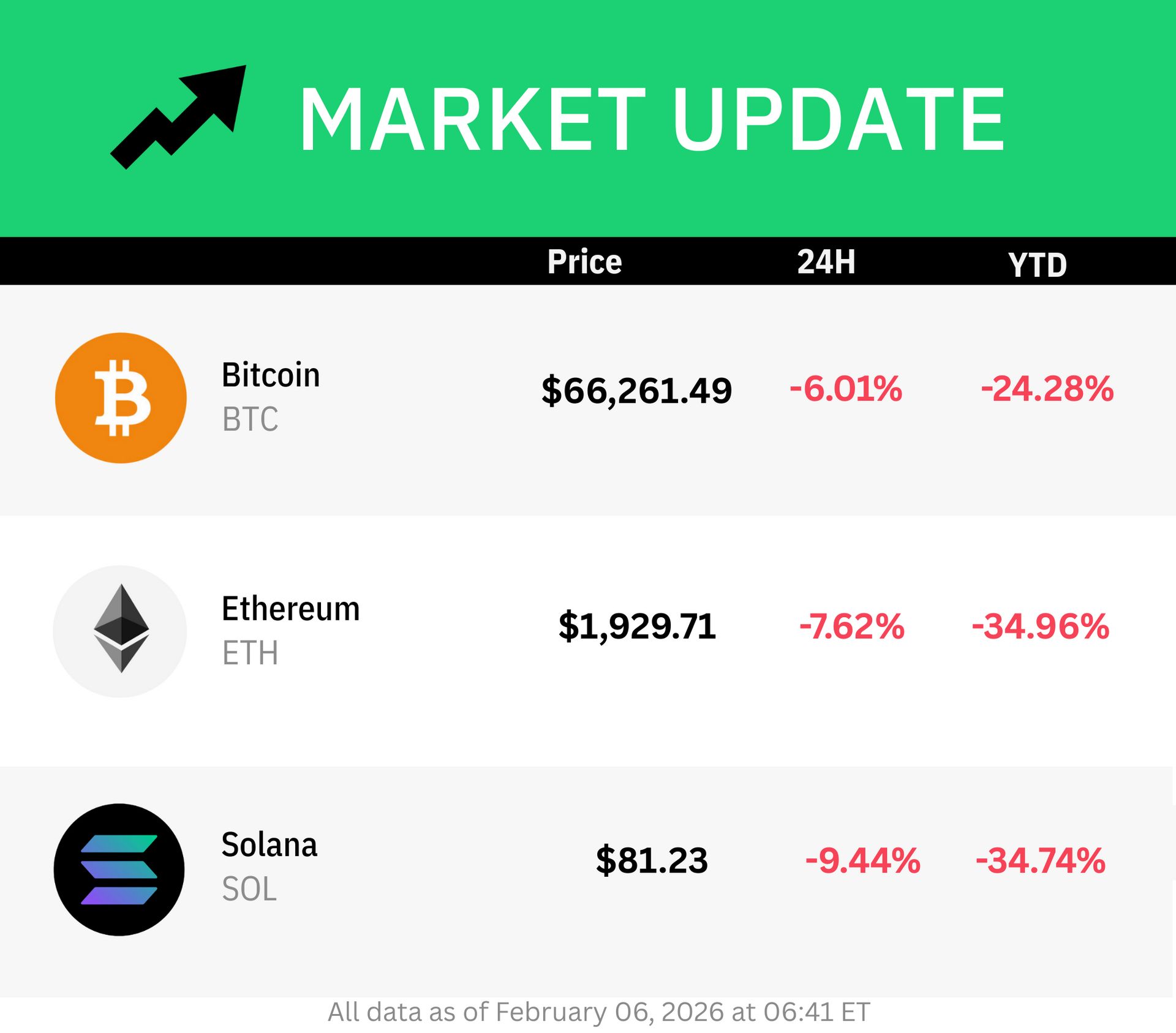

Crypto markets extended last week’s selloff into a full-blown capitulation, with sentiment hitting levels last seen during the 2022 collapse. As of 5:50 am ET, bitcoin was trading near $65,900, after briefly plunging toward $60,000, while ether fell to $1,920 and solana slid to $81.

The Crypto Fear & Greed Index dropped to 9 out of 100, its lowest reading since the Terra meltdown.

The damage has been broad and mechanical. Over the past 24 hours alone, roughly $2.6 billion in leveraged positions were liquidated, the majority tied to long bets. Bitcoin also slipped below its 200-week exponential moving average, a level historically breached only during deep bear markets. From its October peak near $126,000, BTC is now down close to 50%.

ETF flows reflect the stress. U.S. spot bitcoin ETFs posted $434 million in net outflows on Feb. 5, led by $175 million exiting BlackRock’s IBIT, even as the fund saw a record $10 billion in daily trading volume. Ether ETFs lost another $81 million, while solana ETFs bucked the trend with modest inflows.

