- Unchained Daily

- Posts

- Ether Supply On Exchanges Drops To Lowest Level Since Network Launch

Ether Supply On Exchanges Drops To Lowest Level Since Network Launch

Plus: 🧪 Aztec raises $59 millions in CCA sale, 🌐 Jupiter revises vault contagion claims, 🧩 ZKSync Lite sets 2026 sunset.

Hi! In today’s edition:

🪙 ETH hits its lowest exchange balance since 2015

🧪 Aztec raises $59 millions using Uniswap’s new CCA mechanism

🌐 Jupiter acknowledges earlier contagion risk claims were inaccurate

🧩 ZKSync Lite sets shutdown timeline

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

Ether Supply on Exchanges Drops to Lowest Level Since Network Launch

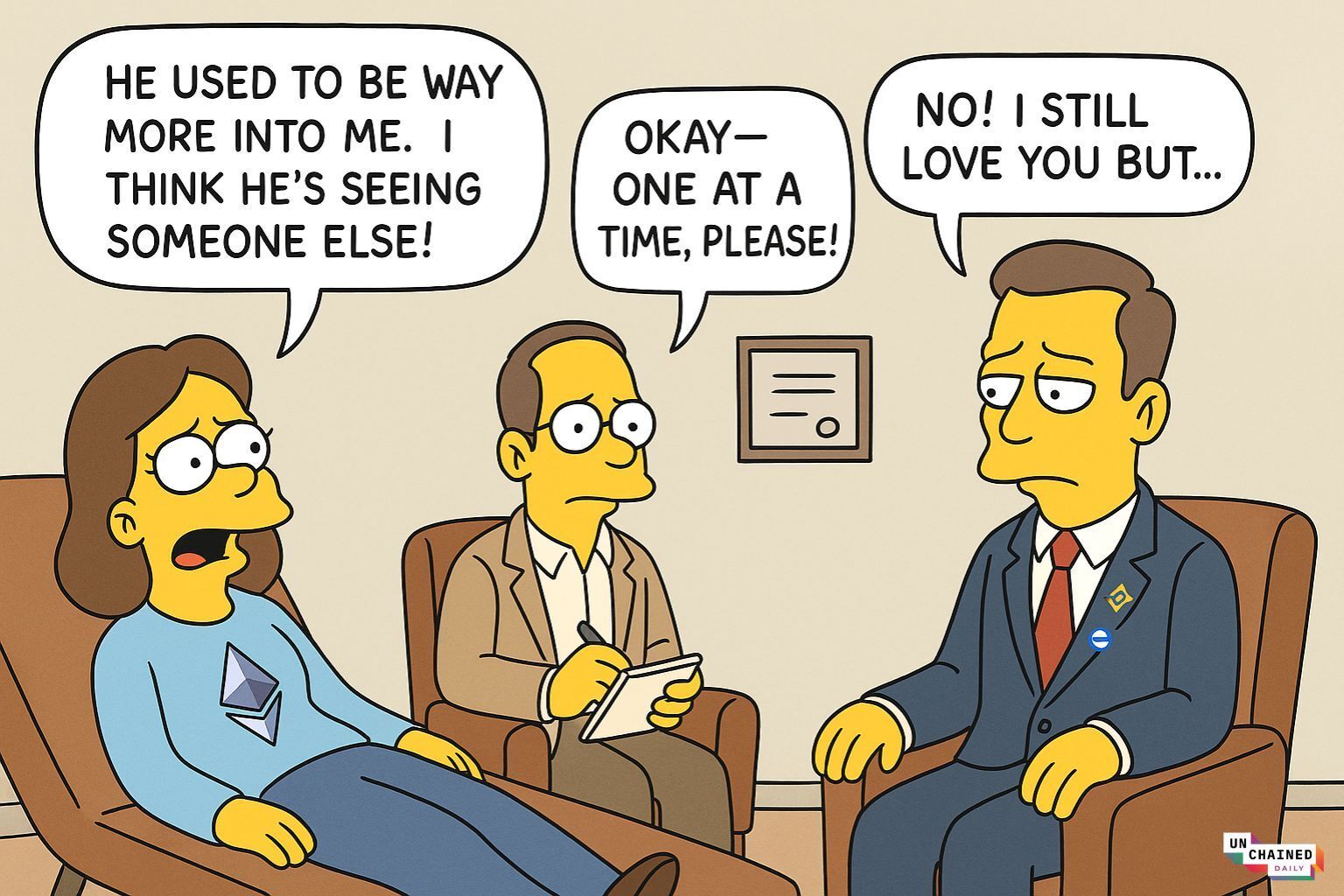

The last few months have seen a significant drop in the amount of ether held on centralized exchanges.

