- Unchained Daily

- Posts

- Infinex Overhauls INX Token Sale After Demand Misfire

Infinex Overhauls INX Token Sale After Demand Misfire

Plus: 🧩 Infinex rewrites sale mechanics, 🧮 Polymarket adds taker fees, 🚨 Flow details $3.9 millions exploit recovery.

Hi! In today’s edition:

🧩 Infinex changes INX sale terms after raising just $600,000

🧮 Polymarket introduces taker fees in 15 minute prediction markets

🚨 Flow details how 40 malicious contracts drove a $3.9 millions exploit

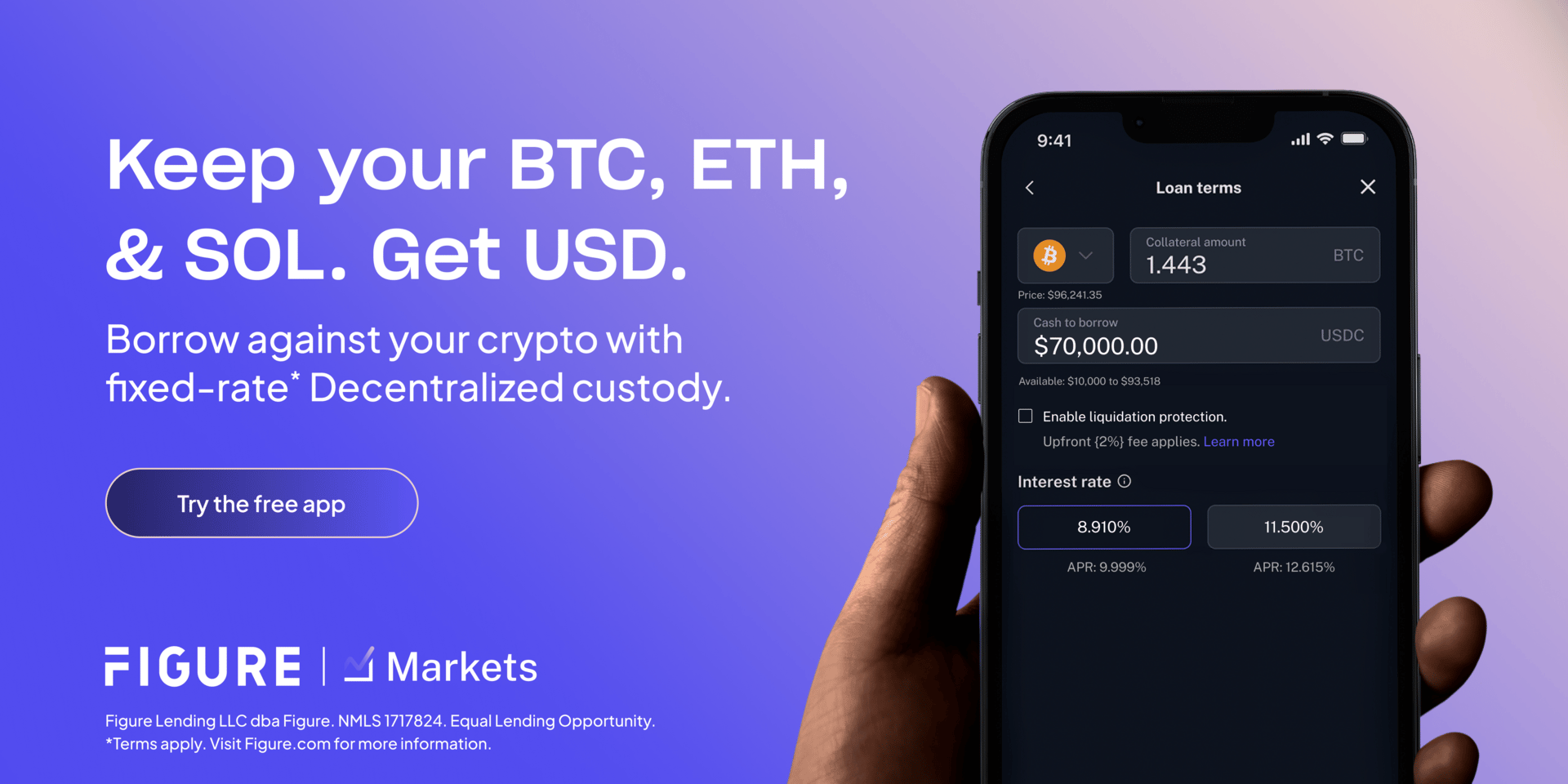

Today’s newsletter is brought to you by Figure!

We all know the mantra: Not your keys, not your coins. But managing self-custody while trying to access leverage is a headache.

