- Unchained Daily

- Posts

- Tether CEO Pushes Back After Arthur Hayes Warns Of USDT Insolvency Risk

Tether CEO Pushes Back After Arthur Hayes Warns Of USDT Insolvency Risk

⚡ Sunday flash crash triggers $470 million liquidations, 🧪 Yearn yETH pool drained, 📉 CoinShares pulls ETF filings, 🚫 Terminal Finance cancels launch.

Hi! In today’s edition:

🔗 Tether counters Arthur Hayes’ USDT insolvency scenario

⚡ Crypto flash crash liquidates $470 million in positions

🧪 Yearn’s yETH pool drained in targeted exploit

📉 CoinShares withdraws multiple ETF filings

🚫 Terminal Finance cancels launch after Converge stalls

Today’s newsletter is brought to you by Uniswap!

Add onchain trading to your product without the hassle. The Uniswap Trading API provides simple, plug-and-play access to deep liquidity - powered by the same protocol that’s processed over $3.3 trillion in volume with zero hacks.

Get enterprise-grade execution that combines onchain and offchain liquidity sources for optimal pricing. No need for complex integrations, ongoing maintenance, or deep crypto expertise - just seamless, scalable access to one of the most trusted decentralized trading infrastructures.

More liquidity. Less complexity.

By Tikta

Tether CEO Dismisses FUD as Arthur Hayes Lays Out Scenario for USDT Insolvency

A new round of debate has broken out over the past few days about whether Tether, the issuer of USDT, is solvent, after BitMEX co-founder and Maelstrom Fund CIO Arthur Hayes published a post outlining how USDT could become insolvent.

His argument centered on Tether’s growing exposure to gold and bitcoin, which he described as an interest rate bet that could turn against the company if markets shift. “The Tether folks are in the early innings of running a massive interest rate trade,” he said, adding that a decline of about 30% in those positions “would wipe out their equity, and then USDT would be in theory insolvent.”

Tether CEO Paolo Ardoino quickly pushed back on X, rejecting what he called recycled “Tether FUD” and pointing to the company’s reported excess equity. “Some influencers are either bad at math or have the incentive to push our competitors,” said Ardoino.

But according to Joseph Ayoub, former head of crypto research at Citi, Hayes’ read leaves out important context. He noted that Tether’s disclosed reserves match stablecoin liabilities but exclude a separate equity balance sheet with investments such as mining operations and extra bitcoin. Ayoub also cited the roughly $10 billion in annual profits Tether generates and said the firm maintains strong liquidity despite being over-collateralized. In his view, “Tether isn’t going insolvent, quite the opposite; they own a money printing machine.”

