- Unchained Daily

- Posts

- Pump.fun’s PUMP Token Debuts With $5.6B Valuation

Pump.fun’s PUMP Token Debuts With $5.6B Valuation

Plus, 📈 Binance adds bonding curves, 📄 Grayscale files confidential IPO docs, 💊 Biotech firm dives deep into HYPE with $888M strategy.

Hi! In today’s edition:

🚀 PUMP token launches at $5.6B FDV

📊 Binance to adopt bonding curves for token sales

📝 Grayscale files confidential IPO registration

💉 Biotech firm goes big on HYPE with $888M strategy

Access up to $1M without selling your Bitcoin

Instant liquidity. No selling. No fees. No early penalties. Backed by your BTC.

Discover a multi-currency wallet that’s easy, quick, and secure, and now SOC 2 Type 2 compliant–one of the highest standards for data security and operational integrity, affirming our commitment to ensuring that your data is protected.

By Tikta

PUMP Begins Trading With $5.6B FDV

Pump.fun’s native token PUMP officially began trading, opening at a fully diluted valuation (FDV) of $5.6 billion, after a whirlwind initial coin offering (ICO) that sold out in under 12 minutes.

Around eight hours into public trading, the token had a volume of $50.5 million on Solana, split evenly between buys and sells, as per data from DEX Screener.

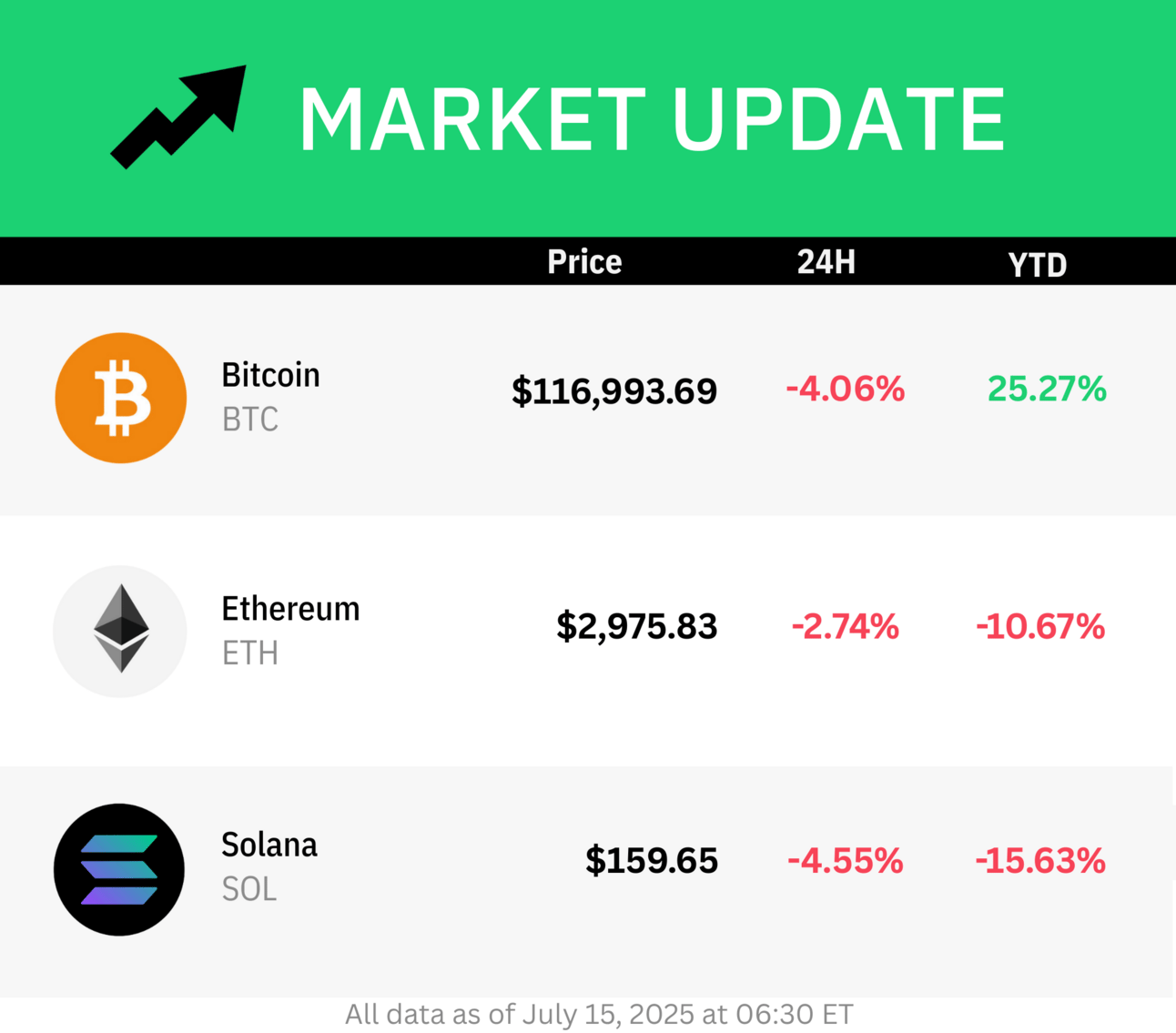

As of 6:30 am ET, PUMP was changing hands at around $0.0058, which means investors in the ICO are sitting on a ~25% profit.

