- Unchained Daily

- Posts

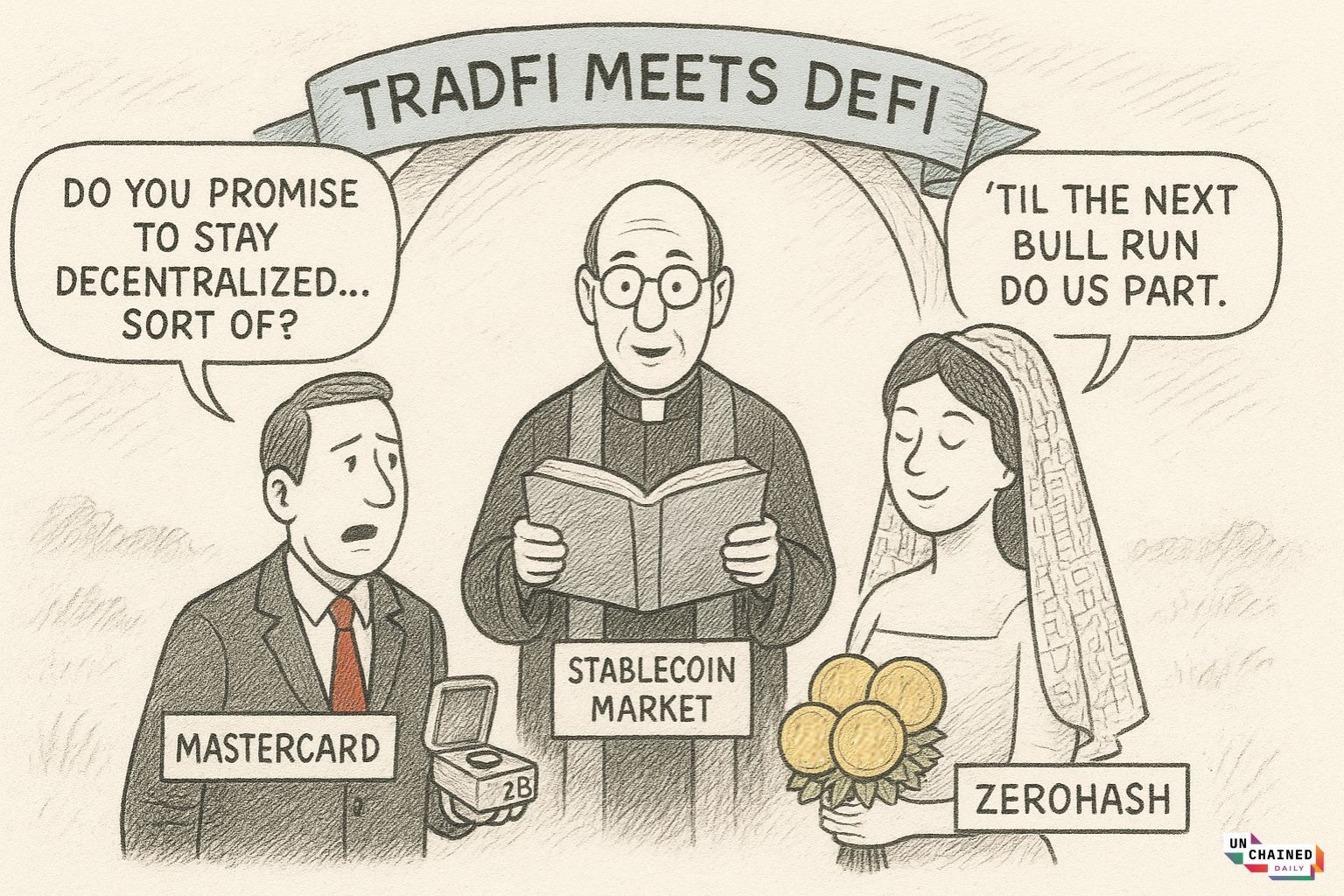

- Mastercard May Buy Zerohash in $2 Billion Stablecoin Push

Mastercard May Buy Zerohash in $2 Billion Stablecoin Push

Plus: 📉 Bitcoin ETFs see $470M outflows after Fed cut, 🪙 Trump memecoin firm eyes Republic acquisition, 📊 Ondo brings tokenized stocks to BNB Chain.

Hi! In today’s edition:

• 💳 Mastercard nears $2B Zerohash acquisition

• 📉 Bitcoin ETFs see $470M outflows after Fed rate cut

• 🪙 Trump memecoin firm eyes Republic.com buyout

• 📊 Ondo expands tokenized stocks to BNB Chain

By Tikta

Mastercard in Talks to Buy Zerohash for $2 Billion: Report

Mastercard is pursuing a deal to acquire stablecoin infrastructure provider Zerohash for up to $2 billion, Fortune reported Wednesday, citing sources familiar with the discussions.

