- Unchained Daily

- Posts

- ETF Outflows Hit $797 Million Amid Dollar Strength, Fed Uncertainty

ETF Outflows Hit $797 Million Amid Dollar Strength, Fed Uncertainty

Plus: 📉 Crypto treasuries deepen selloff, 🪙 Gemini eyes CFTC nod for prediction markets, 🇨🇦 Canada reveals stablecoin framework.

Hi! In today’s edition:

💸 Institutions withdraw $797M from Bitcoin and Ether ETFs

🧾 Professor says digital asset treasuries worsened sell pressure

🎧 Bits + Bips: Why fear might mark the start of a new rally

🪙 Gemini seeks CFTC approval for prediction market

🇨🇦 Canada unveils its first stablecoin regulation framework

By Ayesha Aziz

Investors Pull $797 Million From Bitcoin and Ether ETFs as Fear Rises

Institutional investors withdrew $797 million from U.S. spot Bitcoin and Ethereum exchange-traded funds on Tuesday, extending the outflow streak to five consecutive days. Spot Bitcoin ETFs alone recorded $577.7 million in exits, the largest single-day withdrawal since Aug. 1, led by Fidelity’s FBTC ($356.6 million).

Ethereum ETFs posted $219.3 million in outflows, while BlackRock's ETHA accounted for $111 million. The five-day period has now totaled $1.9 billion in institutional withdrawals. Seven Bitcoin funds reported negative flows on Tuesday.

The crypto fear and greed index plunged to 21, entering extreme fear territory. Fed Chair Jerome Powell's hawkish stance on rate cuts and the ongoing U.S. government shutdown have strengthened the dollar, triggering risk-off sentiment across markets.

Despite the downturn, Derek Lim of Caladan maintains the bullish structure remains intact.

