- Unchained Daily

- Posts

- MEV Lawsuit Against Pump.fun and Solana Escalates

MEV Lawsuit Against Pump.fun and Solana Escalates

Plus: 🔁 Synthetix returns to Ethereum mainnet, 🧩 Polymarket restores service after Polygon issue.

Hi! In today’s edition:

⚖️ MEV lawsuit against Pump.fun and Solana moves forward with new evidence

🔁 Synthetix relaunches its perps DEX on Ethereum mainnet

🧩 Polymarket restores service after Polygon network disruption

📉 Are discounted crypto treasury stocks a value opportunity or a trap?

🎙️ Robinhood’s super app ambitions and crypto strategy

🎧 DEX in the City digs into privacy, surveillance, and crypto security

Today’s newsletter is brought to you by Walrus!

Decentralized data is the future — that’s why Unchained stores its media library on Walrus.

With lightning-fast performance, unparalleled reliability, and granular access controls, your data is secure and dependable, no matter what.

By Tikta

MEV Lawsuit Against Pump.fun, Solana Heats Up

A U.S. federal court has permitted plaintiffs to amend their class-action lawsuit against Pump.fun and Solana Labs, incorporating over 5,000 internal chat logs as evidence of alleged MEV manipulation in token launches.

The plaintiffs allege that MEV, or maximal extractable value, allowed insiders to reorder transactions for profit, prioritizing their buys on new memecoins before public trading.

Jito Labs was initially named in the lawsuit, but later “dropped without prejudice.” Jito developed key MEV infrastructure on Solana, including the Jito Block Engine, bundles, and open-source tools like the MEV bot and SDK for backrun arbitrage.

Chat logs described as confidential reportedly show Pump.fun staff, Solana engineers, and Jito Labs executives coordinating advantages.

Burwick Law, the firm handling the plaintiffs’ legal proceedings, shared the amended complaint on X. Industry watchers have argued that the new evidence was merely a delaying tactic.

“I’m not a lawyer but this lawsuit against Pump.fun and Solana feels dumb and frivolous,” said Delphi Ventures Founding Partner Tommy Shaughnessy on X.

“They are twisting standard MEV mechanics and neutral infrastructure to appear as a ‘secret inside lane’ but even Jito was dropped from the case and they built the tool.”

Synthetix Goes Back to Ethereum Mainnet After 3 Years

Synthetix, a leading DeFi protocol for synthetic assets and perpetuals trading, has returned to the Ethereum mainnet after operating primarily on layer 2 networks like Optimism for about three years.

“In 2022, Synthetix left Ethereum Mainnet, lured by the low fees and abundant blockspace of Optimism,” said Synthetix in a blog post.

“But we quickly (slowly) learned that the layer two scaling roadmap had some harsh trade-offs for applications.”

High gas fees and congestion drove Synthetix to L2s in 2019, fragmenting liquidity across chains. But Synthetix says Ethereum's upgrades have now resolved these issues, allowing high-volume DeFi products like a perps DEX to thrive on mainnet security.

The relaunch of Synthetix’s perpetual DEX went live on the mainnet on Thursday in a private beta limited to 500 whitelisted traders.

Polymarket Resolves Issues After Polygon Network Disruption

Prediction market platform Polymarket confirmed that a recent Polygon network disruption caused temporary issues, but these have since been resolved with full restoration of the site and related functions.

The outage stemmed from a Polygon PoS network problem affecting RPC nodes, though the blockchain continued producing blocks without full downtime.

“The Polygon blockchain was down and affected trades, data providers, deposits, withdrawals, etc,” said a member of the Polymarket team in the platform’s Discord channel.

The event drew focus on the vulnerabilities in external network dependencies, prompting speculation that Polymarket may prioritize its own custom layer 2 for better reliability.

Crypto Treasury Stocks Are on Sale. Is Now the Time to Buy?

