- Unchained Daily

- Posts

- NYC Token Melts Down After Liquidity Pulled at the Top

NYC Token Melts Down After Liquidity Pulled at the Top

Plus: 🏛️ Senators target passive stablecoin yields, 🏦 Corporate bitcoin and ether treasuries keep growing.

Hi! In today’s edition:

🗽 NYC Token crashes after deployer linked wallet pulls liquidity

🏛️ Senators move to ban passive yields on stablecoins

🏦 Bitcoin and ether treasuries expand as ETF inflows return

Today’s newsletter is brought to you by Fuse!

FUSE ENERGY HITS A $5B VALUATION FOLLOWING A $70M SERIES B

Fuse Energy is a $400M ARR utility powering 200,000+ homes, and has recently announced a $70M series B at a blockbuster $5B valuation.

This comes after the recent beta launch of The Energy Network, a new digital layer engineered to scale our grids and save billions in costs.

And now, it’s just building momentum:

$170M raised to date

$5B valuation

Beta live on Solana

Landmark SEC no-action letter secured

Planning listings for early 2026

A new foundation for the grid is coming.

Check out their announcement here and follow Fuse on X for updates.

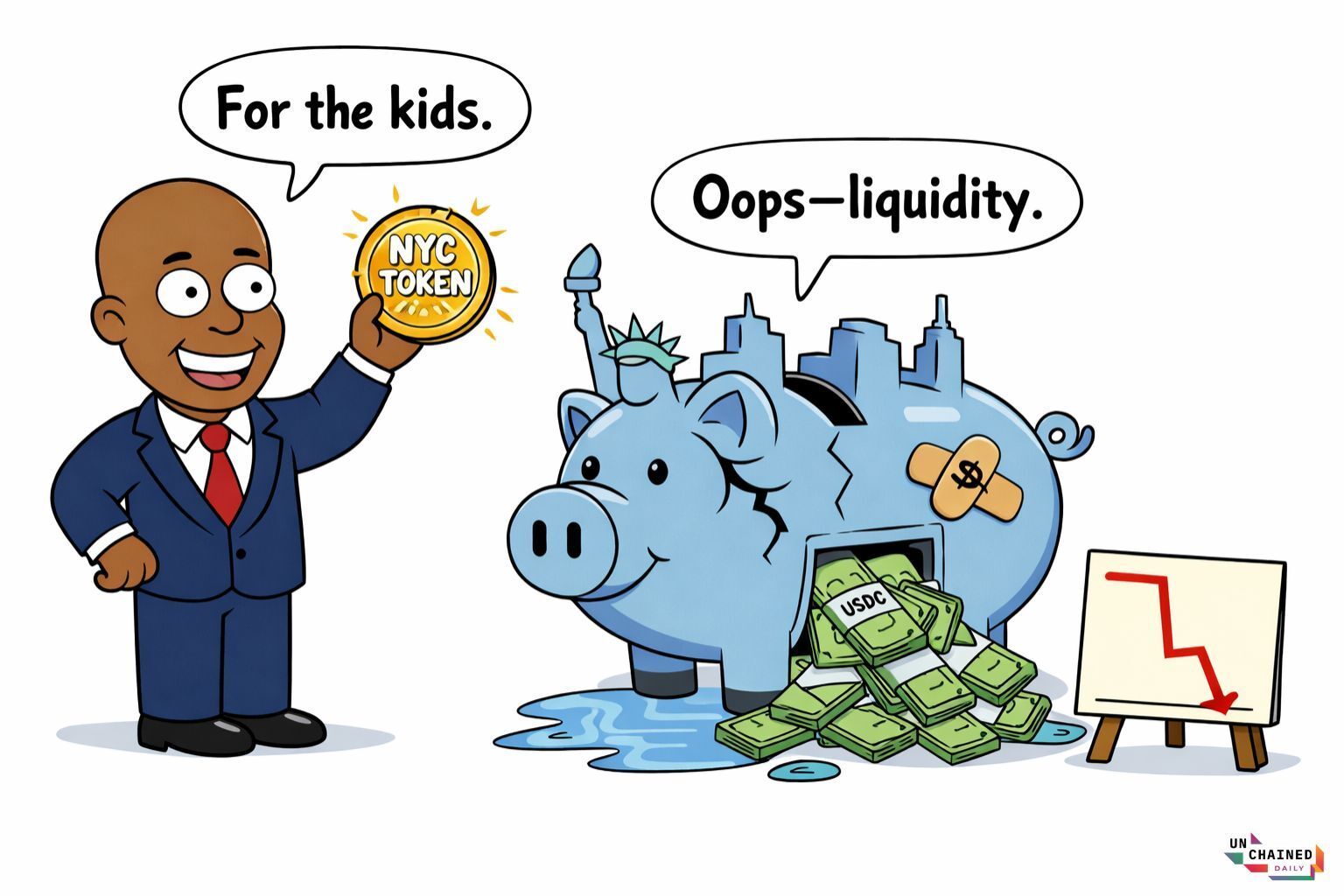

Eric Adams’ NYC Token Crashes Amid Liquidity Concerns

Former New York City mayor Eric Adams unveiled the NYC Token on Monday, claiming it would fund social causes like fighting antisemitism and “anti-Americanism.” But within hours, crypto analysts flagged suspicious activity.

