- Unchained Daily

- Posts

- Plasma Founder Pushes Back on Insider-Selling Rumors

Plasma Founder Pushes Back on Insider-Selling Rumors

Plus: 💥 SBI mining pool hacked for $21M, 📊 Polymarket set for U.S. comeback, 🎧 Manta pivots beyond the crowded L2 market.

Hi! In today’s edition:

🪙 Plasma says: no team sold XPL tokens

💸 Hackers steal $21M from SBI mining pool

🔮 Polymarket bets on U.S. relaunch

🎧 Manta goes app-first in the L2 shakeout

A shoutout to Token2049 and Aptos for sponsoring today’s issue.

Supporting them helps us keep bringing you the top crypto stories. Check them out!

Eric Trump, Donald Trump Jr., Tom Lee headline TOKEN2049 Singapore, October 1-2.

Join 25,000 attendees at the world’s largest crypto event.

Aptos Experience returns Oct 15-16 in Brooklyn

Real problems, real solutions, real users. Two days of immersive conversations with the builders, enterprises and investors shaping the future of money, media and more.

By Tikta

Plasma Founder Claims No Team Member Sold Any XPL

Plasma founder Paul Faecks addressed the controversial launch of the project’s native token XPL on X.

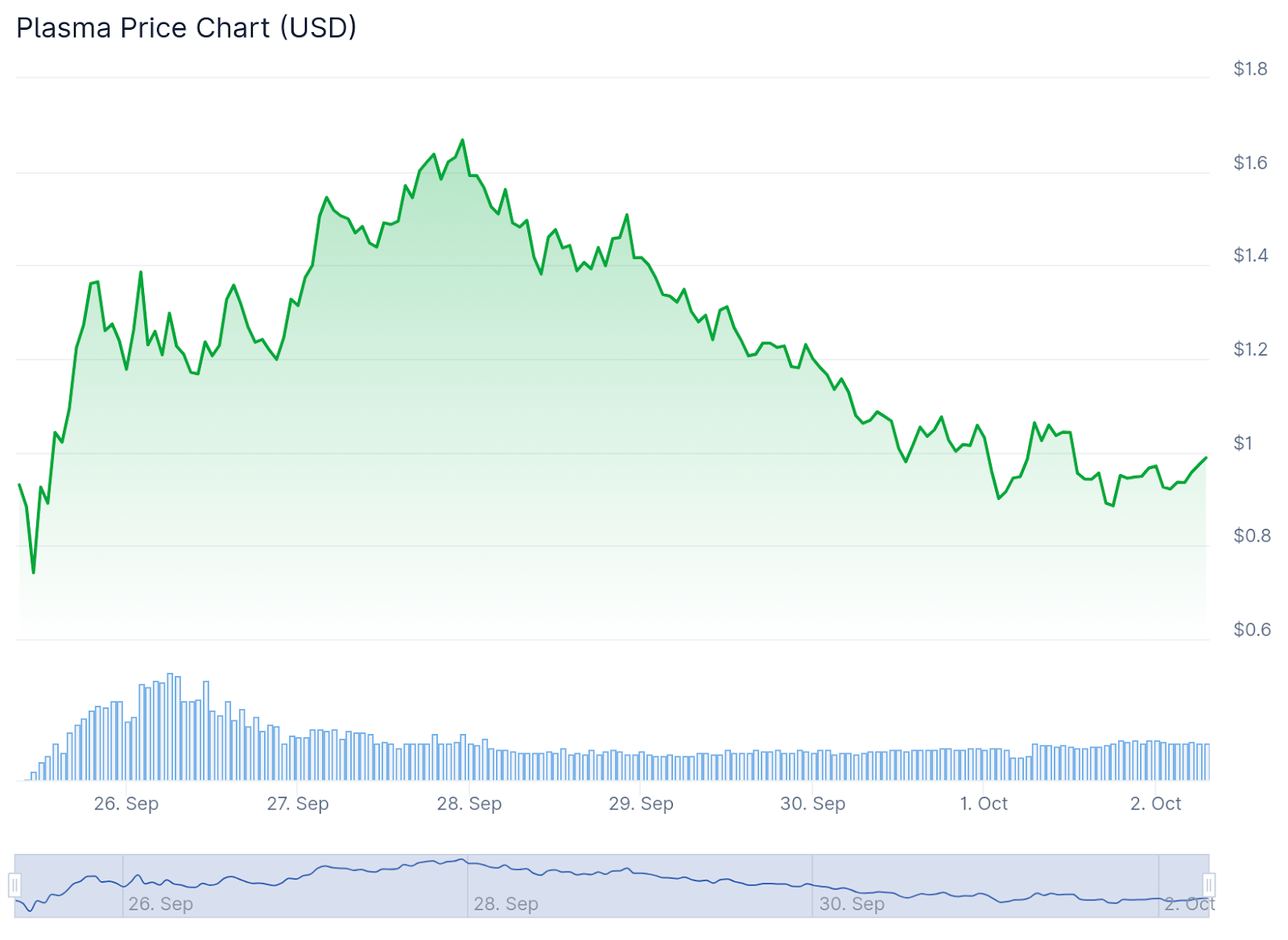

The XPL token dropped around 46% from its all-time high of $1.70 to roughly $0.92 just days after launching. The decline was fueled by speculation that insiders had sold large volumes after the token launched, and rumours that linked Plasma to the controversial Blast project.