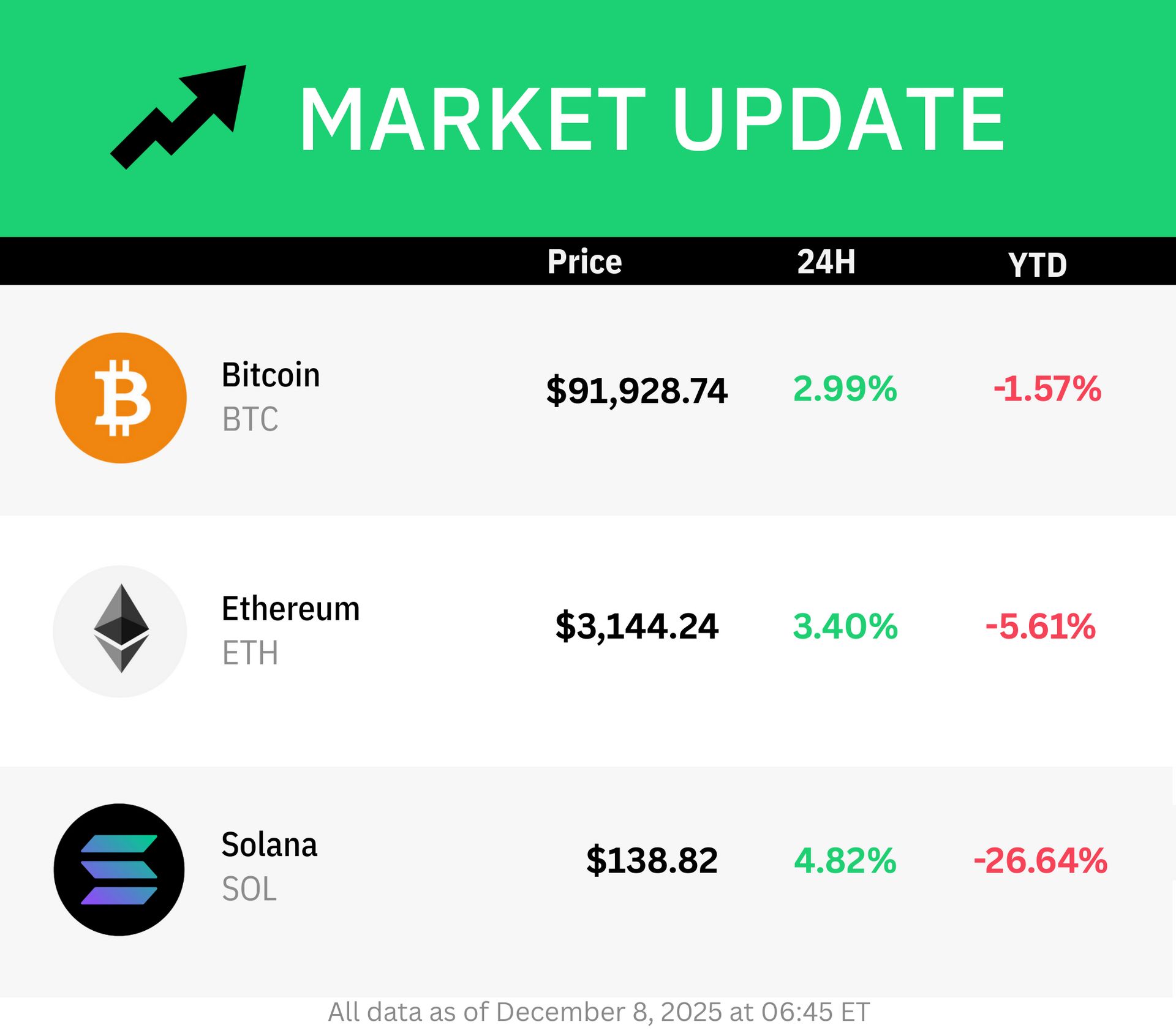

Data from Glassnode shows that ETH exchange balances now sit at just 8.8% of the total supply — the lowest level since Ethereum launched in 2015.

ETH has been flowing into long‑term holding channels, including staking, layer 2 networks, corporate digital asset treasuries (DATs), and collateral loops.

One analyst described it as ETH entering its tightest supply environment ever, with ETH “quietly” being pulled into places that don’t sell, which could create a supply squeeze if demand increases.

In contrast, bitcoin’s exchange balance is still higher at around 14.7% of total supply.

Need a crypto x macro breakdown? 🫠 We’ve got you 👉️ Bits + Bips is LIVE today at 4:30pm ET

Austin Campbell, Ram Ahluwalia, and Chris Perkins get together to discuss the latest: prediction markets, the New York Times’ stablecoin article, the OCP Congress report, and more.

Aztec Raises $59 Million in Token Sale With Uniswap’s CCA

Aztec Network raised $59 million in its AZTEC public sale using the first deployment of the Continuous Clearing Auction (CCA) — a new mechanism for token launches built with Uniswap.

Aztec noted that 19,476 ETH was committed in the sale from 16,741 participants, with more than half the capital coming from the Aztec community.

The sale ran from Dec. 2 to Dec. 6, marking Uniswap's first CCA implementation on v4, which distributed 14.95% of Aztec's total token supply and resulted in a final fully diluted valuation (FDV) of $557 million.