Figure bridges this gap for their Crypto Backed Loans with decentralized MPC custody. Your assets sit in a segregated wallet where you retain ownership—no opaque "commingled funds" risks here.

They are also tackling the biggest anxiety in lending: flash crashes. Their Liquidation Protection for BTC and ETH specifically protects you from getting wiped out during large price drops.

You get the best of both worlds:

Safety: Institutional-grade MPC custody.

Access: Borrow at just 8.91% on Crypto Backed Loans.

Yield: Earn up to 9% APY on cash, backed by real-world assets (HELOCs) with Democratized Prime.

Sleep better knowing your assets (and your upside) are protected.

By Tikta

Infinex Changes INX Token Sale Terms After Low Demand

Infinex, a DeFi platform founded by Kain Warwick of Synthetix, revised its INX token sale terms after raising just $600,000 in three days — far short of the $5 million target from 5% of tokens at a $99.99 million FDV.

“We got the sale wrong,” wrote Infinex in an X post.

“We tried to balance existing Patron holders, new participants, and fair distribution all at once and the result was a sale that (almost) nobody wanted to participate in.”

The team removed the $2,500 per-wallet cap, switched to a "bottom-up" allocation model which increases uniformly until supply is exhausted, and retained Patron NFT holder priority which will be finalized post-sale using real demand data.

The cap removal drew the most backlash from the community as certain wallets on Polymarket made large bets on Infinex raising over $2 million, $3 million and $5 million.

Although Infinex employees claim they are “banned from trading on Polymarket,” many in the community still believe insiders were behind those Polymarket bets.

As of late Tuesday evening, Infinex had raised just 31% of its target, with optimistic projections still estimating the sale will end far below that figure.

Polymarket Introduces Taker Fees in 15-Minute Markets

Prediction markets platform Polymarket has quietly rolled out taker fees specifically for its 15-minute up-or-down crypto price prediction markets.

Updated documentation on the firm’s website notes that all fees will go straight back to market makers as rebates in USDC, with fees going as high as 3% of the trade’s value.

Some industry watchers believe that the updated structure will lead to tighter spreads and potentially eliminate bots that aggressively take liquidity through high-frequency trades.

Arbitrage bots, which turned small stakes into large gains through market lags, now face diminished edges as fees redistribute value to liquidity providers.

But some users have hypothesized that bots that are “built right” could become even more dominant with the new updates.

Attacker Deployed 40 Malicious Contracts to Exploit $3.9M From Flow Network

The Flow Network shared a post-mortem of a Dec. 27 exploit that led to $3.9 million in losses from the protocol, but no user balances were compromised.

The attacker used 40 malicious smart contracts to orchestrate a three-part attack chain, extracting counterfeit tokens before Flow validators halted the chain after the exploit was detected.

“It’s important to also note that these assets were duplicated, not minted, therefore total token supply values for each of the tokens remained unchanged; minting logic was entirely bypassed in the attack,” explained the Flow team.

The Flow Foundation initially floated a full chain rollback to a pre-exploit state, but later pivoted to an “isolated recovery” plan, which involves restarting the chain from the last sealed block.

Flow’s native token FLOW dropped around 40% immediately after the exploit, but has since gained around 6% and was trading at $0.099 as of Tuesday evening.

📊 MSCI delayed any decision on removing crypto-treasury companies from its stock indexes, keeping them included through February while it continues reviewing whether firms dominated by digital asset holdings function more like investment vehicles than operating businesses.

🏛️ U.S. community banks are urging Congress to tighten the GENIUS Act to block exchanges from indirectly paying yield on stablecoins, warning that such rewards could pull deposits away from local banks and hurt small-business lending.

⚙️ Ethereum increased its “blob” data limit to allow more transactions to be bundled by scaling networks, a technical upgrade designed to lower fees and boost capacity while keeping the main blockchain stable.

🥇 Tether introduced “Scudo,” a smaller unit for its gold-backed XAUT token equal to one-thousandth of an ounce, making it easier for users to trade and price tiny amounts of tokenized gold as bullion prices rise.

🏦 Morgan Stanley filed paperwork for new Bitcoin, Solana, and Ethereum investment funds, signaling deeper Wall Street demand for simple price-tracking crypto products as bitcoin ETFs alone now manage about $119 billion.

💵 Barclays made its first stablecoin-related investment by taking a stake in Ubyx, a U.S. startup building clearing infrastructure to help banks and fintechs accept and move regulated digital money such as stablecoins and tokenized deposits.

BowTied Bull: 2026 ETH Update with Etherealize

Three Checkpoints for a Rally by Matt Hougan, Chief Investment Officer of Bitwise