- Unchained Daily

- Posts

- Lazarus Group Tied to $30 Million Upbit Hack

Lazarus Group Tied to $30 Million Upbit Hack

Plus: ⚖️ Do Kwon requests five year sentence, 💸 MegaETH refunds pre deposits, 🏦 Balancer weighs $8 million distribution.

Hi! In today’s edition:

🧨 Lazarus Group linked to $30 million Upbit hack

⚖️ Do Kwon asks for a five year maximum sentence

💸 MegaETH plans to return all pre deposit funds

🏦 Balancer DAO debates distributing $8 million in recovered assets

🎙️ Monad’s launch, MegaETH turmoil, Polymarket’s approval and more on Uneasy Money

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

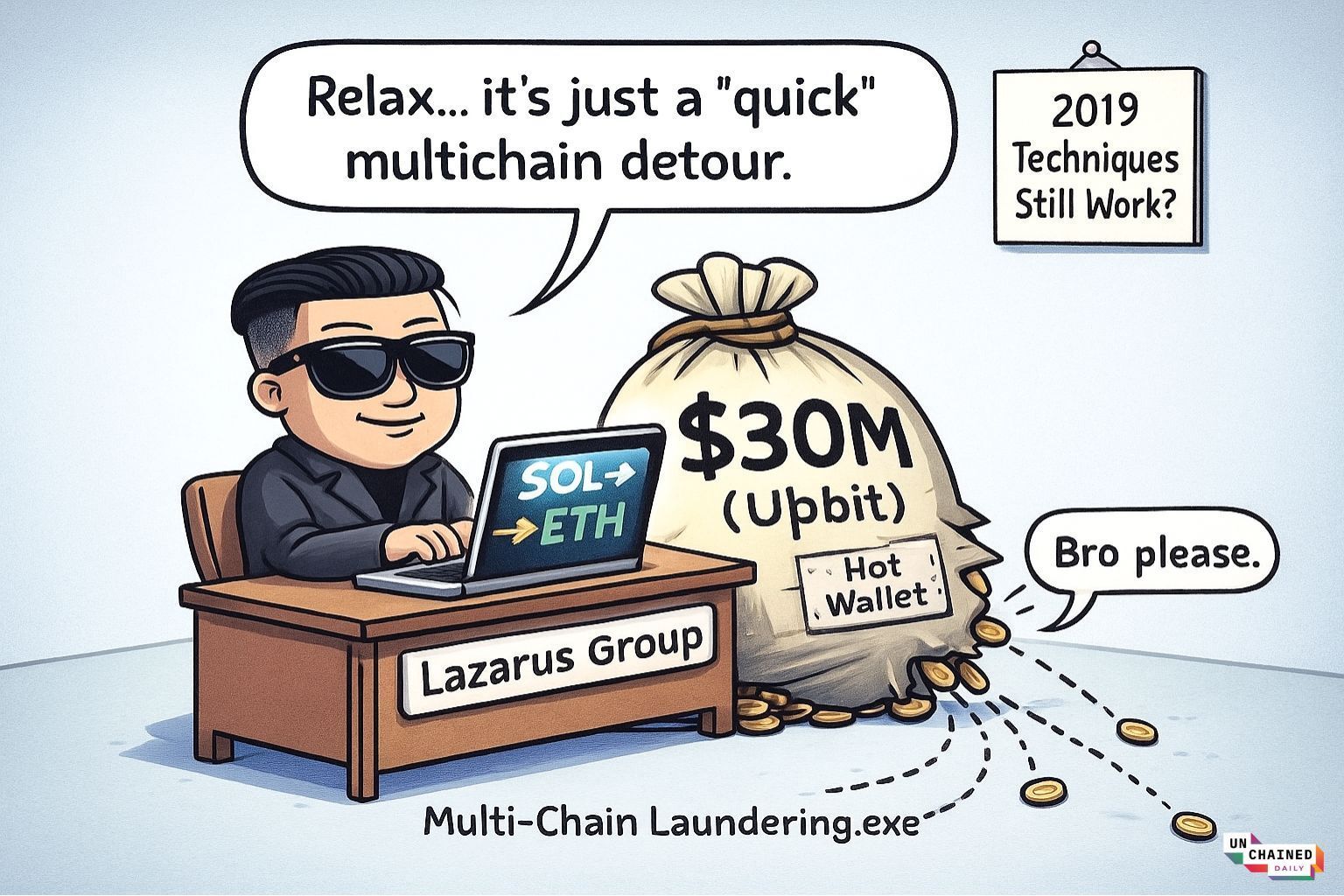

Lazarus Group Linked to $30 Million Upbit Hack: Report

South Korean authorities suspect North Korea's Lazarus Group of orchestrating a $30 million cryptocurrency theft from Upbit, the country's largest crypto exchange, via an exploit on its Solana hot wallet.

According to a report from Yonhap News, South Korean authorities believe that Lazarus was behind the attack and plan to carry out an on-site investigation. Insiders say the technique used in this particular attack resembles the methods used in a 2019 hack.

The breach occurred early on Thursday, when assets worth about $30 million were transferred to an unauthorized address, prompting Upbit to suspend deposits and withdrawals.

The theft involved sophisticated multichain laundering techniques, including rapid conversions of SOL into ETH across multiple wallets.

Upbit's operator Dunamu pledged full customer reimbursement using company funds, with some stolen tokens like $8.18 million worth of LAYER already frozen.

Still full from Thanksgiving? 🥧 We're keeping it light today on Unchained on Air 😄

At 12pm ET: Nick O’Neill, also known as Choose Rich, joins Laura to talk about his crypto-centric viral skits, stunts, and antics!