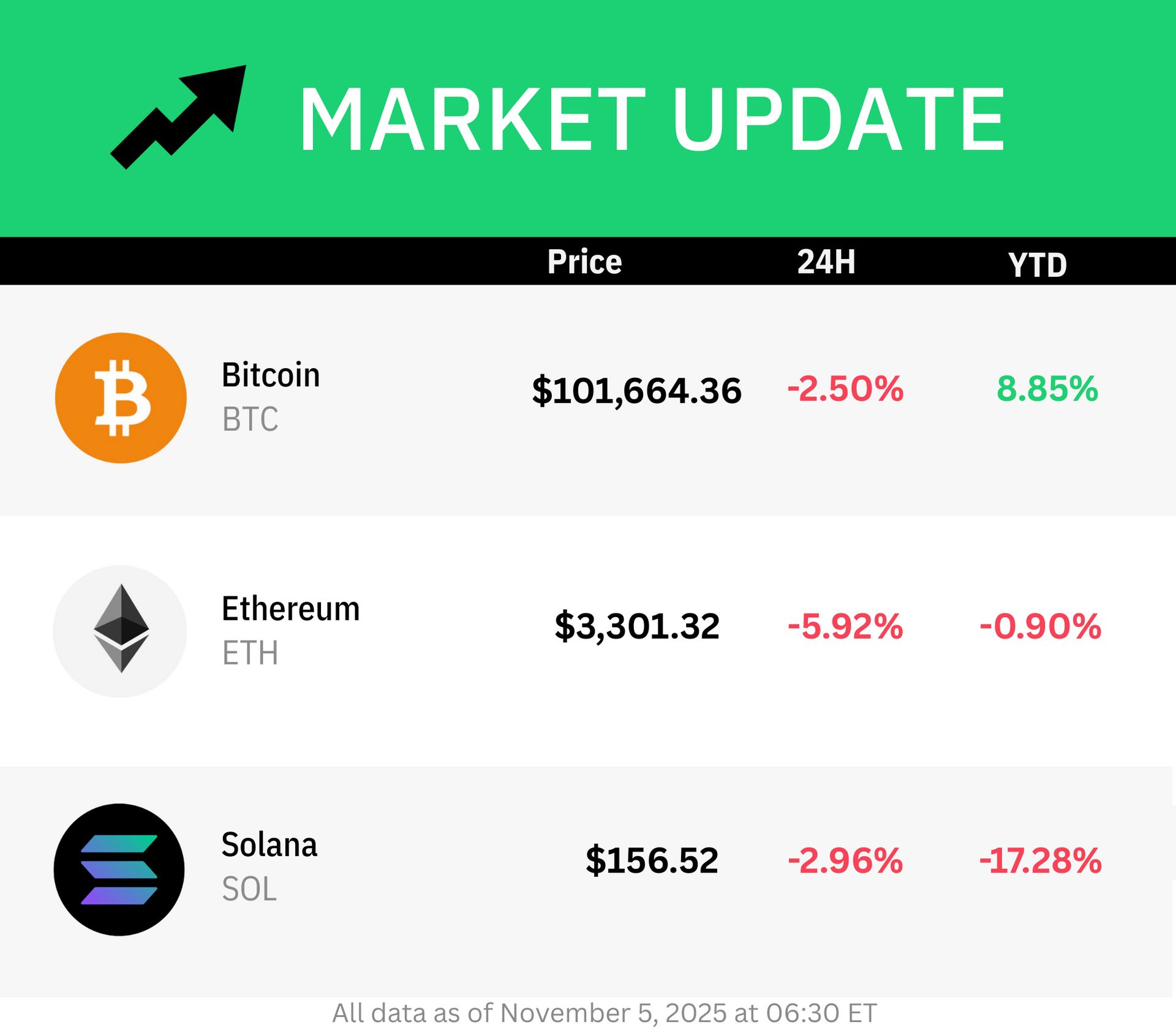

As of 5:30 am ET, bitcoin was trading at $101,669, down 1.9%, while ETH fell 5.3% to $3,292.

Digital Asset Treasuries Accelerate Market Decline, Says Professor

Columbia Business School adjunct professor Omid Malekan argues crypto treasury companies have contributed significantly to bitcoin's price decline. In a Tuesday X post, Malekan stated that digital asset treasuries turned into a mass extraction and exit event, putting downward pressure on prices.

Bitcoin has fluctuated between $99,607 and $113,560 over the past seven days, down from its Oct. 6 all-time high above $126,000. Malekan claimed only a handful of companies attempted to create sustainable value through their treasury strategies.

The professor highlighted that launching public entities costs millions in fees for bankers and lawyers, suggesting some operators viewed the model as a quick profit scheme. Digital asset treasuries have sparked concerns about forced asset sales during downturns due to leveraged positions through convertible notes and debt offerings.

Bitwise reported 207 companies now hold over one million bitcoin tokens worth more than $101 billion. Additionally, 70 companies have added ether to their balance sheets, collectively holding 6.14 million tokens valued above $20 billion.

Bits + Bips: Reasons to Be Optimistic After Bitcoin Falls Toward $100K

What if “extreme fear” is actually the start of something new?

Bitcoin has fallen below $102,000. “Uptober” ended in blood.

But while retail traders are terrified, institutional conversations are heating up.

In this episode of Bits + Bips, hosts Austin Campbell, Ram Ahluwalia, and Chris Perkins are joined by Teddy Fusaro, President of Bitwise, to unpack the week’s market turmoil.

They dig into why institutions are finally comfortable allocating to bitcoin, how Ripple is building an ecosystem that can’t be ignored, and whether Tether’s staggering $500 billion valuation makes sense.

Plus: the shrinking odds of the CLARITY Act, the merging of TradFi and crypto rails, and why the competition in the payments space is so hot.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, PumpFun, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Gemini Seeks CFTC Approval to Launch Regulated Prediction Market

Gemini Space Station Inc. submitted approval documents to the U.S. Commodity Futures Trading Commission to launch a federally regulated prediction market under the name Gemini Titan. The exchange seeks to operate a designated contract market for event contracts, according to 13 public documents on the CFTC website.

