- Unchained Daily

- Posts

- Gemini Wins CFTC Approval To Launch Prediction Markets

Gemini Wins CFTC Approval To Launch Prediction Markets

Plus: 🕵️ Silk Road era bitcoin moves, 🎮 ChronoForge shuts down, 📉 Bitcoin reacts to Fed rate cut.

Hi! In today’s edition:

🏛️ Gemini secures CFTC approval to launch U.S. prediction markets

🕵️ Silk Road era wallets move $3 millions in BTC after a decade of dormancy

🎮 ChronoForge shuts down amid funding shortfalls and gaming downturn

📉 Bitcoin reacts to Fed rate cut with a brief spike and reversal

🎧 Bitcoin’s new phase and the future of the 4 year cycle explored in today’s podcast

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

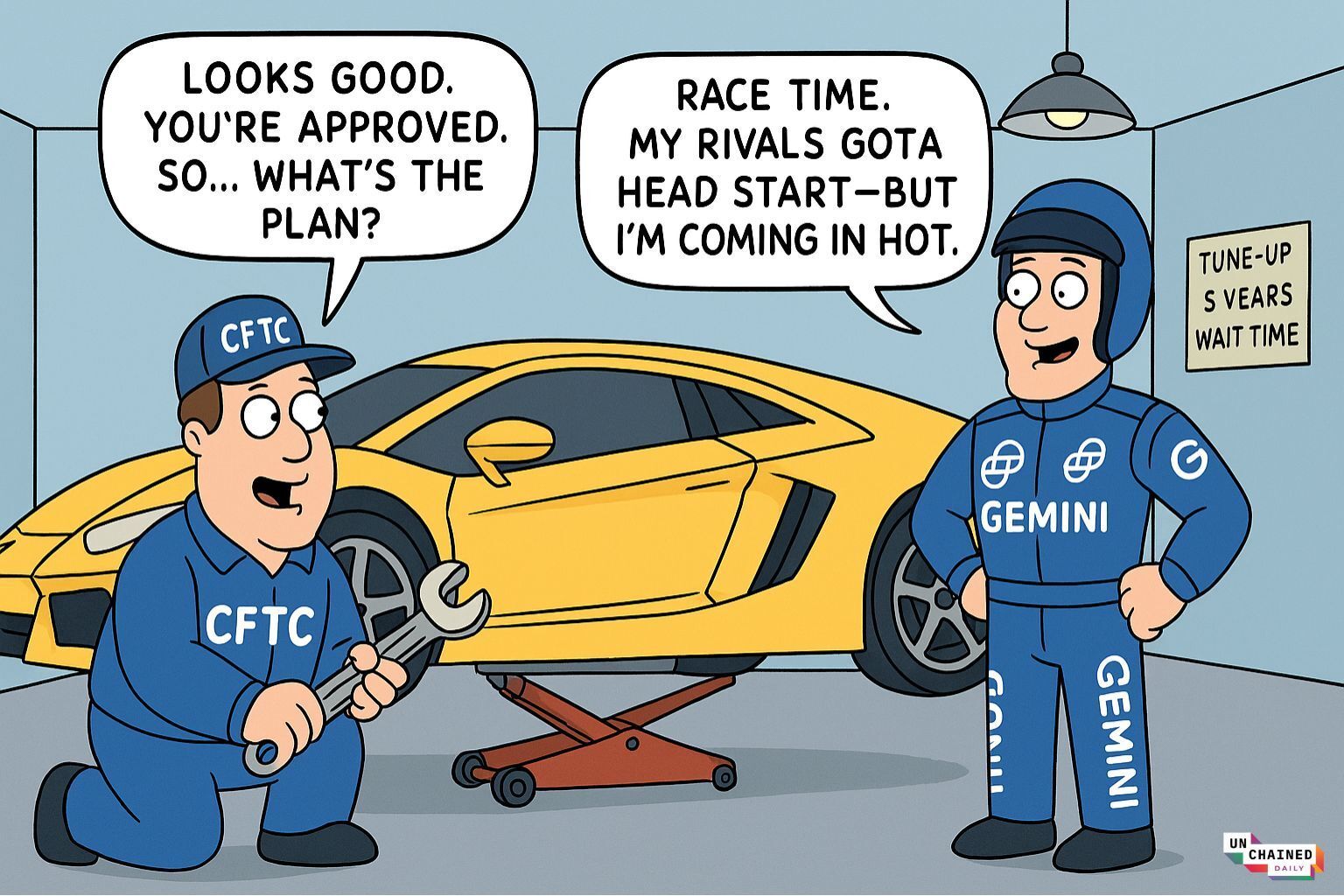

Gemini Wins CFTC Approval to Launch Prediction Markets

Gemini, the crypto exchange co-founded by Tyler and Cameron Winklevoss, received a green light from the U.S. Commodity Futures Trading Commission (CFTC) to launch prediction markets in the U.S.

Five years in the making, the approval from the CFTC now allows Gemini affiliate Gemini Titan to operate as a Designated Contract Market (DCM), enabling U.S. customers to begin trading event contracts on Gemini’s web interface.

“Prediction markets have the potential to be as big or bigger than traditional capital markets. Acting Chairman Pham understands this vision and its importance,” said Cameron Winklevoss in a statement.

The move positions Gemini to compete with platforms like Kalshi and Polymarket amid surging volumes in the prediction market space over the past few months.

