- Unchained Daily

- Posts

- Crypto Winter Nears an Inflection Point

Crypto Winter Nears an Inflection Point

Plus: 🎯 Hyperliquid readies prediction-style markets.

Hi! In today’s edition:

🧊 Analysts debate whether crypto’s winter is nearing exhaustion or more downside

🎯 Hyperliquid prepares HIP-4 upgrade to launch outcome-based prediction markets

Today’s newsletter is brought to you by YO (Yield Optimizer)!

Remember when DeFi meant 15 browser tabs, three stressful bridges, and checking Discord every hour to make sure you weren't getting rugged?

YO (Yield Optimizer) just retired that struggle.

Think of it as the "Easy Mode" button for DeFi. Whether you hold BTC, ETH, USD, EUR, or even GOLD, YO automatically routes your assets into the best risk-adjusted strategies across all chains.

It’s not just an aggregator; it’s an engine that continuously rebalances your portfolio using Exponential’s Risk Ratings (so you don't have to do the due diligence math).

100+ Integrations: Unmatched diversification.

Zero Bridging Stress: Cross-chain yield in one click.

Total Transparency: See exactly where the yield comes from.

Stop farming. Start optimizing.

YO just launched $YO Rewards, where you earn base yield plus additional $YO rewards. For the first campaign, you’ll earn a 14% reward rate on any yoVault!

Crypto at a Crossroads: Winter Fatigue Meets the Risk of Lower Lows

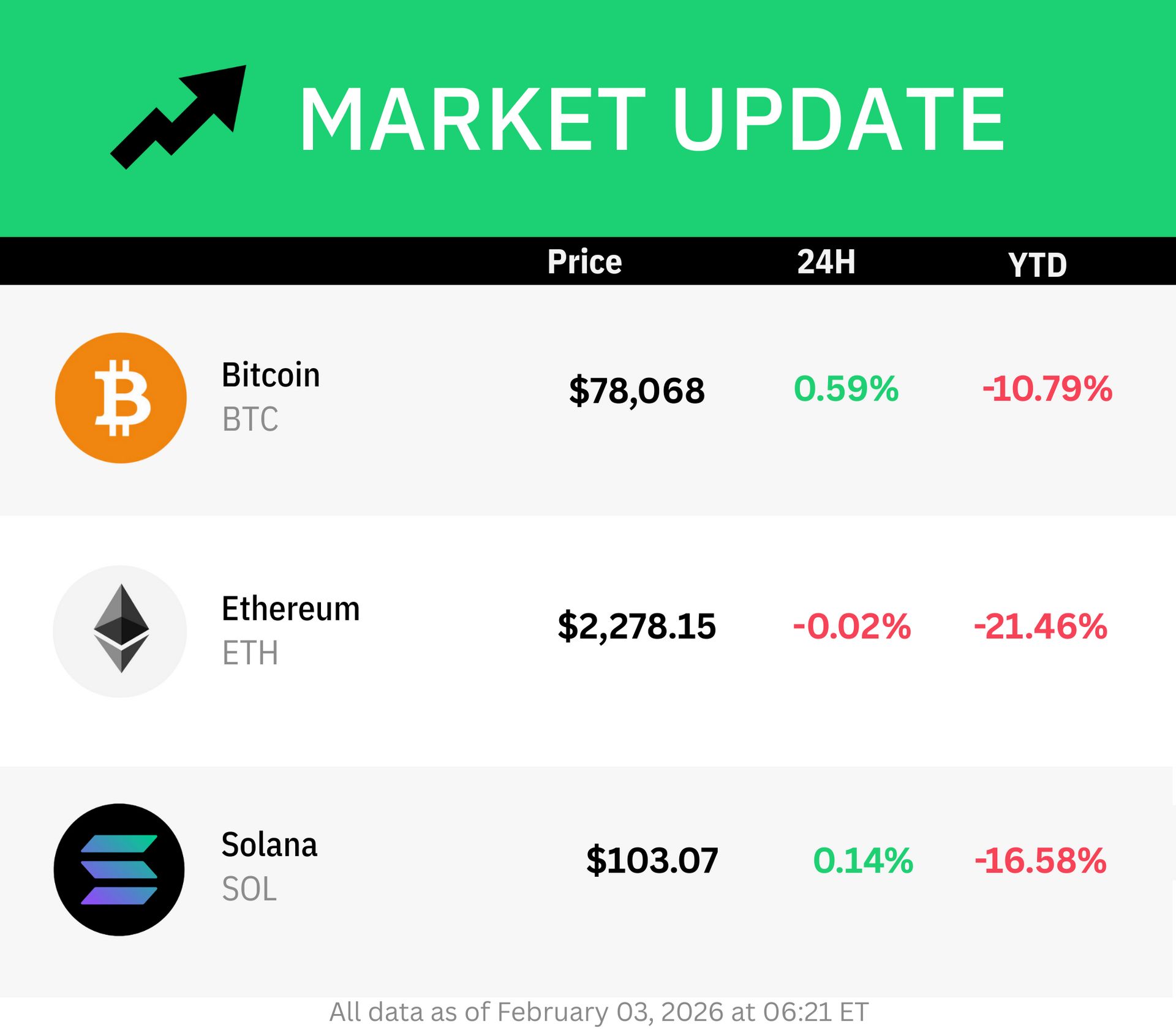

A growing number of market watchers agree on one point: crypto is deep in a winter. Where views diverge is how close the market is to a durable bottom, and how much more pain may come first.

