- Unchained Daily

- Posts

- DeFiLlama Pulls Aster Volumes Over Data Integrity Concerns

DeFiLlama Pulls Aster Volumes Over Data Integrity Concerns

Plus: 🚀 Bitcoin breaks $125K, 💰 MetaMask unveils $30M LINEA rewards, 🛒 Walmart gears up for crypto trading via OnePay.

Hi! In today’s edition:.

🧩 DeFiLlama questions Aster’s volume, pulls it from rankings

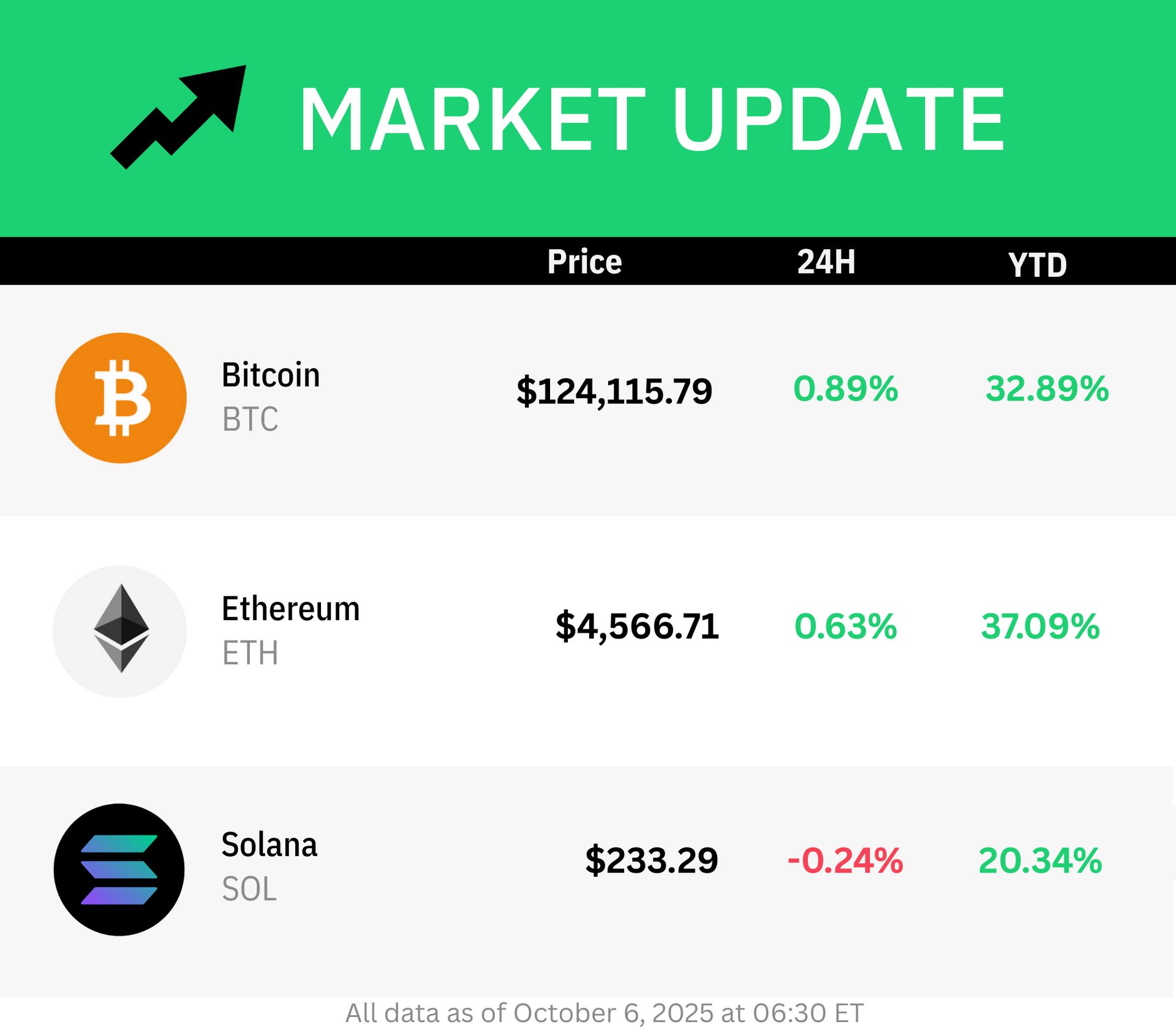

🥇 Bitcoin hits $125K with huge ETF inflows

🎁 MetaMask unveils $30M rewards for LINEA users

💳 Walmart readies crypto trading in its fintech app

A shoutout to Aptos for sponsoring today’s issue.

Supporting them helps us keep bringing you the top crypto stories. Check them out!

Aptos Experience returns Oct 15-16 in Brooklyn

Real problems, real solutions, real users. Two days of immersive conversations with the builders, enterprises and investors shaping the future of money, media and more.

By Tikta

DeFiLlama Delists Aster Perp Volume Over Data Integrity Concerns

Blockchain data platform DeFiLlama has decided to delist the perpetual futures volume data for the Aster decentralized exchange, citing concerns over data integrity.

DeFiLlama’s pseudonymous founder 0xngmi noted that their investigation revealed that Aster's perpetual trading volumes, which got to $100 billion daily, are almost perfectly correlated with Binance's perpetual futures volumes.

The unusual correlation potentially suggests that much of the reported volume on Aster may be artificially inflated or synthetically created.

“Aster doesn't make it possible to get lower level data such as who is making and filling orders, so until we can get that data to verify if there's washtrading, aster perp volumes will be delisted,” said 0xngmi.

The decision preceded a drop in Aster’s native token price, which fell 10% shortly after the news made rounds on social media.

