- Unchained Daily

- Posts

- S&P Global Downgrades USDT to ‘Weak’

S&P Global Downgrades USDT to ‘Weak’

Plus: 📉 Grayscale seeks Zcash ETF conversion, 📊 Hyperliquid upgrade hits $500 millions volume, 🌌 Cosmos debates ATOM overhaul.

Hi! In today’s edition:

💸 S&P Global downgrades USDT’s stability rating

🔐 Grayscale files to convert its Zcash trust into a spot ETF

📊 Hyperliquid’s HIP 3 hits $500 millions in daily trading volume

🌌 Cosmos considers a major overhaul of ATOM tokenomics

🏦 How new U.S. rules may give JPMorgan an edge with deposit tokens

₿ Bitcoin rebounds above $90,000, what now?

🎧 DEX in the City dives into insider trading law in crypto

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

S&P Global Downgrades USDT Rating to ‘Weak’

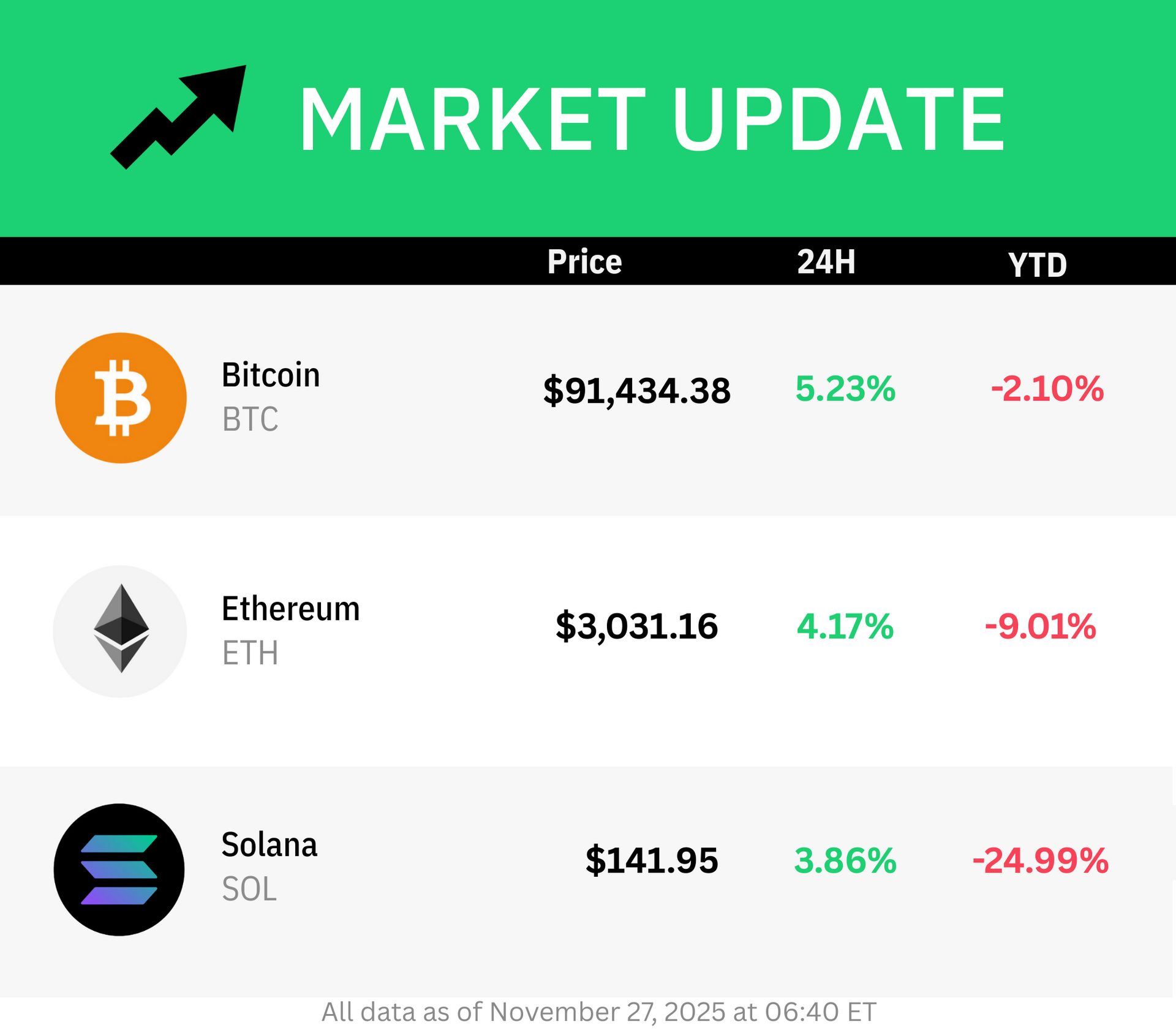

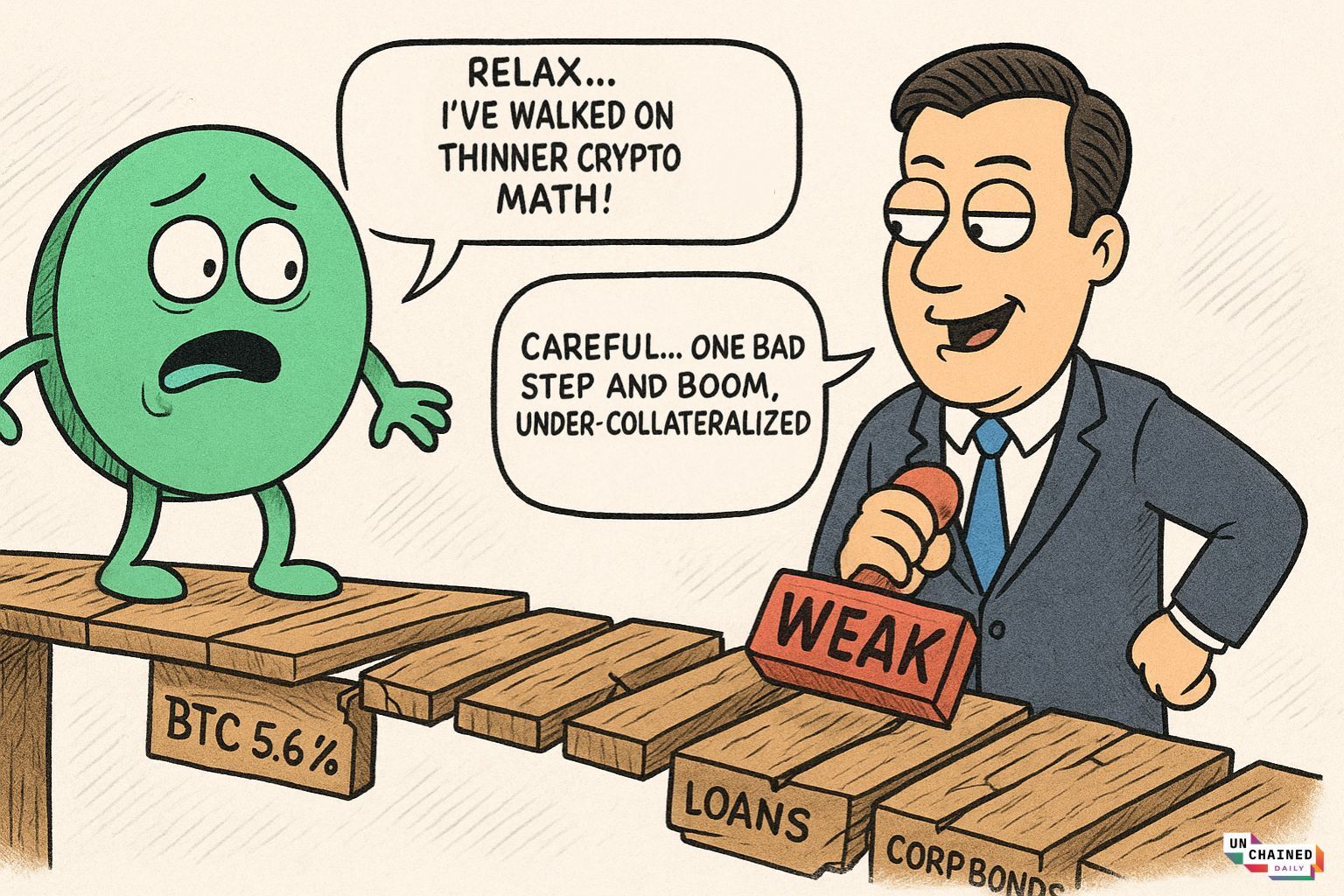

S&P Global Ratings has downgraded the stability rating of Tether's USDT stablecoin from "constrained" to the lowest rating, “weak.”