Trading activity has surged amid the chaos. Perpetual DEXs recorded over $70 billion in daily volume, the second-highest day on record, trailing only the October 10 flash crash.

Meanwhile, the total crypto market cap has fallen to roughly $2.3 trillion, with more than $1 trillion erased since mid-January.

Pressure is also mounting beneath the surface. Bitcoin mining profitability has collapsed, with hash price falling to a record low near $0.03 per terahash, squeezing miners already facing higher power costs.

Together, the data paints a picture of forced selling, thin liquidity, and a market still searching for a durable floor.

Strategy Posts $12.4B Loss as Leadership Moves to Steady Investors

This week’s crypto rout is now showing up clearly on corporate balance sheets.

Strategy (MSTR) reported a $12.4 billion net loss in Q4, largely driven by bitcoin’s sharp decline from its October highs. With BTC briefly slipping below $76,000, the company’s average purchase price, Strategy is now sitting on roughly $9 billion in unrealized losses after spending $54.2 billion to build its bitcoin position.

The result sent Strategy’s stock into another leg down. Shares fell more than 17% after earnings, hitting their lowest level in 18 months and leaving the stock down over 70% from last year’s peak. The firm still holds about 713,500 bitcoin, but its equity premium — long central to its strategy of issuing shares to buy more BTC — has largely evaporated.

Management, however, struck a calm tone. CFO Andrew Kang emphasized that the company is designed to endure extreme volatility, while CEO Phong Le told investors that bitcoin would need to fall to $8,000 and stay there for years before Strategy’s balance sheet faced serious stress. Executive Chairman Michael Saylor echoed that message, calling the company a “digital fortress” and reiterating its long-term commitment to bitcoin.

Saylor also addressed a growing investor concern: quantum computing. He dismissed quantum threats as “horrible FUD,” arguing they are likely a decade away and would affect the entire financial system, not just bitcoin. He announced a new Bitcoin Security program to help coordinate work on quantum-resistant upgrades, stressing that bitcoin is “upgradable” through global consensus.

For now, Strategy isn’t signaling any forced selling. But with shares under pressure and the market questioning leveraged bitcoin exposure, Saylor’s conviction is being tested in real time.

Bitcoin Is Deeply Oversold. Does That Mean the Bottom Is In?

Bitcoin has slid into one of the most oversold conditions in its history, with Ethereum following close behind. Extreme fear is everywhere, but does that actually mean the bottom is in?

In this episode of Bits + Bips, Steve Ehrlich sits down with Fairlead Strategies founder Katie Stockton to break down what the charts are really saying. They discuss why oversold does not automatically mean a bottom, how technicians look for downside exhaustion, and what needs to change before confidence can return to Bitcoin and ETH.

From Ichimoku clouds and MACD signals to sentiment indicators and macro pressure, this conversation cuts through panic to explain what matters now — and what traders should be watching next.

✂️ Gemini, a publicly listed crypto exchange founded by the Winklevoss twins, is exiting the U.K., EU, and Australia and cutting 25% of its workforce to lower costs, narrowing its focus to the U.S. market and its fast-growing prediction markets business.

🇧🇷🚫 Brazil advanced legislation that would effectively ban algorithmic stablecoins by requiring all digital currencies pegged to cash to be fully backed by reserves, tightening rules after past crypto collapses and placing heavy compliance responsibility on exchanges.

🦄 Asset manager Bitwise filed paperwork with U.S. regulators to launch the first ETF tied to UNI, the governance token of Uniswap, as part of a broader wave of crypto investment products encouraged by a friendlier political climate.

💱 Crypto exchange Bullish, a trading platform that also owns CoinDesk, beat Wall Street’s fourth-quarter revenue and earnings expectations thanks to strong spot and options activity but still posted a large accounting loss after marking down the value of its digital asset holdings, sending its shares lower amid a broader crypto selloff.

🏠 ETHZilla, an Ethereum-focused treasury company whose crypto-heavy strategy backfired, pivoted toward real-world asset tokenization by buying a $4.7 million portfolio of manufactured home loans it plans to turn into blockchain-based income tokens.

🏦 Tether invested $100 million in Anchorage Digital, a federally regulated U.S. crypto bank, valuing it at $4.2 billion and strengthening Tether’s push into compliant U.S. stablecoin infrastructure as regulation tightens.

🥇 Tether also bought a 12% stake in Gold.com for $150 million to expand global access to tokenized gold, betting that rising demand for blockchain-based precious metals will drive growth in its gold-backed token XAUT.

🧪 Pump.fun, a Solana-based memecoin launchpad, acquired Vyper, a lesser-known high-speed trading terminal, folding its technology and team into Pump.fun’s multichain “Terminal” product to improve cross-chain and Ethereum-compatible trading as memecoin activity cools.

DL News: Japanese companies warm to Bitcoin treasuries after US slump

Crashes, Manias and Panic's by Raoul Pal