- Unchained Daily

- Posts

- Crypto Markets Rebound After $19 Billion Black Friday Crash

Crypto Markets Rebound After $19 Billion Black Friday Crash

Plus: 💸 Binance pays $283M in depeg fallout, 🧱 Bitcoin Core v30 sparks OP_RETURN debate, 🪙 DATs rethink LSTs as accounting rules bite.

Hi! In today’s edition:

• $19B wiped, but crypto bounces back fast

• 💸 Binance compensates users after depeg chaos

• ⚙️ Bitcoin Core update stirs major OP_RETURN debate

• 📊 DATs eye LST yields, but rules may block them

A shoutout to Aptos for sponsoring today’s issue.

Supporting them helps us keep bringing you the top crypto stories. Check them out!

Aptos Experience returns Oct 15-16 in Brooklyn

Real problems, real solutions, real users. Two days of immersive conversations with the builders, enterprises and investors shaping the future of money, media and more.

By Tikta

Crypto Markets Recover After Record $19 Billion Liquidation

After suffering the largest single-day liquidation in crypto history on Friday — over $19 billion across centralized and decentralized exchanges— digital asset markets are showing signs of recovery.

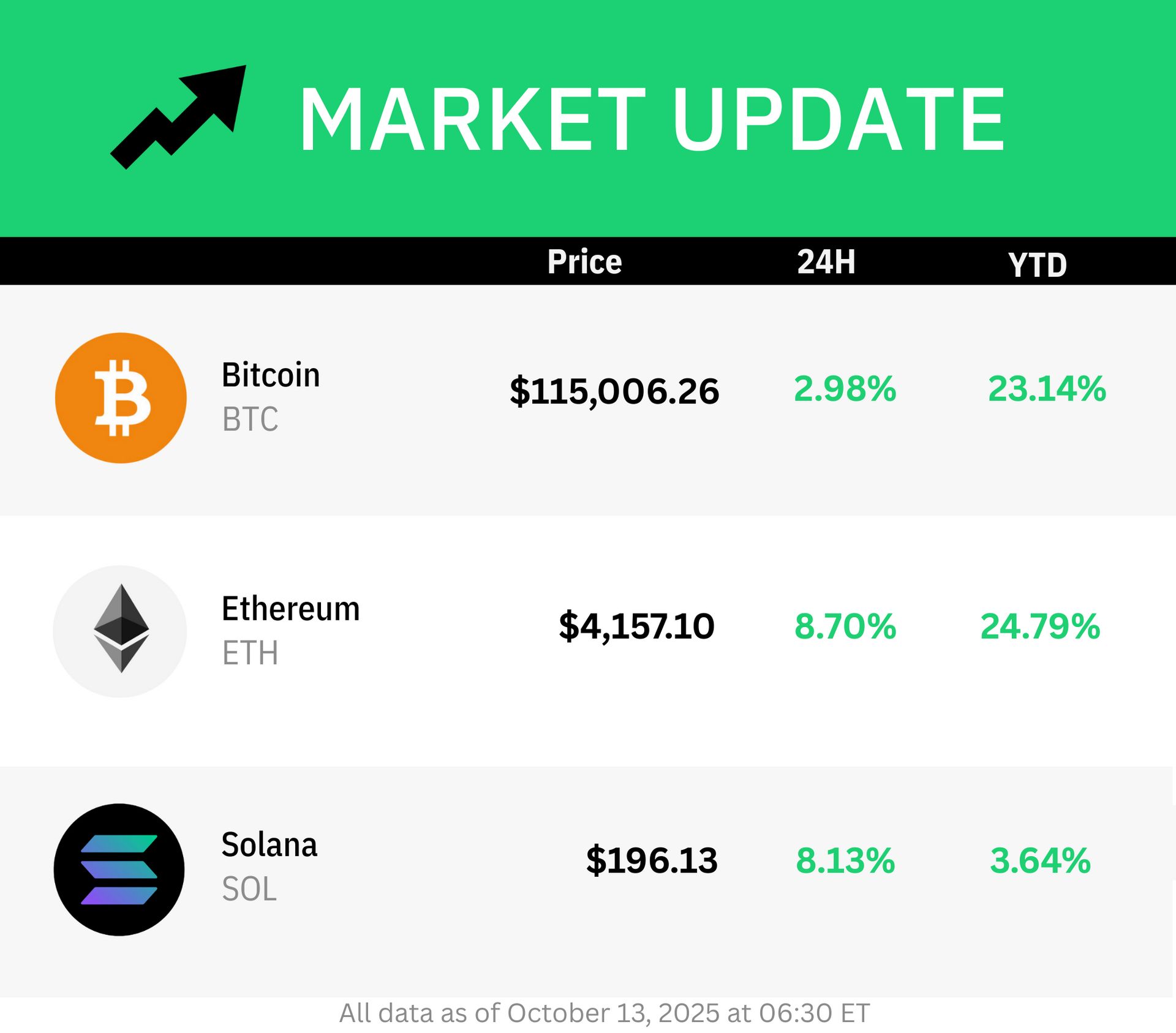

As of Monday morning, bitcoin and ether had recovered from Friday’s lows, with bitcoin trading at $115,150 and ether trading at $4,165.

Chaos Labs CEO Omer Goldberg suggested the day might have been one of DeFi’s worst black swan events.

“On paper, over $19 billion in liquidations hit across CEXs [centralized exchanges] and perp DEXs [perpetual decentralized exchanges]. The real figure was likely higher,” said Goldberg.

The immediate trigger was a surprise announcement by President Donald Trump, who imposed a 100% tariff on all Chinese imports, sharply escalating the U.S.-China trade war.

The speed of the crash was exacerbated by excessive leverage and cross-margined collateral on exchanges. Fragile liquidity conditions in many altcoins led to outsized price drops, while platforms like Binance and Hyperliquid saw mass auto-liquidations.

The event erased up to $670 billion in crypto market value, far surpassing prior records like the March 2020 COVID crash or the FTX collapse.

DeFi protocols like Uniswap and dYdX handled record volumes without disruption, while centralized exchange Binance faced technical outages and pledged compensation to affected users.

“Funding rates across the crypto market have plunged to their lowest levels since the depths of the 2022 bear market,” noted onchain analytics platform Glassnode.

“This marks one of the most severe leverage resets in crypto history, a clear sign of how aggressively speculative excess has been flushed from the system.”