It also resulted in significant backlash against DeFiLlama itself, with some Aster community members questioning the platform’s motives for the delisting.

“We are not [against just Aster], we delisted lighter and many other perp dexs before because of blatant wash trading,” said 0xngmi.

“All we care is about the integrity of our data cause its important that users can trust it.”

Bitcoin Hits All-Time High Ahead of $125,500

Bitcoin rallied to a new record high over the weekend, peaking at $125,559 late on Saturday.

The momentum comes as bitcoin supply on exchanges sits at a six-year low. Several industry watchers pointed out that a similar situation in 2019 had triggered a major supply squeeze before a significant bull run.

“This rally revealed something crucial: long-term holders have cooled their selling intensity. They’re still distributing, but with far less conviction,” noted digital asset investment firm Swissblock.

“This eases supply pressure and allows new participants to accumulate.”

Meanwhile, institutional demand for bitcoin continues to be a strong catalyst for bitcoin’s price.

Bitcoin spot exchange-traded funds (ETFs) saw a major resurgence last week, recording approximately $3.24 billion in weekly inflows, marking their second-largest week on record.

MetaMask to Distribute $30 Million in LINEA Token Rewards

MetaMask plans to launch a new rewards program aimed at boosting user engagement with its wallet services.

The team said the program will reward users for on-chain activities such as token swaps, bridging, staking, portfolio management and referrals, but emphasized that “it is not a farming play.”

“It is shaping up to be one of the largest onchain rewards programs ever built - in MetaMask Rewards Season 1 alone, we'll be distributing over $30M in LINEA token rewards,” said the team.

MetaMask is wholly owned and operated by Ethereum infrastructure firm Consensys, which is also behind the Linea layer 2 network and its native token LINEA.

The MetaMask team’s confirmation of a rewards program comes after a rewards page was deployed to the wallet provider’s official website. However, the page currently redirects to the MetaMask dashboard.

Users have speculated that the rewards program suggests that the widely anticipated MASK token launch could come sooner than expected.

Last month, Consensys CEO Joseph Lubin hinted at the MASK launch in an interview, while noting in an X post that holding LINEA would “open up further rewards opportunities,” particularly in tokens that Consensys is aligned with.

“MetaMask and Linea are cooking somETHing together to make this happen,” said Lubin.

Walmart to Roll Out Crypto Trading via OnePay App: Report

Major U.S. retailer Walmart is set to offer bitcoin and ether trading and custody services through its OnePay app by the end of 2025.

According to a report from CNBC, Walmart’s fintech venture OnePay will enable users to buy, sell, and hold these digital assets directly within the app, and potentially even use them for payments.

Meanwhile, the crypto trading feature will be powered by Zerohash, a crypto infrastructure provider handling secure and compliant transactions.

Sources told CNBC that the service is planned for rollout in various U.S. states before the end of the year. It would position Walmart alongside competitors like PayPal, Cash App, and Venmo, who are already in the business of offering crypto services for more everyday payments.

12 PM LIVESTREAM

Tune in! Unchained is live today at 12:00 pm ET for a 🔥double header:

Bitcoin developer Chris Guida and Adam Back, the inventor of Hashcash and the cofounder and CEO of Blockstream, discuss Knots vs Core at 12 pm ET with Laura Shin.

At 1 pm ET, Ryan Yi breaks down the Unchained Onchain5 with Steve Ehrlich.

📈 Macro Monday With Bits + Bips 📈

Get your weekly dosage of macro x crypto at 4:30 pm ET. Watch live as hosts Ram Ahluwalia and Steve Ehrlich are joined by guests Joshua Lim (FalconX) and Austin Campbell (Zero Knowledge Consulting).

Save it to your calendar!

🔗 Coinbase applied for a federal charter from the U.S. banking regulator, aiming to simplify oversight and strengthen its push to link crypto with traditional finance—while clarifying it doesn’t plan to become a bank.

🔍 NYDIG raised concerns over the Trump-affiliated USD1 stablecoin’s lagging transparency, pointing out that it hasn’t published an attestation report since July despite reaching a $2.7 billion supply and facing looming regulatory scrutiny.

🏛️ The FDIC will revisit its rules around “reputation risk” after accusations that regulators unfairly blocked banks from dealing with crypto clients, echoing Trump’s push to prevent politically motivated banking restrictions.

🧑⚖️ A U.S. judge dismissed a 2022 investor lawsuit against Yuga Labs, saying its Bored Ape NFTs didn’t qualify as investment contracts under the SEC’s rules, since they were marketed as club perks, not profit-making tools.

🔄 The Ethereum Foundation converted $4.5 million worth of ETH into stablecoins via a decentralized exchange to fund grants and research, continuing its cautious treasury shift and focus on practical DeFi projects.

🧙♂️ DeFi lender Abracadabra lost $1.8 million in its third hack since 2024 after a hacker exploited a flaw to mint more of its Magic Internet Money token than allowed, though user funds were reportedly untouched and the protocol promised to repay losses from its own treasury.

🐕 Shibarium developers said they had rotated keys, secured contracts and planned refunds as they prepare to restart their bridge after a $4 million exploit that drained funds and briefly halted the network.

📱 Samsung deepened its tie-up with Coinbase by letting U.S. Galaxy phone owners fund their exchange accounts through Samsung Pay and giving them temporary access to Coinbase One perks via Samsung Wallet.

🥇 Tether and Antalpha are seeking at least $200 million to create a public vehicle that would stockpile Tether’s tokenized gold (XAUt), deepening ties with Bitmain-linked firms and capitalizing on soaring demand for gold-backed digital assets.