By Steven Ehrlich, Unchained Executive Editor

Key Takeaways of the Story:

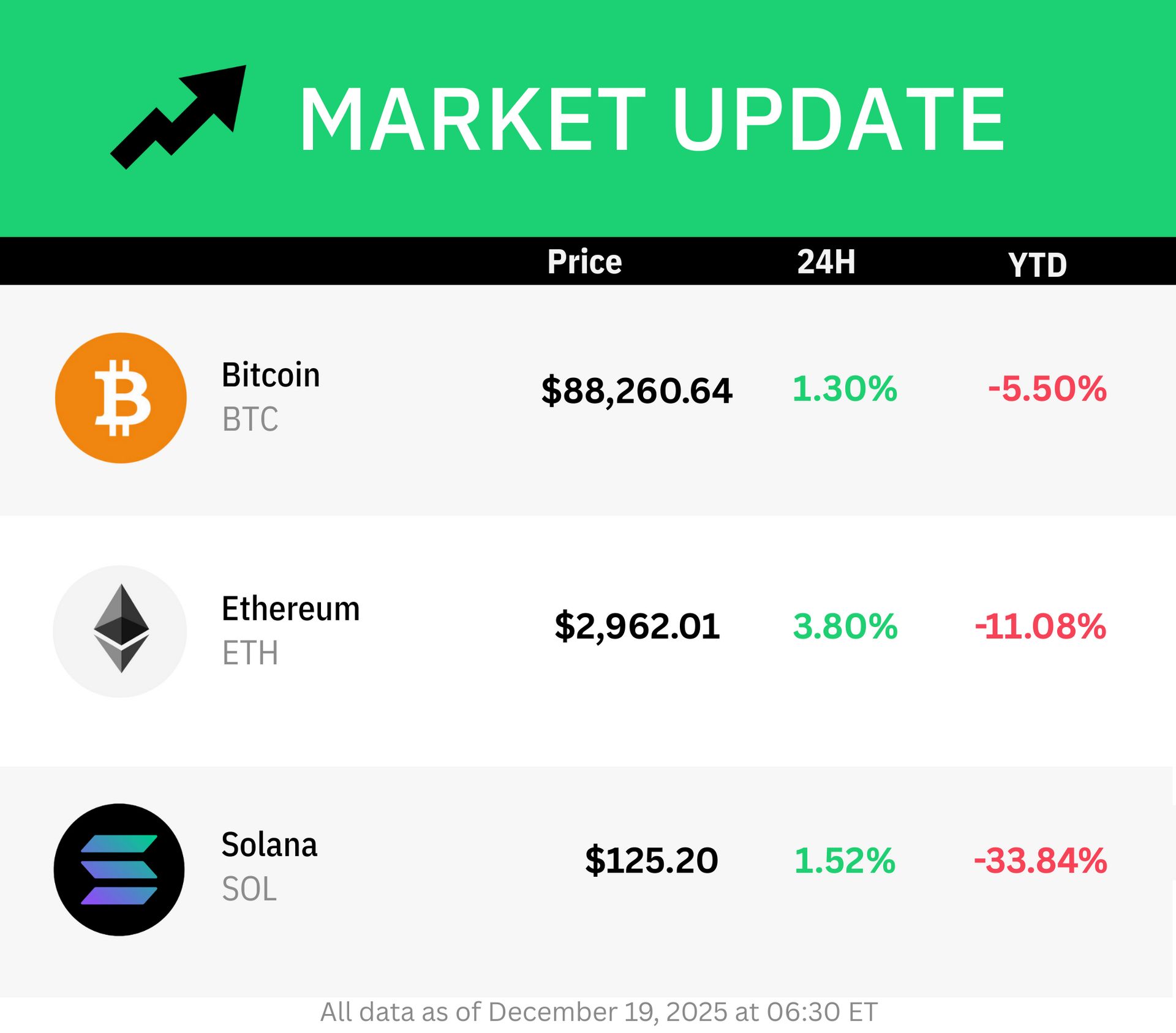

As bitcoin and ether slide sharply from recent highs, investors are looking at value plays in the market. Digital asset treasury stocks, which are now trading at hefty discounts, represent an intriguing opportunity.

The article explores whether these sub-1.0 mNAV valuations represent a GBTC-style opportunity or a value trap.

Digital asset treasury stocks have flipped from trading at large premiums to deep discounts, with many now valued well below their underlying bitcoin or ether holdings.

While history shows discounts like these can create outsized long-term returns, most DATs lack a clear mechanism to close the gap, meaning mispricings can persist or worsen.

Share buybacks and yield generation, especially for ethereum treasuries, may help support valuations but introduce leverage, liquidity, and execution risks.