Bits + Bips: The Interview is LIVE today on Unchained On Air! 🎧️

At 12pm ET, Unchained Executive Editor Steve Ehrlich is joined by CoinTracker’s Shehan Chandrasekera to dive into end-of-year crypto taxes.

Then, at 12:30, Steakhouse Financial’s Sébastien Derivaux joins Steve to discuss crypto lending and risk.

$3 Million Silk Road Bitcoin Moves After 10 Years

Over 300 dormant crypto wallets linked to the dark web marketplace Silk Road transferred millions in bitcoin to an unknown address late on Tuesday.

The wallets moved $3.14 million worth of BTC while retaining about $38 million in BTC across remaining addresses, data from Arkham shows.

Silk Road operated from 2011 to 2013 as a darknet platform, processing over 1.5 million BTC transactions worth $213 million.

It was spearheaded by Ross Ulbricht, who ran the platform until his 2013 arrest and received a full pardon from President Donald Trump in January 2025 after over a decade in prison.

Blockchain analyst Conor Grogan had previously identified wallets containing around 430 BTC, valued at $47 million at the time, as linked to Ulbricht. At least one of those wallets appears to be in the cluster that moved funds on Tuesday.

Web3 Gaming Platform ChronoForge Shuts Down

ChronoForge, a Web3 MMORPG, is the latest crypto firm to shut its doors after funding shortfalls and broader industry challenges.

“After discussions with the Rift Foundation, we have accepted the painful reality that we are unable to sustain the game or token utilities and ChronoForge will be shutting down services by 30 December, 2025,” said the team in an X announcement on Wednesday.

The Rift Foundation, which manages the game’s token and ecosystem, has raised over $3 million through its RIFT token sale to fund development.

Web3 gaming saw a 93% year-over-year funding drop to $73 million in Q2 2025, the lowest in two years, alongside a 17% decline in daily active wallets.

Developers are increasingly pivoting from play-to-earn to AI decentralized applications, with 75% of recent funding going to infrastructure over games.

Bitcoin Briefly Pops Following Fed Rate Cut, Optimistic 2026 Outlook

Bitcoin jumped and then dumped on Wednesday following the U.S. Federal Reserve’s Open Markets Committee’s (FOMC) decision to reduce the targeted funds rate by 25 bps to 350-375 bps at 2pm EST.

The decision is the third reduction this year from the policymaking body, though it was made with three dissents. Regional Fed presidents Austan Goolsbee of Chicago and Jason Schmid of Kansas City voted against the cut, while newly installed Governor Stephen Miran voted for a 50bps cut.

The full story reveals:

Why "not raising is the new cut" according to market reaction

What the Fed's $40B monthly T-bill purchases mean for Bitcoin (and why it's not QE)

Where Grayscale expects bitcoin's bottom is and when new highs could hit

Who's favored to replace Powell in 2026 and what that means for crypto

Will Bitcoin’s New Phase Change It Forever? And Is the 4-Year Cycle Dead?

The crypto markets are disappointing, but our experts aren’t pessimistic. Here’s why one thinks 2026 will prove the four-year cycle is dead.

The crypto sector has celebrated a lot of policy wins in 2025, but price wise, it has arguably been a year to forget.

In this episode of Unchained, Bitwise Head of Research Ryan Rasmussen and Arca Portfolio Manager David Nage join host Laura Shin to discuss the disappointing crypto markets and why their outlook on 2026 is more positive.

They also explained why Vanguard’s crypto pivot is a huge deal, questioned whether Bitcoin could ever be unseated by privacy coins, and discussed why they don’t see the bubble in the DAT market hurting crypto.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🏛️ Superstate announced that the SEC will allow public companies to raise capital by directly selling newly issued tokenized shares on blockchains like Ethereum and Solana in exchange for stablecoins, a shift that could speed up settlements and modernize fundraising without relying on traditional underwriters.

⚖️ Paxful agreed to plead guilty and pay $7.5 million in penalties after U.S. authorities said the now-defunct peer-to-peer Bitcoin marketplace knowingly let criminals move billions through its platform, including sending funds to prostitution sites and sanctioned countries while ignoring basic compliance rules.

🌏 Venture firm a16z crypto opened its first Asia office in Seoul under new regional lead Sungmo Park, aiming to deepen partnerships and help founders scale across markets like Korea, Singapore, and Japan—regions highlighted for high crypto usage and fast-growing onchain activity.

🔄 Coinbase is expanding its built-in support for Solana by enabling in-app decentralized exchange trading for Solana tokens with payments through USDC or traditional methods, a move that follows the earlier SOL–Base bridge launch that stirred debate among parts of the Solana community.

📱 Sei partnered with smartphone giant Xiaomi to pre-install a new wallet and crypto discovery app on Xiaomi devices sold outside China and the U.S., while jointly planning to roll out stablecoin payments across Xiaomi’s global retail network starting in Hong Kong and the EU in 2026.

🥇 Bhutan launched TER, a gold-backed token on Solana distributed by its first digital bank DK Bank, showcasing the kingdom’s push to blend traditional assets with blockchain and signaling future tokenization plans that could extend to silver, rare stones, or even cultural assets.

🤝 Stripe acquired the team behind Valora—a mobile crypto wallet built for Celo stablecoins—to deepen its growing stablecoin business, even as Valora’s app and technology returned to cLabs for continued development outside the acquisition.