Bloomberg reported Tuesday that the Winklevoss twins-owned company aims to offer services directly rather than through partnerships. The move positions Gemini against Kalshi and Polymarket as prediction markets reached $2 billion in weekly volume during October's final week.

The expansion comes as Gemini struggles financially following its September IPO. Shares have dropped 49% since debuting at $32, closing at $16.29 on Tuesday. The company posted a $282 million loss in the first half of 2025, nearly double its $158 million deficit for all of 2024.

Revenue declined to $68.6 million from $74.3 million year-over-year. More than 80% of trading volume now comes from institutional clients rather than retail users.

Canada Unveils Stablecoin Regulation Framework in 2025 Budget

Canada's federal government announced plans to regulate fiat-backed stablecoins through legislation outlined in its 2025 budget released Tuesday. The framework follows the U.S. GENIUS Act passed in July, requiring issuers to maintain sufficient reserves and establish redemption policies.

Stablecoin operators must implement risk management systems protecting personal and financial data under the proposed rules. The Bank of Canada will allocate $10 million over two years starting in fiscal 2026-2027, with $5 million in annual costs afterward offset by regulated issuers under the Retail Payment Activities Act.

Coinbase Canada CEO Lucas Matheson told CBC the regulation would change how Canadians interact with money and the internet forever. The stablecoin market currently stands at $309.1 billion, with the U.S. Treasury projecting growth to $2 trillion by 2028.

Major financial institutions including Western Union, SWIFT, MoneyGram, and Zelle have recently integrated or announced stablecoin solutions. Tetra Digital raised $10 million to develop a digital Canadian dollar backed by Shopify, Wealthsimple, and National Bank of Canada.

⚖️ Convicted FTX founder Sam Bankman-Fried returned to court seeking a new trial after his fraud conviction, but legal experts say overturning the verdict is unlikely despite claims that key evidence was unfairly restricted and his defense was hampered during the original proceedings.

📄 Coinbase’s push for a federal trust bank charter met resistance from major U.S. banking groups, which urged regulators to reject its application, claiming the crypto exchange lacks adequate safeguards and would struggle financially, while Coinbase accused them of protecting their turf.

⚖️ The ongoing U.S. government shutdown paused the SEC’s probe into whether public companies used inside information when trading crypto-related assets, but former officials said subpoenas could follow once operations resume depending on how firms respond to early inquiries.

🏙️ Democratic socialist Zohran Mamdani won the New York City mayoral race against Andrew Cuomo, whose campaign promised a pro-crypto innovation office, while crypto advocacy groups also claimed influence in New Jersey’s election where po-crypto Democrat Mikie Sherrill secured victory.

🕊️ The White House said President Trump’s pardon of Binance founder Changpeng Zhao followed a full legal review, clarifying that Trump’s claim of not knowing Zhao meant no personal relationship, while officials echoed his view that the case was politically driven.

💣 The U.S. Treasury sanctioned eight North Korean bankers, two companies, and 53 crypto wallets for laundering stolen digital funds to finance Pyongyang’s weapons program, part of a crackdown after hackers linked to the regime allegedly stole nearly $3 billion in crypto worldwide.

🔗 UBS carried out the world’s first blockchain-based redemption of a tokenized investment fund using Chainlink’s technology, marking a breakthrough in bringing the $100 trillion global fund industry onto Ethereum through its uMINT product and onchain distributor DigiFT.

Not selling my Sol here at $150.

Because I already sold it last time we crashed at $120.

— Bold (@boldleonidas)

2:26 AM • Nov 5, 2025

Bloomberg: Foreign-Exchange Veterans Seek to Rebuild Crypto in Wall Street’s Image

The Days of 1% Bitcoin Allocations Are Over by Matt Hougan, Chief Investment Officer of Bitwise