- Unchained Daily

- Posts

- Pump.fun’s $600M ICO Becomes 3rd Biggest in History

Pump.fun’s $600M ICO Becomes 3rd Biggest in History

Plus, 📈 PUMP traders make wild options bets, 🕵️ DOJ misquotes reporter in Tornado case, 🧪 Inception shuts down, 🤑 ETH Foundation sells 10K ETH OTC.

Want to be a better crypto trader or investor?

Good Monday!

Tell us what would help you in the Unchained survey. You can enter to win a free subscription to Bits + Bips Premium (coming soon).

In today’s edition:

🚀 Pump.fun raises $600M in minutes

💸 Traders bet on PUMP options market

⚖️ DOJ wrongly attributes quote in Tornado Cash case

🧬 Inception shuts down after 2 years

🤑 Ethereum Foundation sells 10K ETH to SharpLink

Access up to $1M without selling your Bitcoin

Instant liquidity. No selling. No fees. No early penalties. Backed by your BTC.

Discover a multi-currency wallet that’s easy, quick, and secure, and now SOC 2 Type 2 compliant–one of the highest standards for data security and operational integrity, affirming our commitment to ensuring that your data is protected.

By Tikta and Steve Ehrlich

Pump.fun Becomes Third Largest ICO, Raises $600M in 12 Minutes

Solana-based memecoin launchpad Pump.fun raised $600 million in just 12 minutes during the highly anticipated public sale of its PUMP token.

The platform’s co-founder Alon Cohen confirmed the numbers to Bloomberg on July 12. The 150 billion tokens sold for $0.004 in the public sale followed the 180 billion tokens sold in a private sale earlier that week, putting the total sale amount at $1.32 billion.

“PumpFun just became the 3rd largest ICO in history,” said onchain analyst @Adam_Tehc on X, sharing a Dune dashboard documenting the details.

According to the dashboard, the average pre-sale buy size was $44,209, with 202 wallets buying more than $1 million in PUMP tokens.

Only 42.3% of the 23,959 wallets that completed KYC steps were successful buyers.

Crypto exchange Bybit said “an unexpected API delay” resulted in the offering being oversubscribed, which in turn led to a portion of users not receiving allocations.

Kraken co-CEO Arjun Seithi blamed “system constraints” for users not being able to complete orders, despite arriving at the website on time.

Both Bybit and Kraken said they would fully refund affected users.

After the sellout, Pump.fun and participating exchanges entered a 48 to 72 hour distribution phase during which PUMP tokens remain non-transferable and untradable.

PUMP Traders Make Big Options Bets on the Token Surging Past Its ICO Price

With PUMP tokens still locked following Pump.fun’s $600 million ICO, traders who missed out on the sale are rushing into the derivatives market, first with perps, and now with custom options bets reportedly totaling hundreds of millions of dollars.

According to FalconX, clients are snapping up far out-of-the-money call options, betting on serious upside once the token unlocks, a sign of just how bullish sentiment has become.

But with so much riding on price action that hasn’t even started yet, are traders getting ahead of themselves, or spotting an opportunity others missed?

The Pump.Fun ICO took over the crypto timeline and has our attention!

Join Laura’s livestream today at 3:00 PM E.T. to dive into it all with Joe McCann and Haseeb Qureshi!

Prosecutors Mistakenly Attribute Reporter’s Message to Tornado Cash Developer

A Department of Justice (DOJ) prosecutor, in the Tornado Cash case against co-creator Roman Storm, used a misattributed quote to argue that the Tornado Cash team demonstrated a "consciousness of guilt."

The controversy centers on a Telegram message, alluding to the $600 million hack of Axie Infinity’s Ronin bridge, that read: "Heya, anyone around to chat about axie? Would like to ask a few general questions about how one goes about cashing out 600 mil."

Prosecutors initially claimed this message was authored by Tornado Cash co-creator Alexey Pertsev. In reality, the message was originally written by Andrew Thurman, then a senior tech reporter at CoinDesk, and was merely forwarded by Tornado Cash developer Alexey Pertsev to a separate chat.