In a note2 sent to clients on Monday, Bitwise CIO Matt Hougan argued that the industry has effectively been in a bear market since January 2025, even if ETF flows masked the damage for much of last year. Bitcoin is down roughly 39% from its October 2025 high, Ethereum more than 50%, and large-cap altcoins without institutional support have fallen 60%–75%.

Hougan’s conclusion was psychological as much as analytical: “Crypto winters don’t end in excitement; they end in exhaustion.” By historical standards, he believes the market is closer to the end than the beginning.

That long-term framing contrasts with a more tactical warning from Galaxy Digital’s head of research Alex Thorn. In a Feb. 1 note3, Thorn wrote that bitcoin’s structure points to further downside, citing weak price action, macro uncertainty, and one of the largest liquidation cascades in history.

Bitcoin fell 15% in four days, briefly trading near $75,600, below both ETF average cost basis ($84k) and Strategy’s average purchase price ($76k). Nearly 46% of BTC supply is now underwater, a level historically seen near major bottoms, but not always the final one.

Thorn highlighted that outside of 2017, every 40% drawdown from an all-time high eventually became a 50%+ decline, which would imply prices closer to the $60k range, near realized price ($56k) and the 200-week moving average ($58k).

Still, there are signs of stabilization beneath the surface. Long-term holder selling, which averaged $500 million per day in 2025, has notably slowed. On Monday’s Bits + Bips livestream, Cosmo Jiang from Pantera Capital said “fundamentals are a lot better and trending in the right direction,” while Austin Campbell added, “I don’t think there’s been a better time for the industry and the forward path of adoption.”

The picture that emerges is nuanced: structurally healthier crypto markets, improving fundamentals, but a price still searching for capitulation-level conviction. Whether exhaustion has arrived — or still lies ahead — remains the open question.

Hyperliquid Prepares Prediction-Style Markets With HIP-4 Upgrade

Hyperliquid is expanding1 beyond perpetuals with the upcoming launch of HIP-4, a protocol upgrade that introduces “Outcome” trading, a new way to trade event-based results onchain.

The new contracts are fully collateralized and settle within a fixed range, making them suitable for prediction markets and limited-risk, options-like instruments. Unlike traditional leveraged derivatives, Outcomes are designed to avoid margin calls and liquidation cascades, a key selling point after recent bouts of market volatility.

The feature will run on Hypercore, Hyperliquid’s high-performance execution engine, and is rolling out first on testnet. The team said the contracts are a general-purpose building block, leaving room for developers to experiment with applications beyond simple prediction markets.

The announcement landed well with traders. HYPE rose about 7% in 24 hours, extending a strong run that has seen the token gain more than 30% over the past week, even as bitcoin fell sharply.

Momentum has been building since Hyperliquid’s HIP-3 upgrade unlocked permissionless markets tied to real-world assets like equities, gold, and FX. With prediction markets booming across crypto, HIP-4 positions Hyperliquid to compete in one of the sector’s fastest-growing niches.

If you want to learn more about HYPE’s recent run and whether it can be sustained, we covered that extensively in an article last week:

If you want expert help with crypto taxes — without guessing or DIY spreadsheets — Crypto Tax Girl is offering $100 off their crypto tax services for Unchained readers.

They provide personalized support for everything from complex transactions to full tax returns.

🔴 LIVE TODAY: STARTING 12:00PM ET

We’re hosting a three-part livestream starting at noon ET.

We kick off with DEX in the City, hosted by Katherine Kirkpatrick Bos, GC at StarkWare, and Jessi Brooks from Ribbit Capital. Joining them is Edward Woodford, Co-founder and CEO of Zero Hash, on why he turned down a $2B offer from Mastercard and where stablecoins are headed. Plus, what’s going on with CLARITY, and the latest on AI agents.

At 1:00pm ET, Unchained continues with a conversation on the impact of AI on the economy with Michael Casey and David Mattin.

We wrap with a state of the markets interview as Laura speaks with Joshua Lim, Global Co-Head of Markets at FalconX.

📧 Newly released U.S. Justice Department emails revealed that convicted sex offender Jeffrey Epstein invested $3 million in Coinbase in 2014 through a personal entity, with early company leaders aware of the deal, which was arranged by crypto venture firm Blockchain Capital at a $400 million valuation.

🏛️🤝 Talks at the White House between crypto firms and major banks failed to produce an immediate compromise on whether stablecoins should offer yield, leaving lawmakers pressing both sides to agree on changes quickly so a long-delayed U.S. crypto market structure bill can advance.

📈 The STABLE token, tied to the layer 1 blockchain focused on stablecoin activity and backed by Bitfinex, hit a record high ahead of a network upgrade that will switch transaction fees to a cross-chain version of USDT and improve tools for developers and validators.

🇺🇸 President Donald Trump denied knowing about a reported $500 million investment by an Abu Dhabi royal into World Liberty Financial, a Trump-linked crypto platform, as the deal raised concerns about foreign influence and intensified political scrutiny of his family’s crypto ties.

🇭🇰🪙 Hong Kong will begin issuing its first stablecoin licenses in March, with regulators planning to approve only a handful of issuers at first while prioritizing strong safeguards, clean reserves, and anti–money laundering controls as digital tokens grow into a major global payments tool.

💰 ParaFi Capital invested $35 million into Jupiter, a Solana-based onchain trading platform, marking its first external funding round after processing more than $1 trillion in trades and expanding into lending, derivatives, and stablecoins.