A wallet tied to the token’s deployer pulled $2.5 million in USDC liquidity at the market peak, only to re-add $1.5 million after the token’s price had already plunged more than 60%, according to Bubblemaps. The token’s market cap briefly touched $600 million before crashing below $110 million.

Observers likened the activity to the infamous LIBRA token collapse last year, where manipulated liquidity preceded a multi-million dollar wipeout. Critics also warned of centralized control and opaque fund flows.

Adams — once dubbed New York’s “Bitcoin Mayor” — didn’t name co-founders or clarify the token’s structure. While he claimed the project would help children learn about blockchain, the token’s chaotic launch has already drawn comparisons to past politically-backed crypto debacles.

Senators Move to Curb Passive Stablecoin Yields in Market Structure Push

U.S. lawmakers are drawing a clearer line on how stablecoins can be used to generate returns. A revised bipartisan market structure bill unveiled Monday would ban rewards for simply holding stablecoins, while still allowing incentives tied to actual activity like trading, staking, liquidity provision, or posting collateral.

The update, released by Senate Banking Committee Chair Tim Scott, reflects months of negotiation between crypto firms and banks, with stablecoin yields emerging as one of the most contentious issues. Banks have warned that rewards on idle balances blur the line between stablecoins and deposits. Crypto firms counter that limiting incentives risks stifling innovation.

The compromise aims to split the difference: no “sit-and-earn” yields, but flexibility for platforms to reward usage. The draft also adds protections for developers, clarifying that writing or maintaining code alone does not make someone a financial intermediary.

The bill heads toward a key committee markup Thursday, marking a critical step in shaping U.S. crypto regulation.

Bitcoin and Ethereum Treasuries Expand as ETF Flows Turn Positive

Strategy made its biggest Bitcoin purchase since July, acquiring 13,600 BTC—worth over $1.2 billion—as it continues to cement its status as the largest corporate holder of bitcoin.

The buy brings its total stash to 687,400 BTC, valued near $63 billion. The firm funded the move primarily through a $1.1 billion equity offering and an additional $119 million in high-yield preferred shares.

The timing followed a relief moment for Strategy shareholders. MSCI, the global index provider, deferred a decision that could have excluded companies heavily exposed to crypto, like Strategy, from its indices.

While MSCI won’t count new share issuance in index weightings, the firm remains eligible—a win for Strategy’s long-term Bitcoin strategy.

Meanwhile, BitMine continued loading up on ether, adding 24,266 ETH last week and lifting its holdings to over 4.16 million ETH—3.45% of circulating supply.

But Chairman Tom Lee warned that future purchases could stall without shareholder approval to issue more equity. A pivotal vote is scheduled for Thursday. BitMine’s ambition is to accumulate 5% of all ETH in circulation.

Yesterday also ended on a positive note for crypto funds. Bitcoin ETFs saw $117 million in net inflows, snapping a four-day outflow streak. Ethereum, Solana, and XRP spot ETFs also posted gains, signaling renewed investor confidence amid macro uncertainty and political volatility surrounding the Federal Reserve.

💵 World Liberty Financial rolled out World Liberty Markets, its first decentralized lending app built on Dolomite, letting users borrow and lend using the USD1 stablecoin as supply while pushing real usage for a token that now exceeds $3.4 billion in circulation and boosted Dolomite’s DOLO token sharply.

🚀 The U.S. derivatives regulator launched a new innovation advisory committee under Chair Michael Selig to shape future rules for crypto and prediction markets, signaling a more structured approach as Congress debates expanding the agency’s authority over digital assets.

🇰🇷 South Korea’s major crypto exchanges, grouped under the Digital Asset Exchange Alliance, pushed back against a government proposal to cap large shareholder ownership at 15–20%, warning it could weaken accountability for user funds, deter investment, and drive traders toward overseas platforms.

🏈 A U.S. federal judge temporarily blocked Tennessee from enforcing a shutdown order against Kalshi, allowing the CFTC-regulated prediction market to keep offering sports-related contracts while the court weighs whether federal oversight overrides state gambling laws.

📈🔗 Crypto infrastructure firm Bakkt is expanding deeper into stablecoin payments by agreeing to acquire Distributed Technologies Research in a stock-based deal, bringing blockchain payment rails in-house as it prepares new programmable payments and neobanking services.