- Unchained Daily

- Posts

- Perp DEXes Smash $1 Trillion Trading Milestone

Perp DEXes Smash $1 Trillion Trading Milestone

Plus: 🚀 Bitcoin surges past $121K, 🕒 CME eyes 24/7 crypto futures, 📈 VanEck files staked ETH ETF, 🎧 DoubleZero builds an internet for crypto.

Hi! In today’s edition:

• 💥 $1 trillion milestone for perpetual DEXes

• 🪙 Uptober lives: Bitcoin rockets past $121K

• 🔄 CME looks to launch nonstop crypto trading

• 🪙 VanEck files for staked ETH ETF with Lido

• 🎙️ DoubleZero’s internet for blockchains goes live

A shoutout to Token2049 and Aptos for sponsoring today’s issue.

Supporting them helps us keep bringing you the top crypto stories. Check them out!

Eric Trump, Donald Trump Jr., Tom Lee headline TOKEN2049 Singapore, October 1-2.

Join 25,000 attendees at the world’s largest crypto event.

Aptos Experience returns Oct 15-16 in Brooklyn

Real problems, real solutions, real users. Two days of immersive conversations with the builders, enterprises and investors shaping the future of money, media and more.

By Tikta

Perpetual DEX Monthly Trading Volume Passes Trillion-Dollar Milestone

September was a milestone month for perpetual decentralized exchanges (DEXes) as monthly trading volume surpassed $1 trillion for the first time in history.

Data from DeFiLlama shows that perpetual DEXes recorded $1.14 trillion in trading volume, marking a 50% increase from the month prior, led by Hyperliquid and its fast-growing rival Aster.

In the last week alone, Aster recorded $415 billion in perpetual volume, eclipsing Hyperliquid’s $70 billion in the same period.

The BNB Chain-based app is backed by Binance founder Changpeng Zhao’s family office YZi Labs. Its native token ASTER has rallied 2,000% in two weeks and 11% in the last day amid speculation that Binance would soon list the token for spot trading.

Blockchain data shows that Binance spot wallets had begun testing deposits of ASTER.

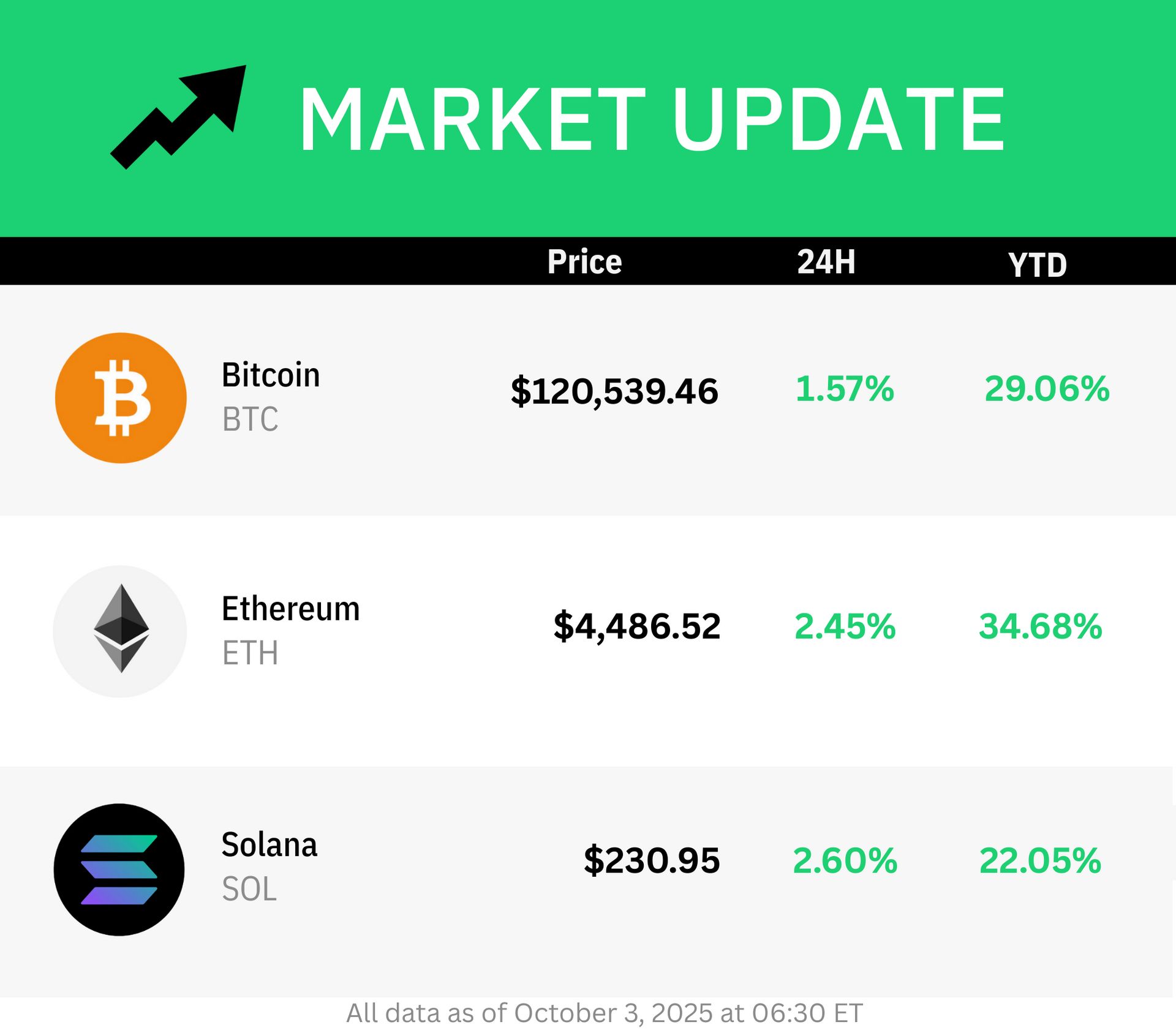

Bitcoin Kicks Off ‘Uptober’ With Rally Past $121,000

Bitcoin surged past the $121,000 mark on Thursday, marking a strong start to October – a month that has historically resulted in positive price action for the asset, earning it the nickname “Uptober.”