The Chicago-based startup provides technology and regulatory tools enabling banks and fintechs to launch compliant crypto trading and tokenization projects. Zerohash raised $104 million at a $1 billion valuation in September, with Interactive Brokers leading the round alongside Morgan Stanley and SoFi.

The potential acquisition would surpass Stripe's $1.1 billion purchase of Bridge last year and marks Mastercard's second reported pursuit this month. The payments giant was also in talks to acquire stablecoin startup BVNK for approximately $2 billion.

Zerohash recently partnered with Morgan Stanley to enable Bitcoin, Ethereum, and Solana trading for E*Trade customers. The startup has provided services for Interactive Brokers, Franklin Templeton, and BlackRock's BUIDL Fund since its 2017 founding. The stablecoin market capitalization has grown roughly $100 billion this year to over $312 billion, according to CoinGlass.

Bitcoin ETFs Record $470 Million Outflows Amid Fed Rate Decision

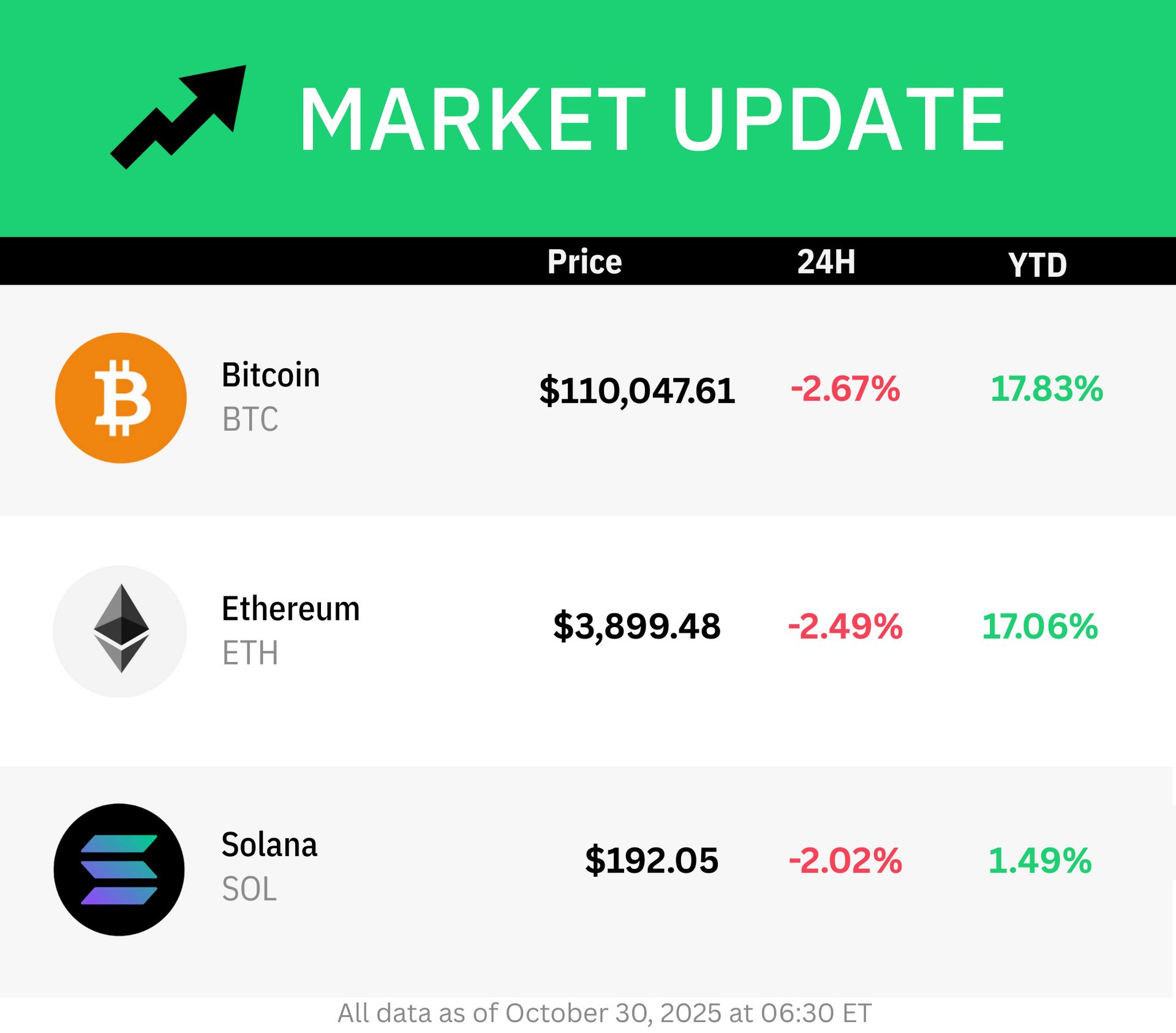

U.S. spot Bitcoin exchange-traded funds shed $470 million Wednesday, marking the largest single-day outflows in two weeks as bitcoin briefly dropped to $108,000 before recovering, according to Farside Investors.