Still, some analysts are optimistic. “Expecting new [all-time highs] this year, we just need Trump to reach an agreement, which seems the most likely scenario,” wrote economist Alex Kruger on X.

Over the weekend, Diogenes Casares, founder of Klyra Protocol, joined Laura to break down what really caused the crash, whether insiders knew it was coming, and how infrastructure failures and extreme leverage turned a policy tweet into crypto’s Black Friday.

Don’t miss it!

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Binance Pays $283 Million to Users After Token Depegs Trigger Major Losses

Crypto exchange Binance compensated affected users after several major tokens — including USDe, BNSOL, and WBETH — lost their pegs during a period of extreme market volatility on Friday.

Binance said it paid out around $283 million in compensation in two batches to Binance Earn users, after reviewing all futures, margin and loan users over a period of 72 hours.

The exchange also plans to implement additional safeguards to prevent another depeg event from occurring. Those safeguards include adding a redemption price to the BNSOL, WBETH, and USDe price index weights and using a minimum price threshold to the USDe index rule to improve price stability.

“When we fall short, we take responsibility—there are no excuses or justifications,” said Binance co-founder Yi He in a Saturday X post.

Pseudonymous onchain analyst @DeFi_Hanzo pointed out a series of transfers from major crypto market maker Wintermute that suggest “something was off” about Binance’s order books.

Wintermute transferred $700 million to Binance, of which $200 million was in bitcoin. When liquidation pressure was at its highest point, the market maker allegedly pulled liquidity.

“On every other exchange you could close, hedge, or buy the dip manually. On Binance, buttons stopped working. Stop orders froze, limit orders hung,” said @DeFi_Hanzo.

“Only liquidations were executed perfectly (but not in the way should have been executed).”

Ethena founder Guy Young also described the USDe depeg as one that was isolated to Binance, on account of the exchange using oracle data from its own orderbook, as opposed to the ones with the deepest liquidity.

“Unfortunately we cannot control how each platform implements and manages their own oracle and risk management designs,” said Young.

Today’s must-watch livestream 👉🚨Black Friday post-mortem on Bits + Bips 🚨

Hosts Ram Ahluwalia and Steve Ehrlich dissect last week’s market meltdown and where we are headed next with 2 special guests!

Bitcoin Core v30 Releases With Expanded OP_RETURN Capacity

Bitcoin Core version 30.0 was officially rolled out over the weekend, introducing improved wallet indexing and accelerated transaction lookups.

