- Unchained Daily

- Posts

- USDT Powers Through Market Turmoil With Record Expansion

USDT Powers Through Market Turmoil With Record Expansion

Plus: 🏦 Crypto bill regains momentum as lawmakers weigh stablecoin compromises.

Hi! In today’s edition:

🟢 Tether posts record USDT growth despite market volatility

🏦 Crypto bill shows signs of life as stablecoin talks resume

Today’s newsletter is brought to you by YO (Yield Optimizer)!

Remember when DeFi meant 15 browser tabs, three stressful bridges, and checking Discord every hour to make sure you weren't getting rugged?

YO (Yield Optimizer) just retired that struggle.

Think of it as the "Easy Mode" button for DeFi. Whether you hold BTC, ETH, USD, EUR, or even GOLD, YO automatically routes your assets into the best risk-adjusted strategies across all chains.

It’s not just an aggregator; it’s an engine that continuously rebalances your portfolio using Exponential’s Risk Ratings (so you don't have to do the due diligence math).

100+ Integrations: Unmatched diversification.

Zero Bridging Stress: Cross-chain yield in one click.

Total Transparency: See exactly where the yield comes from.

Stop farming. Start optimizing.

YO just launched $YO Rewards, where you earn base yield plus additional $YO rewards. For the first campaign, you’ll earn a 14% reward rate on any yoVault!