Fidelity's FBTC led withdrawals with $164 million in outflows, followed by ARK Invest's ARKB at $143 million and BlackRock's IBIT with $88 million. Grayscale's GBTC recorded $65 million in exits, while Bitwise's BITB saw $6 million leave.

The drawdown followed steady gains earlier in the week, with $149 million in inflows Monday and $202 million Tuesday. Bitcoin traded between $108,201 and $113,567 over 24 hours despite the Federal Reserve cutting interest rates by 25 basis points.

Cumulative net inflows dropped to $61 billion, with total assets under management declining to $149 billion, representing 6.75% of bitcoin's market capitalization. ETFs hold about 1.5 million BTC (≈ $169 billion).

Trump Memecoin Firm Pursuing Republic Acquisition: Bloomberg

Fight Fight Fight, the company behind the Trump-linked memecoin, is in discussions to acquire the U.S. operations of investment platform Republic.com, Bloomberg reported Wednesday.

The deal could enable Republic users to transact using the TRUMP memecoin while providing crypto startups new fundraising avenues. Fight Fight Fight and CIC Digital, a Trump Organization affiliate, collectively own 80% of the memecoin.

Republic has facilitated over 3,000 fundraising campaigns for retail and accredited investors, with backing from Galaxy Digital and Binance's venture arm. The platform has embraced blockchain-based tokenization of real-world assets.

The TRUMP memecoin launched in January ahead of Trump's second inauguration, surging to nearly $9 billion in market capitalization before plunging approximately 90% to around $1.64 billion. Fight Fight Fight is also seeking to raise $200 million for a digital asset treasury to accumulate the token, according to reports last week.

Ondo Brings 100 Tokenized Stocks to BNB Chain Platform

Ondo Global Markets expanded its tokenized securities platform to BNB Chain, giving 3.4 million daily active users access to over 100 Wall Street stocks and ETFs.

The integration enables non-U.S. investors across Asia and Latin America to access American equities through blockchain-based settlement. PancakeSwap, BNB Chain's largest decentralized exchange, will serve as the primary trading platform for these tokenized assets.

Ondo Global Markets launched on Ethereum in September and quickly surpassed $350 million in total value locked while generating nearly $670 million in onchain volume. The platform currently has approximately 28,370 holders of tokenized financial products.

Ondo Finance has become one of the largest real-world asset tokenization platforms since July 2021, with $1.8 billion worth of assets tokenized onchain. The company raised $20 million in Series A funding from Peter Thiel's Founders Fund in 2022 and recently acquired U.S.-regulated broker Oasis Pro.

📰 Crypto media outlet Blockworks shut down its news division to concentrate on its growing data analytics business, leading to staff layoffs and marking a major shift from journalism toward data products the company says investors and blockchain firms now rely on daily.

🧠 The Ethereum Foundation launched a new website tailored for businesses aiming to adopt Ethereum, hoping to simplify integration and boost institutional use amid Wall Street’s growing interest in blockchain tools.

⚖️ Former Binance CEO Changpeng Zhao is considering legal action against U.S. Senator Elizabeth Warren over her claim he bribed Trump for a pardon, following backlash over his criminal plea and the controversial USD1 stablecoin’s political ties.

📊 Former FTX US president Brett Harrison launched a startup offering crypto-style perpetual futures for traditional assets like stocks and currencies, drawing fresh regulatory attention as he reintroduces high-leverage tools to mainstream finance.

💧 Solana-based dark exchange HumidiFi announced it would launch its WET token through an initial coin offering in November using Jupiter’s new DTF platform, after processing nearly $34 billion in trades over the past month.

🏢 Securitize and investment bank BNY Mellon revealed a new onchain fund that will give investors access to AAA-rated loan products via blockchain, with $100 million already lined up by credit protocol Grove as demand for tokenized assets accelerates.

🏦🚀 Consensys, the company behind MetaMask, reportedly picked JPMorgan and Goldman Sachs to lead its upcoming IPO as improving U.S. crypto regulations encouraged it to speed up its public listing plans.

⚡🤖 Crypto mining firm TeraWulf aims to raise $500 million to fund a massive AI-powered data center in Texas, doubling down on its pivot toward artificial intelligence after securing multibillion-dollar support from Google and Morgan Stanley.

🏦 Trading firm DRW Holdings and VC firm Liberty City Ventures are reportedly planning a $500 million token treasury for the institution-focused Canton Network, signaling deep-pocketed support for compliant blockchain finance.

congrats to zerohash on the $2bn sale. what the fuck is zerohash btw?

— threadguy (@notthreadguy)

7:56 PM • Oct 29, 2025

A16z crypto’s Paul Cafiero on “why trade media matters”

DL News: Bitcoin devs clash over adding ‘existential’ filtering feature to $2.2tn network