- Unchained Daily

- Posts

- ETHZilla Dumps $40 Million in ETH for Buyback After Shareholder Letter

ETHZilla Dumps $40 Million in ETH for Buyback After Shareholder Letter

Plus: 📈 Bitcoin leverage jumps to $37B before Fed decision, 🏦 IBM unveils digital asset platform, 💳 Citi teams with Coinbase, 📊 Four new altcoin ETFs hit U.S. markets this week.

Hi! In today’s edition:

💥 ETHZilla dumps $40M in ETH after investor revolt

⚡ Bitcoin traders pile on $37B in leverage pre-Fed

🧰 IBM’s new digital asset hub targets global finance

🪙 Citi + Coinbase team up for stablecoin transfers

🚀 Altcoin ETF wave hits Wall Street this week

By Ayesha Aziz

Meme Stock Investor Sparks ETHZilla's $40 Million ETH Selloff

ETHZilla has offloaded approximately $40 million worth of ETH from its treasury to fund a share repurchase program, the company announced Monday.

The Ethereum treasury firm sold the tokens after prominent investor Dimitri "Capybara Stocks" Semenikhin published an open letter urging the strategy shift.

Semenikhin, known for his role in Beyond Meat's recent 1,000% price surge, has acquired roughly 2.2% of ETHZilla shares. The investor identified a significant valuation gap, noting the firm was trading at just 50% of its net asset value when he initiated his position.

Chairman and CEO McAndrew Rudisill confirmed the company will continue selling ether to repurchase shares as long as the stock trades below its net asset value. Shares of ETHZ jumped 14% during Monday's trading session and climbed to $23 in after-hours activity.

Billionaire Peter Thiel's Founders Fund holds a 7.5% stake in ETHZilla, acquired in August.

Bitcoin Leverage Surges to $37 Billion Ahead of Fed Rate Cut Decision

Traders have pushed bitcoin open interest to $37.63 billion ahead of Wednesday's Federal Reserve interest rate decision. The surge in derivatives positions reflects widespread expectations that policymakers will announce another quarter-point rate cut.

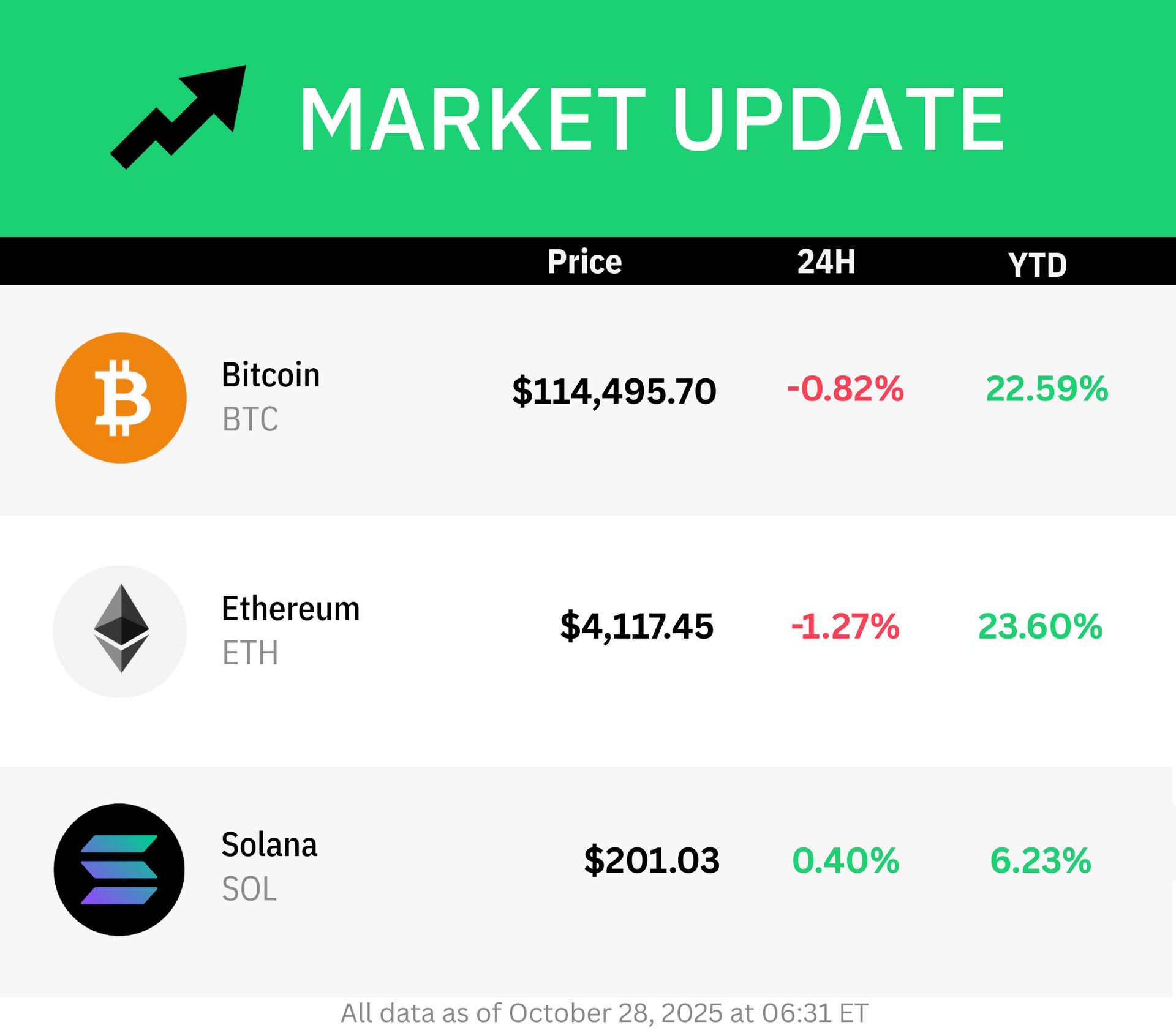

Bitcoin climbed from $107,600 last week to just above $116,000, with the rally accompanied by open interest growth from $33 billion. The Federal Reserve meeting has become a focal point for crypto investors anticipating a 25-basis-point reduction to the 4.00-4.25% range.