This evidentiary error has become a significant point of contention, with the defense arguing it undermines the reliability of the prosecution’s narrative and the integrity of the case.

“The government also makes the preposterous claim that its attribution of the reporter’s message to Pertsev was actually legally proper, claiming that by forwarding the message, Pertsev somehow adopted it,” wrote Storm’s lawyers.

“It would be like saying that, when the victim of a threat forwards to the police a message he received that says, ‘I’m going to burn your house down,’ that the victim is now saying he is going to burn the police officer’s house down.”

Liquid Restaking Platform Inception Shuts Down

Inception, a liquid restaking token platform, announced it will sunset operations despite two years of development and recent funding.

In a statement shared on X on Friday, the team attributed the decision to the lack of a “product market fit” along with a “lack of liquid rewards in shared security” that made its future unsustainable.

“We want to reassure everyone that all user assets are safe and withdrawals remain available at any time. We recommend retrieving any deposited funds at your earliest convenience,” said the team.

Inception was built as a Layer 2 protocol compatible with EigenLayer and Symbiotic, aiming to boost liquidity and yield for restaked assets by issuing liquid restaking tokens (LRTs).

The platform launched over 15 LRTs, integrated with more than 60 DeFi protocols, and underwent eight security audits.

Inception raised $3.5 million in seed funding in January from a range of prominent crypto investors.

Join the Bits + Bips crew live today at 4:30 pm E.T. to discuss Crypto Week, BTC all-time highs and ETH price action, and MORE from the latest in crypto and macro.

NYU professor and Zero Knowledge Consulting founder Austin Campbell joins in!

The Ethereum Foundation sold 10,000 ETH to SharpLink Gaming in a direct over-the-counter (OTC) deal valued at $25.7 million, with the transaction executed at an average price of $2,572.37 per ETH and settled on July 10.

“This sale funds the EF’s [Ethereum Foundation] core operations & activities, including protocol R&D, ecosystem development, community grant funding and more,” said the Ethereum Foundation on X.

SharpLink, which trades on Nasdaq under the ticker SBET, positions ETH as its primary treasury reserve asset. It is also the first publicly traded company to have acquired ETH directly from the Ethereum Foundation.

The deal was completed just before ETH surpassed $3,000 last week, meaning SharpLink acquired the ETH at a notable discount to the prevailing market price.

Onchain data shows that SharpLink acquired another $48.5 million worth of ETH on Sunday, bringing the firm’s total holdings to 270,000 ETH, with an unrealised profit of $81.8 million.