The ratings agency said the new rating reflects Tether’s increased exposure to “higher-risk assets” backing its reserves, naming bitcoin, gold, secured loans, and corporate bonds as examples.

Specifically, they claimed that bitcoin, which constitutes about 5.6% of USDT's circulating supply, exceeds the over-collateralization buffer, raising concerns that a decline in bitcoin prices could lead to under-collateralization and threaten the stablecoin's stability.

Tether CEO Paolo Ardoino responded to the agency’s latest assessment on X, saying “we wear your loathing with pride.”

“The traditional finance propaganda machine is growing worried when any company tries to defy the force of gravity of the broken financial system,” he added.

The rating report comes after research from onchain analytics firm Glassnode found that this cycle’s USDT netflow to exchanges had a “strong negative correlation with BTC’s mid-term performance.”

Grayscale Files to List Zcash ETF

Grayscale Investments has filed an S-3 registration statement with the U.S. Securities and Exchange Commission (SEC) to convert its existing Grayscale Zcash Trust into a spot exchange-traded fund (ETF) focused on ZEC.

If approved, the fund would be the first-ever regulated spot ETF for a privacy-preserving crypto, and will be listed on the NYSE Arca under the ticker symbol ZCSH.

“As privacy becomes foundational across crypto, we view ZEC as a key contributor to a well-balanced digital asset portfolio,” said Grayscale.

The move comes amid heightened interest for ZEC, which has rallied 1147% over the last three months, as privacy discussions across the crypto community intensified.

HIP-3 Records $500 Million in Daily Volume

HIP-3, an upgrade to the Hyperliquid decentralized trading platform, recorded over $500 million in trading volume within 24 hours.

Much of this activity centered around synthetic markets tied to perpetual contracts linked to major stock indices and individual stocks.

The XYZ100 synthetic market, likened to the Nasdaq 100 index, led with $320 million in volume, followed by Nvidia and Google synthetic markets, which collectively accounted for $100 million in volume.

HIP-3 lets qualified builders launch their own perpetual futures perps markets directly on Hyperliquid’s core infrastructure without needing approval from a central listing committee.

“On a long enough time horizon I think there is a chance that equity perpetual volumes could end up eclipsing crypto native volume,” said @Crypto_McKenna, Managing Partner at Arete.xyz.

Investors in Hyperliquid’s native token HYPE are also bracing for a $334 million token unlock this weekend — an event that could put significant sell pressure on HYPE.

Cosmos Considers ATOM Tokenomics Overhaul

The Cosmos community is considering a proposal to overhaul the tokenomics model for its native token ATOM, shifting towards a revenue or fee-based model aimed at long-term sustainability.

Still in its research phase, the proposal, put forward by Cosmos Labs Ecosystem Growth Lead Robo McGobo, calls for moving away from the current cyclical inflation model and instead anchoring ATOM's value on actual network usage fees.

This includes reducing token issuance over three years, gradually increasing staking rewards to favor long-term stakers, and unifying ATOM's roles as a reserve, gas, and settlement asset across the ecosystem.

“This is extremely exciting, and the most important upcoming proposal likely of the next decade for ATOM,” said Maghnus Mareneck, co-founder and co-CEO of Cosmos Labs.

How the GENIUS Act Creates a Built-In Advantage for Banks and Deposit Tokens

By Jason Brett

On Nov. 12, JPMorgan crossed a line that the rest of the banking sector has been tiptoeing around for years: it put real institutional dollars onto Base, an Ethereum Layer 2 network developed by Coinbase.