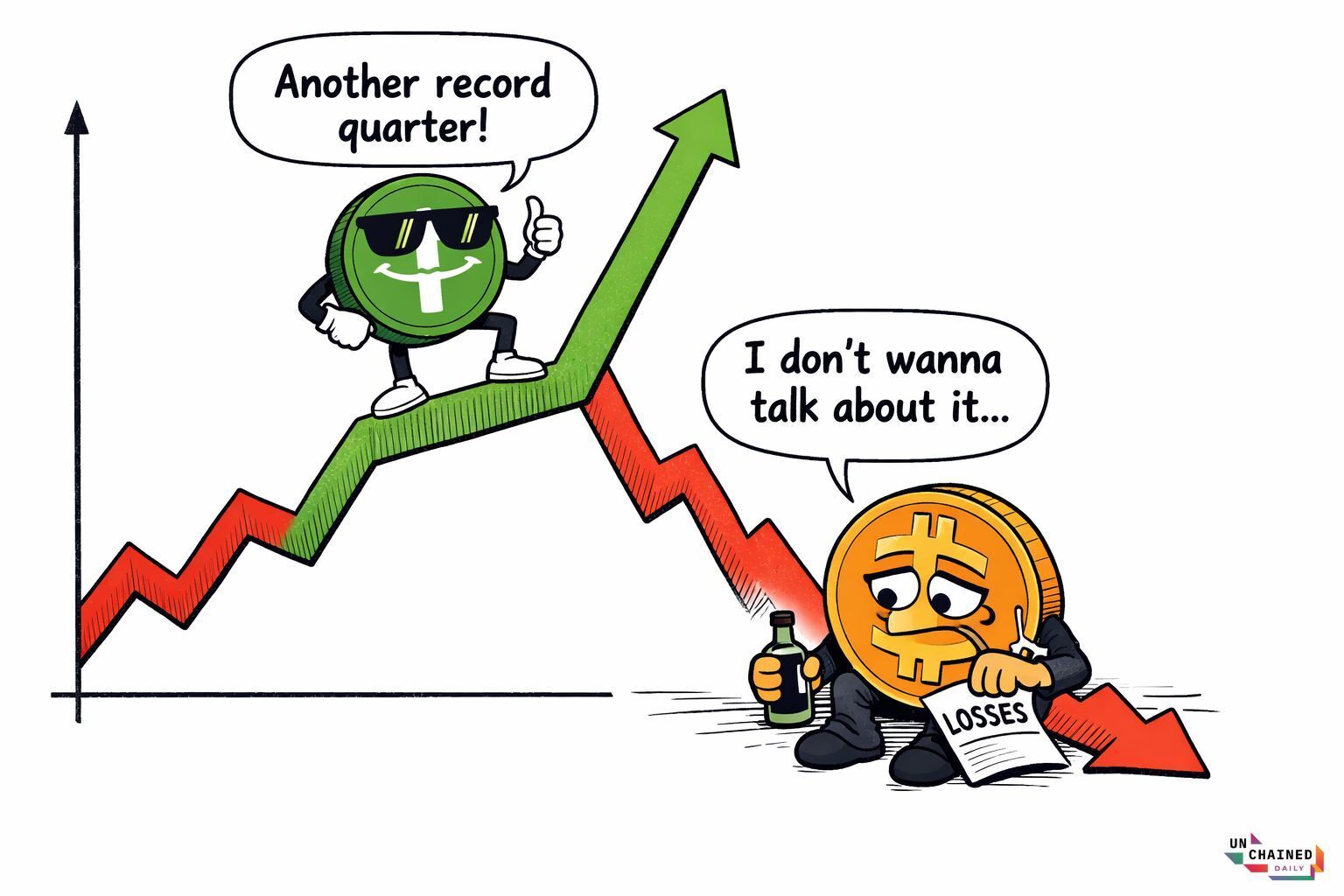

Tether Defies Market Slump With Record USDT Growth in Q4

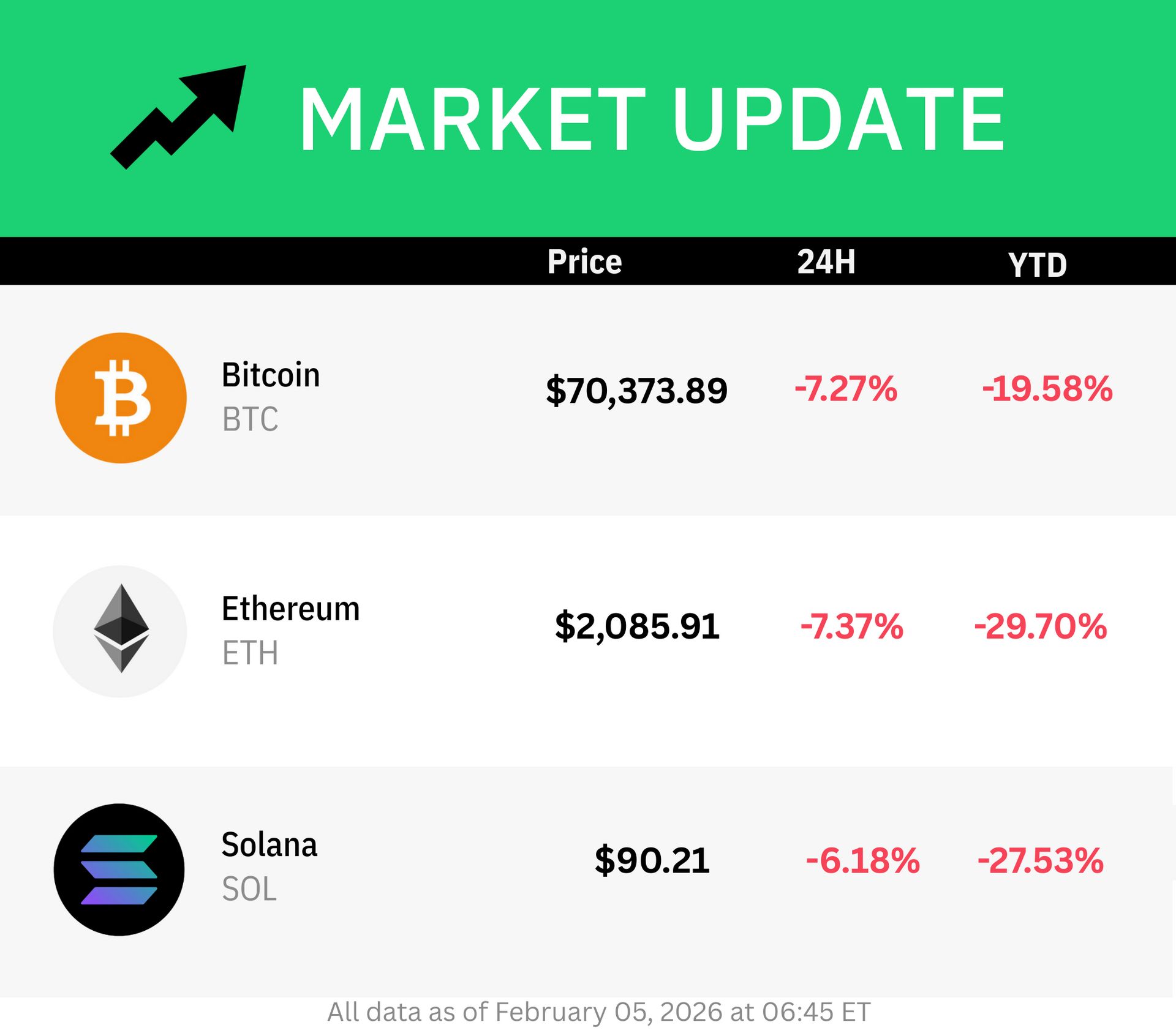

Tether reported record growth across nearly every USDT metric in the fourth quarter of 2025, even as crypto markets reeled from October’s liquidation cascade.