Sunday Flash Crash Triggers $470 Million Crypto Liquidations in Four Hours

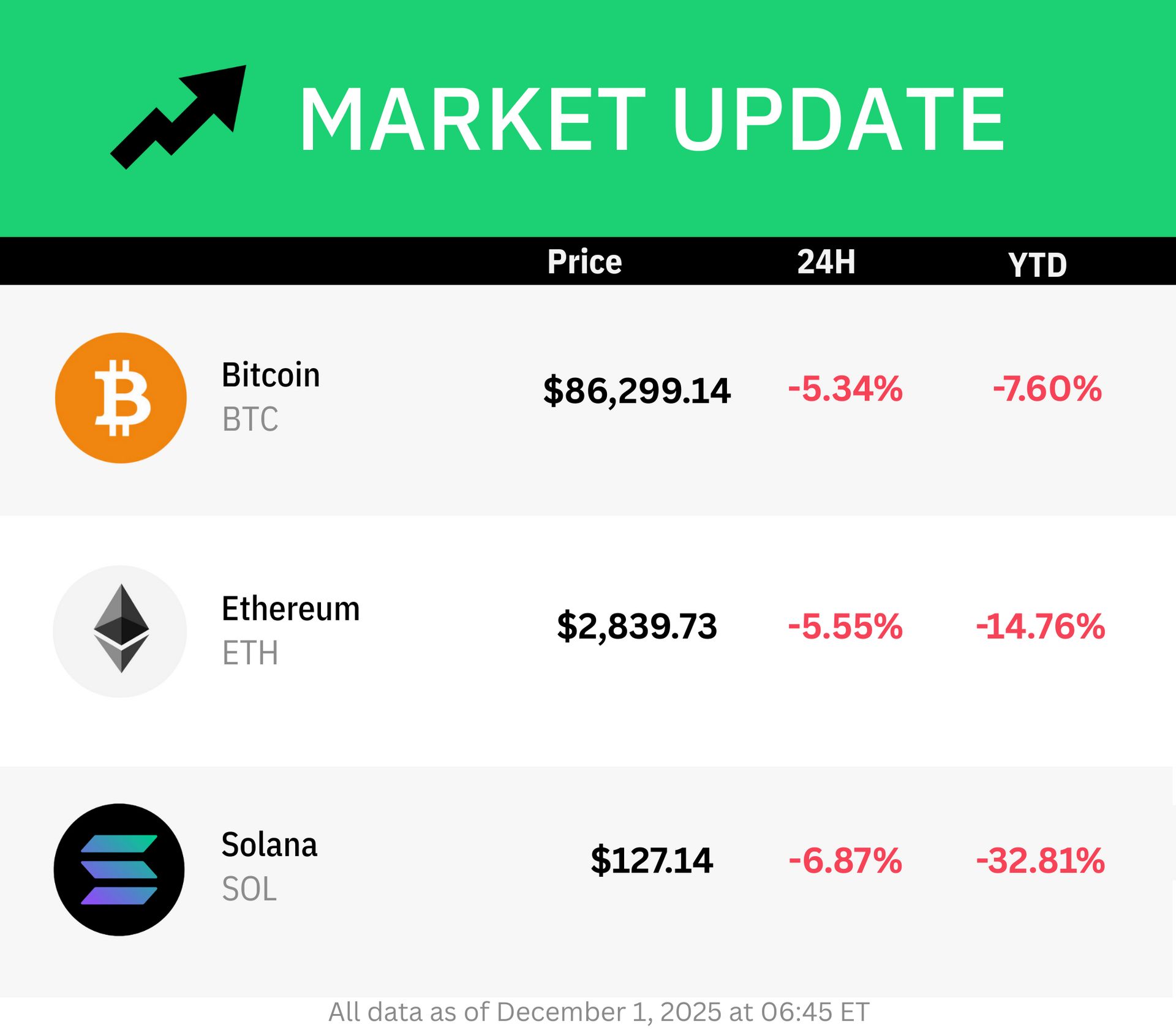

Bitcoin saw a dramatic 5% drop late Sunday evening, plunging below the $87,000 mark and setting off a cascade of liquidations.

Data from CoinGlass shows that $470 million was liquidated across crypto exchanges over a four-hour period as of 10 pm ET, with levered long positions accounting for $470 million in liquidations.

The single largest liquidation order took place on Binance on an ETH/USDC pair valued at $14.48 million.

Notably, there was no major news event driving Sunday’s crypto selloff, which saw the total market capitalization of crypto assets fall below the $3 trillion mark.

“Downside liquidity swiped first, which is what we want to happen,” commented one industry watcher @Skyodelic on X.

“It would've been a lot more worrying had we pushed hard on Sunday, taken the short liqs first, then headed for longs after.”

Today at 4:30pm ET: the 1st Bits + Bips episode of the last month of 2025! 🥹

Austin Campbell, Ram Ahluwalia, and Chris Perkins are joined by OG Bits + Bips host Alex Kruger to discuss the biggest news in crypto x macro LIVE, including Black Friday sales, the state of the U.S. consumer, Fed rate cut possibilities, and more.

$3 Million Drained From Yearn Finance’s yETH LST Stableswap Pool

Yearn Finance’s yETH LST stableswap pool on Curve suffered an exploit on Sunday evening, in a targeted attack that created an essentially unlimited supply of yETH, emptying the pool in one transaction.

Blockchain data shows that the attacker sent over $3 million worth of ETH to crypto mixer Tornado Cash in batches of 100 ETH each.