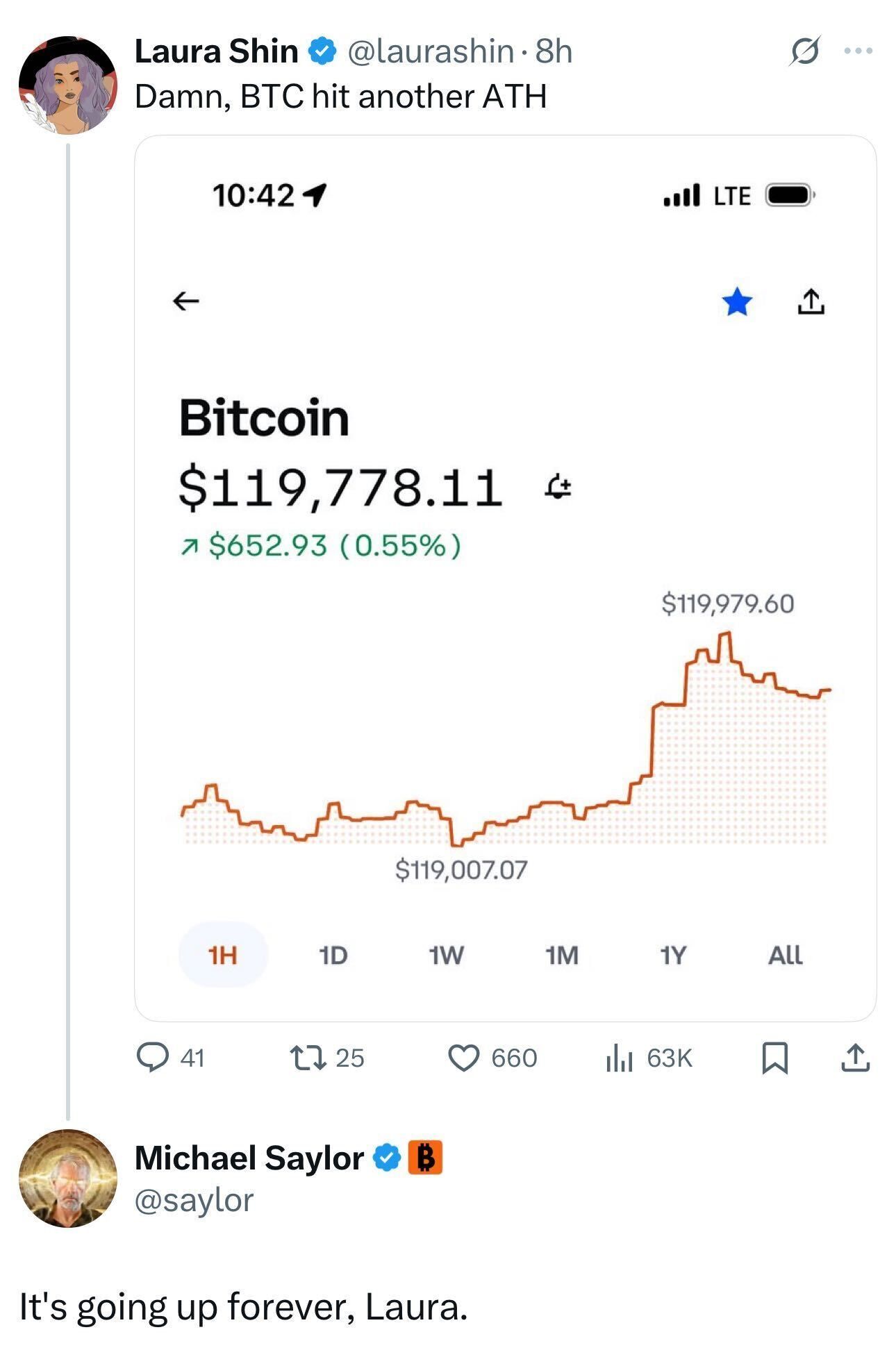

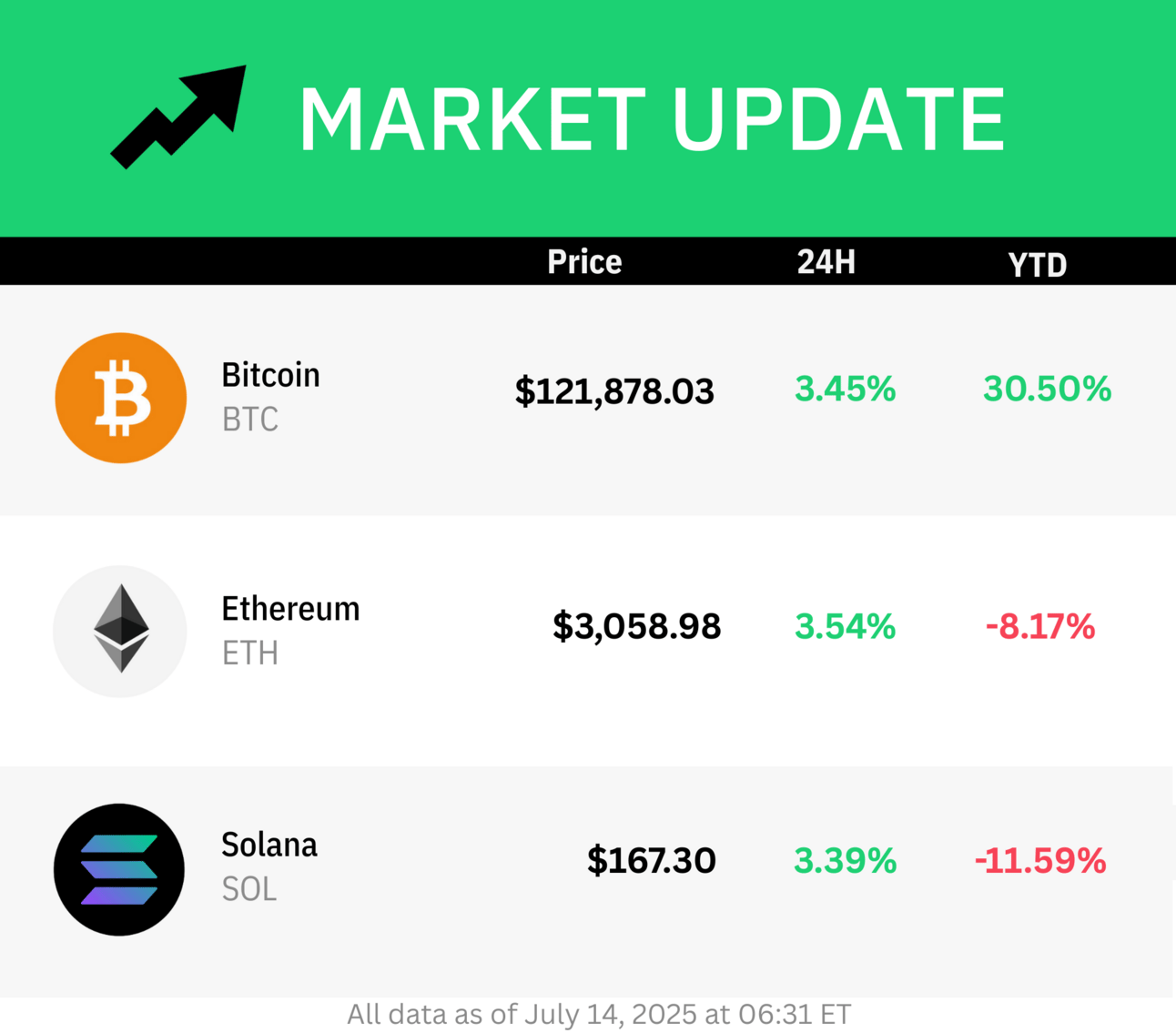

🟠📈 Bitcoin hit a new all-time high above $123,000 as investors piled into ETFs and futures ahead of U.S. congressional debates on major crypto bills during “Crypto Week.”

💬 Despite a cease-and-desist from the Trump family, Bill Zanker claimed continued collaboration and revealed a $TRUMP mobile game is on the way, as Justin Sun works to expand the token to Tron amid ongoing SEC charges.

⚖️🚫 Grayscale challenged the SEC’s sudden freeze on its approved GDLC ETF conversion, calling the unexplained delay unlawful and damaging to investors awaiting access to a large-cap crypto index fund.

🛑 Tether will permanently disable USDT on five underused blockchains—including EOS, Kusama, and Omni—by September 1, citing performance issues and shifting focus to high-volume networks like Ethereum and Tron.

📂 Coinbase sued Oregon Governor Tina Kotek, accusing the state of hiding documents about its abrupt crypto policy reversal that led to a surprise lawsuit against the exchange.

📉 Frontrunning profits on Solana have dropped sharply this year as core infrastructure upgrades reduced toxic validator visibility into pending trades, according to Anza’s Max Resnick.

🇮🇳 CoinDCX’s CEO denied allegations from WazirX that it moved user funds abroad, insisting all customer assets remain held in a fully compliant Indian entity, Neblio Technologies.

💵🚀 Crypto infra firm Zerohash is set to raise $100 million at a near-unicorn valuation, following major partnerships with Stripe and BlackRock-linked firms as demand for stablecoin rails intensifies.

The Aave Effect by Kolten

Bloomberg: Stablecoin Growth Presents New Risks for Regulators, BIS Says