Ether also posted a three-week high north of $4,500, leading major altcoins higher over the last 24 hours.

Barring 2018 and 2014, bitcoin has ended higher in 10 of the last 12 years, posting the best performance in October 2013 where the asset gained 54.85%.

In a note to clients on Wednesday, JPMorgan analysts estimated that bitcoin could hit a high of $165,000 by the end of the year, saying the digital asset was undervalued compared to gold.

“The steep rise in the gold price over the past month has made bitcoin more attractive to investors relative to gold, especially as the bitcoin to gold volatility ratio keeps drifting lower to below 2.0,” said JPMorgan analyst Nikolaos Panigirtzoglou.

CME Plans 24/7 Crypto Futures Trading

The CME Group plans to offer 24/7 trading for its crypto futures and options on the CME Globex platform, pending regulatory approval.

The options exchange will seek to roll out around-the-clock trading in early 2026 amid increased client-side demand.

It will include a minimum two-hour weekly maintenance window, but otherwise will be continuous, allowing clients to trade crypto derivatives every day of the week, including weekends and holidays.

Trades executed during these off-hours will be assigned the next business day for clearing, settlement, and reporting.

CME Group's crypto futures and options have seen record growth this year, including $39 billion in notional open interest and a 230% year-on-year increase in average daily volume.

VanEck Registers Lido Staked ETH ETF

Asset manager VanEck has filed for the VanEck Lido Staked Ethereum ETF by registering it as a statutory trust in Delaware.

The registration is a preliminary step before seeking approval from the U.S. Securities and Exchange Commission (SEC).

The ETF would offer exposure to staked ether through Lido, the major liquid staking protocol that allows users to earn staking rewards while maintaining liquidity by using tokens like stETH.

Lido has around $38 billion in total value locked and is the largest Ethereum-based protocol by that metric. After news of VanEck’s filing was made public, Lido’s native token LDO rallied 7%.

How DoubleZero Built a Faster Internet for Crypto and Helped All DePIN

Austin Federa joins on launch day to reveal how the project built a new high-performance network for blockchains, plus why the SEC’s no-action letter could be a turning point for DePIN.

DoubleZero just launched its mainnet-beta, offering a new type of high-performance fiber network for blockchains, live across 5 continents and already adopted by 20%+ of Solana stake.

Co-founder Austin Federa joins Unchained to walk through:

How DoubleZero creates a dedicated internet for crypto

Who contributes fiber and why they earn the 2Z token

What the SEC’s no-action letter means for crypto and DePIN specifically

And what this could unlock for L2s, onchain trading, and more

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

💲 The total value of all stablecoins hit a record $301 billion, with Tether holding 58% dominance at $176 billion and USDC at $74 billion as institutional demand and new U.S. policy support boosted growth.

🔍 The Trump administration is preparing to nominate new leadership for the CFTC, with SEC crypto policy expert Mike Selig seen as a front-runner, as it seeks to bolster the commission’s role ahead of major crypto legislation.

🔥 Monthly trading volume on decentralized perpetual exchanges surpassed $1 trillion for the first time in September, fueled by a surge in activity on Aster, Hyperliquid and Lighter as competition reshaped the market’s leadership.

🔗 Mantle unveiled a new service to help tokenize real-world assets with built-in compliance tools, and will also host the USD1 stablecoin backed by a Trump-linked finance firm, pushing its MNT token to a record high.

🚨 State regulators warned that the new U.S. crypto legislation could weaken their ability to prosecute fraud by limiting oversight powers and redefining key legal terms, just as crypto-related scams are spiking nationwide.

🏙️ A Coinbase-backed program called Future First began giving 160 low-income New Yorkers aged 18–30 a total of $12,000 each in USDC stablecoins through Coinbase wallets to test if crypto-based aid can outperform traditional cash transfers.

⏰ CME Group revealed plans to launch 24/7 crypto futures and options trading by early 2026, aligning its schedule with the nonstop crypto market and aiming to lure traders from offshore rivals—pending regulatory approval.

💳 Crypto.com teamed up with lending protocol Morpho to let customers borrow against their crypto deposits via Cronos, following a similar Coinbase partnership that already generated over $1 billion in loans.

🧾 ETH DAT FG Nexus partnered with Securitize to let investors hold tokenized versions of its Nasdaq-listed dividend-paying shares on Ethereum, making it one of the first public firms to fully shift equities to blockchain while keeping all legal protections.

🤝 GSR will acquire U.S.-registered broker-dealer Equilibrium Capital to expand its regulated services for institutions and strengthen its foothold in the American crypto market, pending final approval.

💸 Bitwise launched $ICRC, the first ETF using a covered call strategy on Circle ($CRCL), giving investors a way to earn monthly income from exposure to the $74B stablecoin giant behind USDC.

"with your credit card? you deposited onto a perps app with your credit card?"

— Buck (@BuckOnTwidder)

2:37 PM • Oct 2, 2025