While the overall scale of financial damage is still unclear, yETH appears to have collapsed to near zero due to dilution.

“We are investigating an incident involving the yETH LST stableswap pool. Yearn Vaults (both V2 and V3) are not affected,” wrote the Yearn Finance team on X.

Yearn Finance's yETH is a protocol that aggregates liquid staking tokens (LSTs) like stETH into a diversified pool, enabling users to mint yETH by depositing LSTs or swapping via a Curve yETH/ETH pool.

According to analysis from D2 Finance, the attacker used a flash loan to manipulate the vault's update rates logic, skewing the internal exchange rate and tricking the protocol into minting an infinite amount of shares against a small deposit.

“The Root Cause: Reliance on dynamic, state-dependent exchange logic for share issuance,” said D2 Finance.

CoinShares has withdrawn its U.S. spot exchange-traded fund (ETF) registration filings for XRP, Solana staking, and Litecoin.

CoinShares CEO Jean-Marie Mognetti cited a strategic shift away from single-asset crypto ETFs in a crowded and competitive U.S. market dominated by large traditional financial firms.

Instead, CoinShares plans to focus on crypto equities, thematic baskets, and multi-asset active strategies.

Other issuers such as Grayscale, Bitwise, and Canary Capital have successfully launched XRP and Solana-related ETFs in the U.S., contributing to the increasing competition in the crypto ETF market.

CoinShares’ withdrawals come as the firm prepares for a $1.2 billion merger to go public on Nasdaq.

Terminal Finance Cancels Launch After Converge Mainnet Stalls

The Ethena-incubated decentralized exchange (DEX) Terminal Finance has abandoned its launch after Converge — its planned deployment destination — never went live.

“This left us with deposits and a fully built protocol, but without the ecosystem it was designed for,” said the Terminal Finance team in an X post, announcing the decision to cancel the launch.

“Launching a project just to launch a project goes against our principles. Preserving integrity is paramount.”

Terminal Finance’s pre-deposit “Root Access” campaign attracted $280 million in deposits from over 10,000 wallets, with early deposits flowing in as early as June.

The team noted that existing holders of Pendle positions tied to Terminal Finance will continue receiving their entitled yield-like rewards, and that all participants in the pre-deposit campaign can withdraw their funds at full value.

Bring onchain trading to your app with the Uniswap Trading API. Access global liquidity, simplify integration, and power swaps at scale - all from one reliable API.

🧾 The U.K. will require crypto exchanges to log every detail of residents’ transactions starting January 2026 so tax authorities can match that data against filings, marking a major shift toward strict transparency under global reporting standards.

⚡ Tether decided to shut down its Bitcoin-mining site in Uruguay and lay off most of its staff there after soaring energy costs and a past dispute over unpaid power bills made the operation too expensive to maintain.

🚫🇨🇳 China’s central bank reiterated that all crypto activity remains illegal and singled out stablecoins as a threat to financial security, warning they fail basic identity and anti-money-laundering standards and fuel underground money flows.

📈 BlackRock revealed that its Bitcoin ETFs—led by the U.S. product IBIT—have unexpectedly become its biggest revenue engine, pulling in billions of dollars and even capturing over 3% of all Bitcoin as assets surged toward the $100 billion mark.

🇧🇷 São Paulo is rolling out a blockchain-based microloan program for small farmers using fintech firm Tanssi’s custom infrastructure, offering fast loans of up to $2,800 through a dedicated appchain that avoids the unpredictability of public blockchains.

🎮 Sony Bank plans to roll out a U.S. dollar-backed stablecoin by fiscal 2026 through a new American unit built with partner Bastion, aiming to let U.S. gamers and anime fans pay for Sony content more cheaply and efficiently as the company deepens its push into blockchain infrastructure.

📈 Hong Kong’s HashKey, which runs the city’s largest licensed crypto exchange, is closer to going public after passing its stock-exchange listing hearing, setting the stage for a potential $500 million IPO aimed at funding tech upgrades and expansion despite the firm still operating at sizable losses.

In Defense of Exponentials by Dragonfly’s Haseeb Qureshi

The Ethereum X account on Fusaka