On decentralized perpetual exchange Hyperliquid, the funding rate had flipped positive after opening in the red, implying that traders had started betting on a higher price after initially shorting the token.

A positive funding rate typically occurs when there is high demand for long positions, causing the futures price to trade above the spot price.

Perpetual volume for PUMP on Hyperliquid crossed $728 million, while spot trading volume for PUMP hit the $100 million mark.

“At current market cap and FDV, PUMP revenue returned to token holders (25%) is higher than HYPE, AAVE, and RAY buybacks as a % of supply,” wrote Arete Capital analyst @Daveeemor on X.

“The token also trades at the lowest multiples based on both total revenues and revenues to token holders.”

Binance Introduces Pump.fun-Style Bonding Curve Model

Binance is introducing a Pump.fun-style bonding curve mechanism for upcoming token launches, marking a major shift in how new tokens are distributed and priced on its platform.

This new model is set to debut within the Binance Wallet on July 15, through a partnership with the meme token launchpad Four.Meme.

One key feature of the new bonding curve mechanism is dynamic pricing, which means token prices will not be fixed, but rather increase with real-time demand.

Tokens bought during the token generation event will also be non-transferable until the event ends, preventing premature trading or speculation. Participants can still sell their tokens back into the bonding curve before the event ends, provided there is demand from other buyers.

The approach is inspired by the success of Pump.fun and LetsBonk on Solana, which have popularized bonding curve-based launches for memecoins and viral tokens.

Grayscale Files Confidential IPO Paperwork

Grayscale Investments has taken a major step toward a potential public market debut by confidentially submitting a draft registration statement (Form S-1) to the U.S. Securities and Exchange Commission (SEC) on Monday.

This confidential filing is a common precursor to an initial public offering (IPO) and allows Grayscale to work privately with the SEC to finalize important details – such as the number of shares to be offered and the proposed price range – without making them public during the initial review phase.

If approved, the largest crypto asset manager could become a publicly traded company by the end of 2025, joining a wave of similar moves by crypto firms, including stablecoin issuer Circle.

Grayscale currently manages around $50 billion in assets.

Sonnet BioTherapeutics Unveils $888 Million HYPE Token Treasury Strategy

Sonnet BioTherapeutics, a Nasdaq-listed biotech company, has announced a major strategic pivot into the crypto sector by forming an $888 million Hyperliquid (HYPE) token treasury.

It will be executed through a business combination with a newly formed entity Rorschach, resulting in the creation of Hyperliquid Strategies Inc. (HSI), which is set to be the largest U.S.-listed public company holding the HYPE token on its balance sheet.

HSI will hold approximately 12.6 million HYPE tokens, valued at about $583 million at the time of the agreement, along with $305 million in cash. The cash reserve is earmarked for further HYPE token purchases and operational capital.

The initiative is supported by high-profile investors, including Paradigm, Galaxy Digital and Pantera Capital.

Sonnet shares surged 200% in pre-market trading on Monday, ending the day up 86% at $9.64.

📈 Aave became the first DeFi lending protocol to surpass $50 billion in net deposits, driven by TradFi adoption, multichain growth, and increasing use of stablecoins.

📊 Despite labeling crypto as speculative, Vanguard now holds over 20 million shares in Strategy due to passive index exposure, making it the firm’s largest institutional shareholder.

🕵️♂️ UAE-based Aqua 1 denied links to scandal-hit market maker Web3Port after a journalist tied its $100 million investment in Trump-affiliated World Liberty Financial to a figure previously accused of manipulation and banned from exchanges.

🛡️ U.S. banking regulators clarified that while no new rules are being introduced, banks must adhere to existing standards when safeguarding crypto, especially regarding private key custody and anti-money laundering controls.

👜 A U.S. judge dismissed a class-action case against Dolce & Gabbana USA over its failed DGFamily NFT project, ruling the American entity wasn’t legally tied to promises made by its Italian parent.

🇰🇿 Kazakhstan is evaluating crypto as a new reserve asset class for its sovereign wealth and currency funds, citing global central bank trends and interest in Bitcoin ETFs and digital asset-linked equities.

🌐 Ondo Finance acquired blockchain developer Strangelove to strengthen its infrastructure for tokenizing real-world assets, weeks after announcing a $250 million RWA investment initiative with Pantera.

🥃 Superstate CEO Robert Leshner bought control of liquor e-commerce firm LQR House for $2 million, promising a total leadership overhaul after a 90% stock collapse and warning investors to tread carefully.

does this mean that hyperliquid is going to cure cancer

— Taiki Maeda (@TaikiMaeda2)

2:12 PM • Jul 14, 2025

Big crypto returns often mean big tax hits.

Lumida Wealth helps offset these gains and reduce taxes using direct indexing and long/short strategies.

We can offset tax liabilities and keep you positioned for more growth.

Capriole Investments: The Bitcoin Liquidity Tap

This bitcoin thesis will retire your bloodline by Udi Wertheimer

Dune Analytics on the PUMP ICO stats