“No sniping, bundling, timing games. Just slow, fair price discovery ending at 59% above the floor — with literally days to bid earlier and get a better average price,” said Uniswap founder Hayden Adams on X.

CCA enabled fair price discovery by splitting bids across timed blocks, clearing at uniform prices to prevent sniping or gas wars, and integrated ZK Passport for private, verifiable participation checks.

Tokens also became available for staking post-sale, requiring sequencers to hold 200,000 AZTEC. As of late Sunday evening, over 570 million AZTEC tokens were staked.

We talked about the mechanics of the sale on this episode of Unchained:

Jupiter COO Says Vault’s ‘Zero Contagion’ Claim Was Not Fully Accurate

Jupiter’s Chief Operating Officer Kash Dhanda admitted that prior claims about Jupiter Lend’s vaults having “zero contagion risk” were “not a hundred percent correct,” following backlash over how the vaults are actually designed and managed.

Although Jupiter describes its vaults as isolated, the protocol allows rehypothecation or recollateralization of deposited assets to improve capital efficiency, meaning collateral from one vault can be reused within a wider liquidity structure.

Prior social media posts that described the vaults as such were deleted by the Jupiter team.

“We deleted it to avoid it kind of going any further. In hindsight we should have issued a correction right when we deleted it,” said Dhanda.

Earlier this week, Solana lending platform Kamino blocked Jupiter Lend’s migration tool, citing concerns that Jupiter’s risk model and “zero contagion” messaging was misleading users about true systemic risk.

ZKSync Lite to Wind Down in 2026

ZKsync’s original layer 2 network, zkSync Lite, is being fully wound down, with remaining support and infrastructure slated to end in 2026.

zkSync Lite is a user-focused zk-rollup from Matter Labs that went live on the Ethereum mainnet as one of the earliest zero‑knowledge rollups.

It was initially optimized for simple payments, swaps, and NFT transfers rather than full smart-contract support. Its successor, zkSync Era, added Ethereum Virtual Machine (EVM) compatibility and broader decentralized application functionality.

Matter Labs effectively stopped active development on zkSync Lite once zkSync Era became the flagship network, and by 2024 several ecosystem participants were already treating Lite as deprecated.

“This is a planned, orderly sunset for a system that has served its purpose and does not affect any other ZKsync systems,” said the ZKSync team in a post on X.

Around $50 million in user funds remains bridged to ZKSync Lite, with concrete details around dates for the migration yet to be shared.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

💼 Ripple’s $500 million share sale attracted heavyweight Wall Street firms at a $40 billion valuation, but many investors treated the deal like a hedged bet on XRP — negotiating guaranteed returns and special protections because roughly 90% of Ripple’s value came from its massive, lock-up-restricted XRP stash, which has since slumped during crypto’s broader downturn.

👛 Farcaster co-founder Dan Romero said the project is abandoning its long-running “social-first” playbook and will now center all growth around its in-app wallet, hoping that a “wallet-first, network-second” model finally delivers the product-market fit its social features never achieved.

🔥 U.S. prosecutors urged a New York judge to give Terraform Labs co-founder Do Kwon a 12-year sentence, arguing his role in the 2022 TerraUSD collapse amounted to a massive deception that helped trigger wider crypto failures, including FTX’s downfall.

🇮🇳 Coinbase reopened sign-ups in India and said it will add a rupee on-ramp in 2026, marking a cautious return after its 2022 launch was derailed by payment restrictions and a full exit the following year.

🏝️ Binance will relocate its global base from the Cayman Islands to Abu Dhabi’s ADGM after securing full regulatory approval, moving all services under three newly licensed entities covering trading, custody, clearing, brokerage and OTC operations starting January 5, 2026.

🧩 The European Commission proposed moving crypto-firm supervision from individual countries to the EU’s markets regulator, ESMA, aiming to fix uneven MiCA enforcement and create a single cross-border rulebook, though the plan still needs approval from Parliament and the Council.

⛽ Vitalik Buterin argued that Ethereum needs a trustless onchain gas-futures market so users can hedge against unpredictable fee swings in the coming years, potentially letting people lock in or prepay for transaction costs over specific time windows.

🧩 SEC chair Paul Atkins said he expects the entire U.S. financial system to run on blockchain within two years, arguing that tokenizing markets could sharply improve transparency and help regulators track risks in real time.

💻 Monet Bank, a small Texas lender owned by billionaire Trump ally Andy Beal, said it’s entering crypto lending and digital-asset banking to serve as infrastructure for the sector, joining a tiny group of U.S. banks cautiously stepping into digital-asset services.

💳 Western Union is building a prepaid stablecoin card for people in high-inflation countries to help customers preserve purchasing power, alongside plans to release its USD-linked stablecoin USDPT on Solana in early 2026.

🦅 Robinhood plans to enter Indonesia by buying local brokerage Buana Capital Sekuritas and licensed crypto dealer Pedagang Aset Kripto, with the deal set to close in early 2026 and the firms’ majority shareholder staying on as an adviser.