According to the company’s latest quarterly report, USDT’s market capitalization rose by $12.4 billion during the quarter to a new high of $187.3 billion, extending its lead over rival stablecoins that saw flat or sharply negative growth.

User adoption continued to accelerate. Tether estimated it added 35.2 million new users in Q4, bringing total global users to 534.5 million, the eighth straight quarter with more than 30 million new users. Onchain holders climbed by a record 14.7 million to 139.1 million, with USDT wallets now representing 70.7% of all stablecoin wallets. Monthly active onchain users also hit an all-time high of 24.8 million.

On the balance sheet, Tether’s total reserves grew $11.7 billion to $192.9 billion, including $141.6 billion in U.S. Treasuries, 96,184 BTC, and 127.5 metric tons of gold.

Tether said the data shows USDT is increasingly used not just for trading, but as a store of value and payment rail, even during periods of market stress.

However, Tether is reportedly scaling back discussions for a massive $15–$20 billion fundraising after investors balked at a valuation near $500 billion, with advisers now considering a much smaller raise despite the stablecoin issuer generating billions in annual profits from assets backing USDT.

Crypto Bill Shows Signs of Life as Industry Floats Stablecoin Compromises

After weeks of stalled negotiations, the push to pass a sweeping U.S. crypto market structure bill may not be dead after all. According to reporting from journalist Eleanor Terrett, Democratic staffers described a recent meeting as “positive” and “arguably the most productive Democratic meeting to date.”

Senate Majority Leader Chuck Schumer attended, stressing the importance of continued engagement with the industry and urging lawmakers to keep momentum alive. The effort, which many thought was on life support just weeks ago, is now seen as very much back in play.

Behind the scenes, crypto firms are also adjusting their strategy. Bloomberg reported that companies are floating new compromises aimed at breaking the Senate deadlock, particularly around stablecoins.

Proposals include giving community banks a larger role by allowing them to hold stablecoin reserves or issue tokens through partnerships. The goal is to ease concerns that stablecoin rewards could pull deposits away from traditional banks, a key sticking point for critics of platforms like Coinbase.

While no agreement has been reached, both sides remain at the table, and lawmakers say talks are ongoing.

Worried about your crypto taxes?

If you want expert help with crypto taxes — without guessing or DIY spreadsheets — Crypto Tax Girl is offering $100 off their crypto tax services for Unchained readers.

They provide personalized support for everything from complex transactions to full tax returns.

🔍 U.S. House investigators are probing World Liberty Financial, the Trump-linked crypto startup, over a reported secret $500 million UAE-backed stake and the use of its USD1 stablecoin in a $2 billion Binance deal, demanding detailed ownership, payment, and governance records amid concerns over conflicts of interest and foreign influence.

📧 Newly released U.S. Justice Department emails revealed that convicted sex offender Jeffrey Epstein had a far deeper personal and professional relationship with Bitcoin entrepreneur and Tether co-founder Brock Pierce than previously known, including years of correspondence, shared social networks, and involvement in Pierce’s romantic life after Epstein’s 2008 conviction.

📊 The U.S. derivatives regulator scrapped a Biden-era effort to restrict political prediction markets, with new leadership reopening rulemaking to support platforms like Kalshi and Polymarket under a more permissive interpretation aimed at encouraging financial innovation.

🏛️ CME Group revealed it is exploring the creation of a proprietary “CME Coin” that could run on a decentralized network, part of the world’s largest derivatives exchange’s broader push into tokenized cash and blockchain-based collateral with support from Google.

🚪 Kyle Samani stepped down as managing director of crypto investment firm Multicoin Capital after nearly a decade, choosing to explore other areas of technology while remaining personally invested in crypto and optimistic that new U.S. laws could drive major adoption.

💵 Fidelity launched its dollar-backed stablecoin FIDD for both retail and institutional clients, allowing users to mint and redeem tokens directly with Fidelity on Ethereum as clearer U.S. regulations encouraged traditional asset managers to issue onchain money.

🌐 Japanese tech firm Startale and financial giant SBI Holdings launched Strium, a new blockchain built for banks and institutions to trade currencies, synthetic stocks, and tokenized real-world assets, starting with derivative-style products before moving to fully regulated onchain equities.

💶 BBVA, Spain’s second-largest bank, joined Qivalis — a consortium of major European lenders — to help launch a regulated euro-pegged stablecoin aimed at reducing reliance on U.S. dollar tokens that dominate the global stablecoin market.

🕵️♂️💹 TRM Labs, a blockchain analytics company that helps governments and financial institutions track crypto crime, reached a $1 billion valuation after raising $70 million in a Series C led by Blockchain Capital to expand its tools as AI-driven fraud and illicit crypto activity accelerate.