Buying discounted DATs is not a clean arbitrage trade and works best as a long-term, high-conviction bet rather than a short-term dip-buying strategy.

Inside Robinhood’s Big Super App Plan: ‘There’s Still a Lot of Work to Be Done’

Robinhood is moving toward offering a full suite of crypto services and overhauling the infrastructure underpinning its stock trading services with blockchain technology.

In this episode of Unchained, Robinhood Crypto Senior Vice President and General Manager Johann Kerbrat discusses the company’s “super app ambitions” and potential competition with Coinbase.

He also discusses the platform’s entry into prediction markets and resistance from state regulators. Could state opposition to prediction markets drive businesses offshore?

Plus, will tokenized stocks make IPOs redundant? And where are we in the crypto market?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

DEX in the City: How Privacy in Crypto Makes Everyone’s Finances More Secure

The SEC this week held a roundtable on financial surveillance and privacy in another sign of the major shift in the regulator’s approach to crypto.

In this DEX in the City episode, Espresso co-founder Jill Gunter joins hosts Jessi Brooks and Katherine Kirkpatrick Bos to unpack the major talking points and takeaways from the roundtable. And more importantly, what it signals about the SEC’s approach to crypto and privacy.

With legacy financial institutions coming onchain, like JPMorgan and DTTC, they discuss how crypto can actually help prevent data breaches and have a better product for users and companies alike.

Interestingly, Jill recounts how she lost $30,000 in an exploit involving crypto mixer Railgun and why she didn’t even try to hide it from regulators at the roundtable.

Plus, was Do Kwon’s sentence excessive? Well, according to Jessi, it’s a complicated question, but she unpacks what people misunderstood about the judge’s decision.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Decentralized data is the future — that’s why Unchained stores its media library on Walrus. With lightning-fast performance, unparalleled reliability, and granular access controls, your data is secure and dependable, no matter what.

💥 The administrator winding down Terraform Labs sued trading firm Jump Trading for $4 billion, accusing it and two executives of improperly profiting from and contributing to the collapse of Do Kwon’s crypto ecosystem.

📊 JPMorgan said it did not expect stablecoins to reach a $1 trillion market by 2028, forecasting instead $500 billion to $600 billion as growth stayed tied mainly to crypto trading rather than everyday payments that move money faster without boosting supply.

🧾 White House crypto and AI adviser David Sacks said the CLARITY Act was expected to reach Senate markup in January, with key committee chairs confirming it would be reviewed and potentially amended before a full Senate vote.

🇬🇧🔄 Crypto exchange Bybit reentered the U.K. after two years away, restarting spot trading on 100 crypto pairs by partnering with London-based Archax to comply with the country’s strict financial promotion rules.

⚖️ The SEC charged VBit founder Danh Vo with fraud, alleging he raised over $95 million by falsely selling bitcoin mining investments, misused $48.5 million for personal spending, and misled investors about how many mining machines actually existed.

📜 The U.S. Senate confirmed Michael Selig as chair of the CFTC, putting a former SEC crypto counsel in charge as lawmakers move to give the agency a central role in overseeing digital asset markets.

🏦 SoFi launched SoFiUSD, a fully dollar-backed stablecoin issued by its regulated bank to let banks, fintechs, and large businesses move money almost instantly on public blockchains, starting with Ethereum and potentially expanding further.

⚡ UK startup Fuse Energy reached a $5 billion valuation after raising $70 million to expand internationally, betting that its vertically integrated model—building, generating, and supplying renewable power end to end—can cut household energy costs and meet surging demand from AI and electric vehicles.

💳 Intercontinental Exchange, the owner of the New York Stock Exchange, is holding talks to invest in crypto payments company MoonPay as part of a funding round targeting a roughly $5 billion valuation, up from its $3.4 billion price tag in 2021.

Ready for Merge is a podcast for investors, builders, and operators who want to stay informed on Ethereum and Bitcoin protocol development. Hosted by ChristineD. Kim, former host of Infinite Jungle and Mapping Out Eth.2.0, each episode breaks down core developer debates, protocol upgrades, and governance tradeoffs—without hype.

Listen now on:

Messari: The Crypto Theses 2026

The Defiant: Lido Outlines $60M Plan to Expand Beyond Liquid Staking