Users on prediction market Myriad have assigned a 92.6% probability to this outcome. Gracy Chen, CEO at Bitget, noted markets have already priced in the expected rate cut. She projects bitcoin could reach $118,000 to $120,000 by month's end if the asset maintains support above $112,000, though she cautioned that leverage-driven volatility remains a significant risk factor.

IBM Launches Digital Asset Platform for Banks and Governments

IBM unveiled its Digital Asset Haven on Monday, targeting banks, governments and corporations seeking secure blockchain infrastructure.

The technology giant developed the platform in partnership with crypto wallet provider Dfns to deliver comprehensive custody and compliance services.

The software-as-a-service offering will support custody, transaction routing and settlement across more than 40 public and private blockchains. IBM plans to launch the platform in the fourth quarter of 2025, with expanded functionality rolling out in Q2 2026.

Dfns CEO Clarisse Hagège emphasized that digital asset infrastructure must meet the same standards as traditional financial systems. Growing institutional adoption of stablecoins and tokenized real-world assets is driving demand for blockchain-based services.

Blockchain addresses holding tokenized stocks surged to over 90,000 in July from 1,600 in June, demonstrating growth patterns similar to the early DeFi expansion.

Citi Partners With Coinbase to Pilot Stablecoin Payment Services

Citigroup has partnered with Coinbase to develop stablecoin payment capabilities. The collaboration initially focuses on simplifying client transfers between fiat currency and cryptocurrency.

Debopama Sen, Citi's head of payments, stated clients are increasingly demanding programmability, conditional payments and enhanced speed alongside round-the-clock payment access. Citi recently raised its forecast for the digital dollar market to $4 trillion by 2030, up from the current $315 billion.

The partnership announcement follows passage of the GENIUS Act earlier this year, which establishes a regulatory framework for stablecoins taking effect in early 2027.

Citigroup joins JPMorgan and Bank of America in the early stages of developing stablecoin-related services for institutional clients. Circle, issuer of USDC, went public earlier this year with shares surging 167% on the first trading day.

Altcoin ETF Wave Hits US Markets With Four Launches This Week

Canary Capital will debut the first U.S. exchange-traded funds tracking Litecoin and Hedera on Tuesday. The Litecoin and Hedera ETFs join two Solana funds launching this week as altcoin products reach American investors.

Bitwise confirmed its Solana Staking ETF will also begin trading Tuesday, while Grayscale's Solana ETF lists Wednesday. The sudden progression caught many observers off-guard as the NYSE and Nasdaq certified 8-A filings offering fund issuers an alternative approval route.

The listings end months of uncertainty about launch timing, complicated by the ongoing U.S. government shutdown now entering its fourth week. Bitcoin ETFs now manage approximately $150 billion in assets, with BlackRock's iShares Bitcoin Trust accounting for more than half the total. Ethereum funds surpass $27 billion in assets under management.

🔥💰 Ethereum layer 2 project MegaETH’s token sale attracted around $500 million in bids—nearly 10 times its original target—forcing the team to implement a special allocation system for the oversubscribed offering.

🤖 The AI token sector surged as x402 payment protocols gained momentum, pushing Virtuals ecosystem coins up sharply and driving a rapid spike in transaction activity tied to AI agent-led finance.

🚫🇨🇳 China reaffirmed its strict stance on private crypto while pledging to expand the use of its central bank digital currency, warning that stablecoins still pose risks despite their rapid growth in the U.S. and elsewhere.

🦊 A website claiming to be MetaMask’s token portal surfaced online, driving up betting odds of a MASK token launch to 35% on Polymarket, though the wallet provider has not confirmed its authenticity and has repeatedly warned users against phishing attempts.

📊 Kalshi filed a federal lawsuit against New York regulators after receiving a cease-and-desist letter over its sports prediction markets, seeking to establish federal legal priority over state gambling rules.

🍁 Canada is accelerating its efforts to create a stablecoin rulebook to be unveiled with the Nov. 4 federal budget, as officials and industry players push to clarify how these tokens should be regulated and prevent capital from flowing into U.S. stablecoins.

🏦 Coinbase joined forces with asset management giant Apollo to build out its stablecoin lending and tokenized credit services, aiming to tap into what it projects could be a $3 trillion market by 2030.

🏛️📈 tZero, a platform that helps companies issue and trade blockchain-based securities, said it plans to go public in 2026 and may raise additional funds beforehand.

🐸 PumpFun expanded its grip on the memecoin ecosystem by buying the Padre trading terminal, boosting its own token while wiping out most of Padre’s value, sparking backlash from disappointed holders.

Me listening to a new trader saying he sold to buy back lower later

— naiive (@naiivememe)

3:33 AM • Oct 28, 2025

DL News: Why Bitcoin will ‘never go below $100,000 again’ after this week – DL News

Aave v4: The Future of DeFi Begins by darknight.eth

TVL: Total Value Lost by Jake, investment partner at L1D