The most controversial change was the removal of the 80-byte limit on OP_RETURN, which was a restriction placed on the data that could be included in a transaction output for non-financial purposes.

Critics, including prominent developers Luke Dashjr and Nick Szabo, argued that the change could introduce blockchain bloat, increased node operating costs, network spam, and the risk of illicit data being permanently stored on the blockchain.

Proponents say that allowing more data enhances use cases for decentralized payroll, transparency, and onchain applications, with fees acting as the main regulator of block space.

“If we socially lose the ability to make rational changes, Bitcoin has far worse problems,” said Blockstream founder Adam Back, who supported the upgrade, and pointed out that it contains “security fixes.”

“If a change is really controversial, the default should be to slam the brakes, not to force-bundle it with 'security updates,' mock one side of it, etc,” commented crypto lawyer Gabriel Shapiro.

Bitcoin Knots, an alternative full-node client software for Bitcoin, maintained by Dashjr, now accounts 21.26% for all bitcoin nodes, up from 4% of nodes four months ago.

If you want to understand the Core vs Knots debate, here’s a great interview Laura did last week:

DATs Want to Use LSTs to Juice Yields. The Problem? They Can Hurt Earnings

By Steve Ehrlich

Liquid staking token (LST) providers, which already hold over $104.5 billion in assets, should be a perfect tool for digital asset treasury (DAT) companies looking for ways to generate maximum income from their balance sheets.

However, an outdated accounting rule means those same LSTs are causing headaches.

LSTs can be particularly appealing to DATs because they allow firms to generate excess yields on top of staking rewards, which are seen as a basic hurdle rate in crypto.

“One key difference and intended benefit of liquid staking is that it provides for liquidity by allowing the company to earn staking rewards while still maintaining the ability, provided through the receipt token, to enter into other transactions,” said a representative for Sharplink, an Ethereum DAT, in a statement to Unchained.

But as the industry fights to change outdated accounting rules, could this technicality become a major obstacle to crypto’s next wave of corporate adoption?

🏅 Norwegian authorities launched a probe into possible leaks of the Nobel Peace Prize results after a sudden surge in bets on Polymarket correctly predicted Venezuelan activist Maria Corina Machado’s win, raising concerns over insider trading.

💼 Blockchain startup Securitize, which helps investors gain tokenized exposure to traditional assets like stock indexes, is reportedly in talks to go public through a $1 billion merger with a blank-check firm backed by Cantor Fitzgerald.

🏦 A group of major global banks including Goldman Sachs, Santander, and UBS teamed up to explore launching a stablecoin-like digital money backed one-to-one by real currencies, aiming to test blockchain’s potential for improving cross-border payments and competing with existing crypto stablecoins.

⚡ Hyperliquid is preparing to activate its HIP-3 upgrade today, allowing anyone who meets onchain requirements to launch their own perpetual futures markets without centralized approval, marking a major step toward fully decentralized listings.

🌐 Akash Network announced plans to shut down its Cosmos-based blockchain and migrate to a new, more secure and liquid network, launching an open search that could lead to Solana or another major chain as its next base layer.

🕊️ Benoît Pagotto, the 41‑year‑old co‑founder of RTFKT—the NFT fashion studio acquired by Nike—passed away unexpectedly, leaving behind a legacy of groundbreaking digital fashion collaborations and cultural influence in Web3.

🪙 Morgan Stanley decided to open up its crypto investment products to all wealth clients, including retirement accounts, marking a major shift from its previous high-net-worth-only policy as it leans further into Bitcoin, Ethereum, and Solana trading.

📈 Prediction market platform Kalshi hit a $5 billion valuation after raising over $300 million from top investors like Sequoia and Andreessen Horowitz, announcing plans to expand its event-based trading to more than 140 countries.

What hyperliquid homepage sees 30 mins before a big tariff announcement

— gojo (@defi_gojo)

6:10 PM • Oct 11, 2025

“So you put $5,000 on a credit card to trade crypto, and in five years you turned it into $9 million?”

“Yes Dave”

“And you then lost it all in twenty minutes, and in those five years you never paid off the credit card which now has a $28,600 balance?”

“That’s correct Dave”

— Michael McQuaid (@michaelgmcquaid)

12:48 AM • Oct 12, 2025

Lessons about Leverage by Jeff Park

Haseeb Qureshi on whether Ethena’s USDe actually depegged

Duo Nine on why exchanges “are a necessary evil”