It took this step with a new type of digital asset, called a deposit token, because it is not necessarily fully-backed like more common stablecoins. The bank dubbed this asset JPM Coin (JPMD), and early transactions with clients like B2C2, Coinbase, and Mastercard show how quickly funds can now settle in tokenized form, with transfers completing in seconds instead of days.

What makes this launch particularly significant is not just that it runs on a public chain, but that JPMorgan is framing JPMD as a superior alternative to stablecoins for institutional use.

But with new rules under the GENIUS Act and fresh regulatory shifts underway, does JPMorgan now have a built-in edge that stablecoin issuers can’t match?

Bitcoin Climbs off the Mat. Can It Hold Onto $90K?

By Steven Ehrlich

After threatening to fall below $80,000 last week, bitcoin has finally started to recover. Now, the asset is priced at over $90,000.

But where does it go from here? Can it defend $90,000? The picture is a little mixed.

DEX in the City: Insider Trading and Crypto: What the Law Actually Says

The DEX in the City crew explores the complexities of insider trading law and how it applies to crypto from projects to digital asset treasury companies.

Insider trading has become a hot topic in crypto in recent months, from questionable digital asset treasury stock trades to suspiciously timed asset trades amid news-led market volatility. But do people really know what it means?

In this episode of DEX in the City, hosts Jessi Brooks of Ribbit Capital, Katherine Kirkpatrick Bos of StarkWare and Vy Le of Veda explore the complexities of insider trading law and how blockchain technology can make it easier to detect.

They also delve into how AI agents impact market dynamics, the problem with regulators not being able to hold crypto and how insider trading law would differ from centralized to decentralized platforms. Plus Katherine talks about the future of front-running and Vy explains how DATs should approach insider trading policy.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🧿🚫 Thailand’s privacy regulator ordered Sam Altman’s World digital-ID project to delete over 1.2 million locally collected iris scans and halt all operations, after experts ruled that swapping biometric data for crypto violated the country’s data-protection rules.

⛓️ Vitalik Buterin said Ethereum is likely to shift next year from broad “scale everything” upgrades to more targeted tuning by raising the gas limit fivefold while also making costly on-chain actions five times more expensive, aiming to boost overall throughput without overwhelming node operators.

Vitalik also argued that encrypted messaging is essential for safeguarding digital privacy, praising apps like Session and SimpleX for enabling anonymous accounts and metadata protection while donating 128 ETH to each team to encourage more work on privacy-preserving communication tools.

⛽ Meanwhile, Ethereum’s gas limit quietly rose from 45 million to 60 million on Nov. 25 after validators crossed the 50% approval threshold, with developers saying they can now safely push more aggressive base-layer scaling thanks to stricter block-size protections, faster clients, and stable testnet performance.

🛑 Upbit reported an abnormal $38.5 million outflow on the Solana network and froze withdrawals for affected tokens, a move that triggered sudden price premiums on Solana-linked assets in Korea as traders scrambled for liquidity during the disruption.

❓ Crypto firm Alt5 Sigma abruptly split with its acting CEO and COO after previously agreeing to buy $1.5 billion worth of WLFI tokens from a Trump-linked project where a Trump family entity would receive most token-sale proceeds, deepening questions around the company’s governance.

📊 Nasdaq requested permission to quadruple the daily trading limit for options on BlackRock’s Bitcoin ETF, IBIT, arguing that demand has grown so sharply that traders now need room for larger hedging and more complex strategies built around the $70 billion fund.

🌍 Securitize secured full EU regulatory approval to run a cross-border trading system for tokenized securities and plans to debut a new issuance platform on Avalanche next year, giving it the rare status of being licensed for this activity in both the U.S. and Europe.

🤖 Tech giant Naver and Upbit owner Dunamu committed about $6.8 billion over five years to build new financial infrastructure using AI and blockchain, with plans that include launching a Korean-won-pegged stablecoin.

🧩 DWF Labs launched a $75 million fund aimed at backing DeFi builders tackling deeper liquidity and risk-management problems rather than copy-paste products, marking another expansion for the controversial market-maker-turned-investor that already holds stakes in more than 1,000 crypto projects.