“No team members have sold any XPL. All investor and team XPL is locked for 3 years with a 1 year cliff,” said Faecks.

He also claimed that only three of Plasma’s 50-member team had spent time at Blast and that the team had not directly engaged with market maker Wintermute in any way.

Blockchain data shows that addresses tied to Wintermute transferred significant amounts of XPL to exchanges during the launch period, which contributed to market liquidity and volatility after Plasma's token generation event.

SBI’s Bitcoin Mining Pool Hacked for $21 Million: ZachXBT

SBI Crypto, a major Japanese Bitcoin mining pool and a subsidiary of the SBI Group, suffered a $21 million hack on Sept. 24, according to blockchain sleuth ZachXBT.

According to ZachXBT, patterns in the hack closely match previous cyberattacks linked to North Korea’s Lazarus Group, a notorious state-backed entity known for targeting crypto assets as a source of funding under global sanctions.

The hacked funds were reportedly routed through five instant exchanges and then sent to crypto mixing service Tornado Cash, making them difficult to trace.

SBI Crypto maintains a significant role in both the Bitcoin and Bitcoin Cash networks, ranking as one of the largest global mining pools at the time of the breach.

The SBI Group had not officially confirmed or commented on the breach as of Wednesday evening.

Polymarket Set for U.S. Relaunch Within Days

Polymarket, the world's largest crypto-based prediction market, is set to relaunch in the U.S. within days, according to regulatory filings.

The move would make the prediction market’s return to U.S. operations four years after being banned by the Commodity Futures Trading Commission (CFTC).

The prediction market platform self-certified four event contracts on QCX ’s official website, three of which are for sports event outcomes, while the fourth is for election winners.

“The Exchange intends to list the Product(s) no earlier than October 2, 2025, which is no earlier than the Commission’s business day following this submission,” read the self-certification contracts filed on Sept. 30.

QCX is the CFTC-licensed derivatives exchange that Polymarket acquired for $112 million, meaning it now holds a Designated Contract Market (DCM) license, legally enabling it to self-certify event contracts for U.S. users.

Polymarket founder Shayne Coplan recently appeared as a panelist at the CFTC–SEC Joint Roundtable and joked about being "whisked away" by regulators.

Too Many Layer 2s on Ethereum? That’s Why This L2 Is Pivoting

Kenny Li, co‑founder of Manta Network, joins Unchained to announce a major strategic pivot: Manta is moving beyond its layer 2 roots to focus on building applications.

He explains why the L2 market has become oversaturated, what it will take to bring the next wave of users onchain, and how he envisions the future of scalability resembling cloud computing rather than one dominant chain.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

🥊Gold vs stocks!

Tune in LIVE as Unchained Executive Editor Steve Ehrlich moderates a debate between Ram Ahluwalia and Vinny Lingham at 12pm ET, following up on last week's lively Bits + Bips episode. 🔥

🧪 Ethereum’s upcoming Fusaka upgrade moved closer to launch after passing a key test on the Holesky network, with developers planning two more trial runs this month before setting a mainnet release date.

🧬 The Sui blockchain partnered with Ethena and SUI Group to launch suiUSDe, a yield-generating native stablecoin backed by digital assets and futures, aiming to boost ecosystem growth and stablecoin volume.

💰 Strategy avoided a massive tax hit after the IRS clarified firms don’t need to include crypto price changes when calculating the 15% corporate minimum tax.

📱 Coinbase integrated 1inch’s swap API into its app to offer faster, decentralized token trades, expanding its push into DeFi as part of its goal to become a one-stop exchange for all types of assets.

📊 CoinGecko said it was developing a new valuation method for cryptocurrencies after a proposal to burn 45% of Hyperliquid’s tokens reignited criticism over misleading supply metrics like fully diluted value, which often exaggerate project worth.

🧑💻 Tornado Cash developer Roman Storm filed a motion to dismiss his conviction for running an unlicensed money service, arguing the trial lacked proof of criminal intent and warning the verdict could threaten open-source crypto software.

👋 Ripple’s long-serving CTO David Schwartz announced plans to leave his role after over a decade shaping the XRP Ledger, though he’ll stay on as a board member and adviser as the firm faces growing pressure from new crypto payment competitors.

🌐 A UAE-backed blockchain project said it is the first to adopt ZKsync’s new Airbender zero-knowledge technology, which it plans to use to support a dirham-pegged stablecoin and large-scale digital services for governments and institutions in emerging markets before its mainnet launch later in 2025.

🏦 A $671 million new DAT called Avalanche Treasury Co. was formed to buy and hold AVAX tokens, becoming the latest crypto treasury firm aiming to go public and give investors direct exposure to blockchain assets.

The stablecoin duopoly is ending by Nic Carter

Bastille Day by Arthur Hayes

DL News: Robinhood CEO: Here’s when the tokenisation ‘freight train’ will shake up the $115tn stock market