Do Kwon Requests 5-Year Maximum Prison Term

Terraform Labs co-founder Do Kwon has requested a maximum prison term of five years for his role in the $40 billion collapse of the TerraUSD stablecoin (UST) in 2022.

Prosecutors in the U.S. agreed to a plea deal with a maximum sentencing cap of 12 years, which Kwon’s lawyers argued “does not consider the totality of circumstances that support a sentence not greater than five years’ incarceration” in a letter filed earlier this week.

Kwon himself wrote a letter to the judge, accepting “full responsibility” for the failure of the Terra ecosystem.

“I got swept up in my own overconfidence. I made many mistakes. I made misrepresentations that came from a brashness that is now a source of deep regret,” he said.

He also expressed regret for not making the public aware how Jump Crypto had helped restabilize UST during its de-pegging event in 2021.

“After markets stabilised, as per our agreement I was asked not to publicly discuss what Jump had done,” said Kwon.

“How Jump had helped is immaterial: that they helped at all needed to have been made public, with investors then being free to make their own decision.”

Kwon’s sentencing hearing is scheduled to take place on Dec. 11.

MegaETH Plans Return of All Pre-Deposit Funds

MegaETH will return all funds from its pre-deposit bridge campaign, admitting the execution was "sloppy.”

The pre-deposit event, intended to preload liquidity for its USDm stablecoin ahead of the Frontier mainnet launch, was plagued by multiple technical and operational failures.

That included an incorrect SaleUUID causing transaction failures, strict rate limits that blocked many users, a misconfigured multisig transaction that was executed prematurely, and chaotic cap changes that led to deposits far exceeding intended limits.

“Execution was sloppy and expectations weren’t aligned with our goal of preloading collateral to guarantee 1:1 USDm conversion at mainnet,” said the MegaETH team.

“The refund process requires a new smart contract, currently under audit. Refunds shortly after.”

Balancer DAO Considers Proposal to Distribute $8 Million Recovered From Exploit

The Balancer community is debating a proposal on how best to distribute $8 million in funds recovered from a $116 million exploit in early November.

The proposal targets reimbursements solely to affected liquidity providers via pro-rata payouts based on Balancer Pool Tokens (BPT) holdings at snapshot blocks.

The plan emphasizes non-socialized distribution, limiting funds to specific exploited pools rather than the broader community, and in-kind payments using the original lost tokens to prevent price discrepancies.

White hat hackers would receive 10% bounties on their recoveries after KYC verification, while internal recoveries return directly to pools without bounties.

The proposal still awaits Balancer DAO governance approval.

Uneasy Money: Monad Soars After Launch. Was Its Slow ICO an Advantage in the End?

The crew delves into Monad’s mainnet launch performance, the lessons from MegaETH’s botched TVL campaign, Polymarket’s CFTC greenlight, Cardano’s chain split and more.

In this episode of Uneasy Money, hosts Kain Warwick, Luca Netz and Taylor Monahan discuss Monad’s mainnet launch performance and how its ICO strategy may have proven solid in the end.

They also delve into MegaETH’s botched TVL campaign with Kain explaining why scrambling is bad for projects.

In addition, they dissect Polymarket’s CFTC greenlight, Klarna’s stablecoin launch, Cardano’s chain split and Berachain’s secret Brevan Howard deal.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🕵️ Justin Sun intensified his accusations against Hong Kong trust firm First Digital Trust, claiming it secretly moved hundreds of millions in TUSD reserves offshore and forged paperwork to hide it, while urging regulators to tighten loopholes after a Dubai court froze assets connected to the alleged misuse.

💻 A malicious Chrome extension called Crypto Copilot quietly siphoned small but scalable amounts of SOL from every Raydium trade by inserting a hidden second transaction, with researchers warning that its obfuscated code let it remain undetected for months on the official Chrome Web Store.

🎮 Animoca Brands said it plans to broaden its 2026 strategy beyond gaming into areas like stablecoins, AI tools, decentralized physical infrastructure, and DeFi, while also preparing a Nasdaq listing through a reverse merger and predicting that institutional demand will shift the industry from speculation to real utility.

🛡️📱 Vitalik Buterin donated roughly $765,000 in ETH to the privacy-focused messaging apps Session and SimpleX, saying better encrypted communication is essential as governments expand surveillance and as crypto users seek tools that hide both identities and metadata.

🔄 Polygon executive Aishwary Gupta predicts a “super cycle” for stablecoins with over 100,000 issuers in the coming years, arguing that banks will need to issue blockchain-based deposit tokens to keep deposits from flowing into digital dollars and to compete in payment networks that automatically swap between different stablecoins.

🇰🇷🛑 South Korea plans strict new anti-money-laundering rules that will extend surveillance to even tiny crypto transfers, block risky overseas exchanges, tighten standards for local platforms, and allow authorities to freeze suspicious funds instantly while banning people with tax or drug-crime histories from owning major stakes in crypto firms.

💱 Chainalysis data showed that several inflation-hit nations — including Turkey, Argentina, Nigeria, Venezuela, and Bolivia — increasingly relied on crypto as a store of value, moving over $445 billion in combined transaction volume as citizens sought shelter from rapidly weakening local currencies.

🚀 Infinex announced its Sonar token sale offering 5% of the INX supply at a $300 million valuation to widen ownership ahead of its 2026 token launch, giving large allocations to Patron NFT holders while opening a capped lottery for newcomers as it pushes its vision for an all-in-one “crypto superapp.”

Adapt or Die by Arthur Hayes, CIO of Maelstrom

DL News: Robinhood’s Kalshi competitor marks new threat for beleaguered prediction market