- Unchained Daily

- Posts

- Weekend Crypto Rout Exposes How Thin the Market Has Become

Weekend Crypto Rout Exposes How Thin the Market Has Become

Plus: 🧨 $2.5 billions liquidated in a brutal washout, 🧵 Industry veterans clash over what really caused the October 10 crash.

Hi! In today’s edition:

🧨 A brutal weekend reminded traders how fast leverage cuts both ways

🧵 Crypto Twitter reopens the October 10 wound and the takes are flying

Today’s newsletter is brought to you by YO (Yield Optimizer)!

Remember when DeFi meant 15 browser tabs, three stressful bridges, and checking Discord every hour to make sure you weren't getting rugged?

YO (Yield Optimizer) just retired that struggle.

Think of it as the "Easy Mode" button for DeFi. Whether you hold BTC, ETH, USD, EUR, or even GOLD, YO automatically routes your assets into the best risk-adjusted strategies across all chains.

It’s not just an aggregator; it’s an engine that continuously rebalances your portfolio using Exponential’s Risk Ratings (so you don't have to do the due diligence math).

100+ Integrations: Unmatched diversification.

Zero Bridging Stress: Cross-chain yield in one click.

Total Transparency: See exactly where the yield comes from.

Stop farming. Start optimizing.

Crypto’s Weekend Washout Tests Conviction After a Brutal Week

After a bruising week for markets, the weekend delivered a full-blown crypto washout.

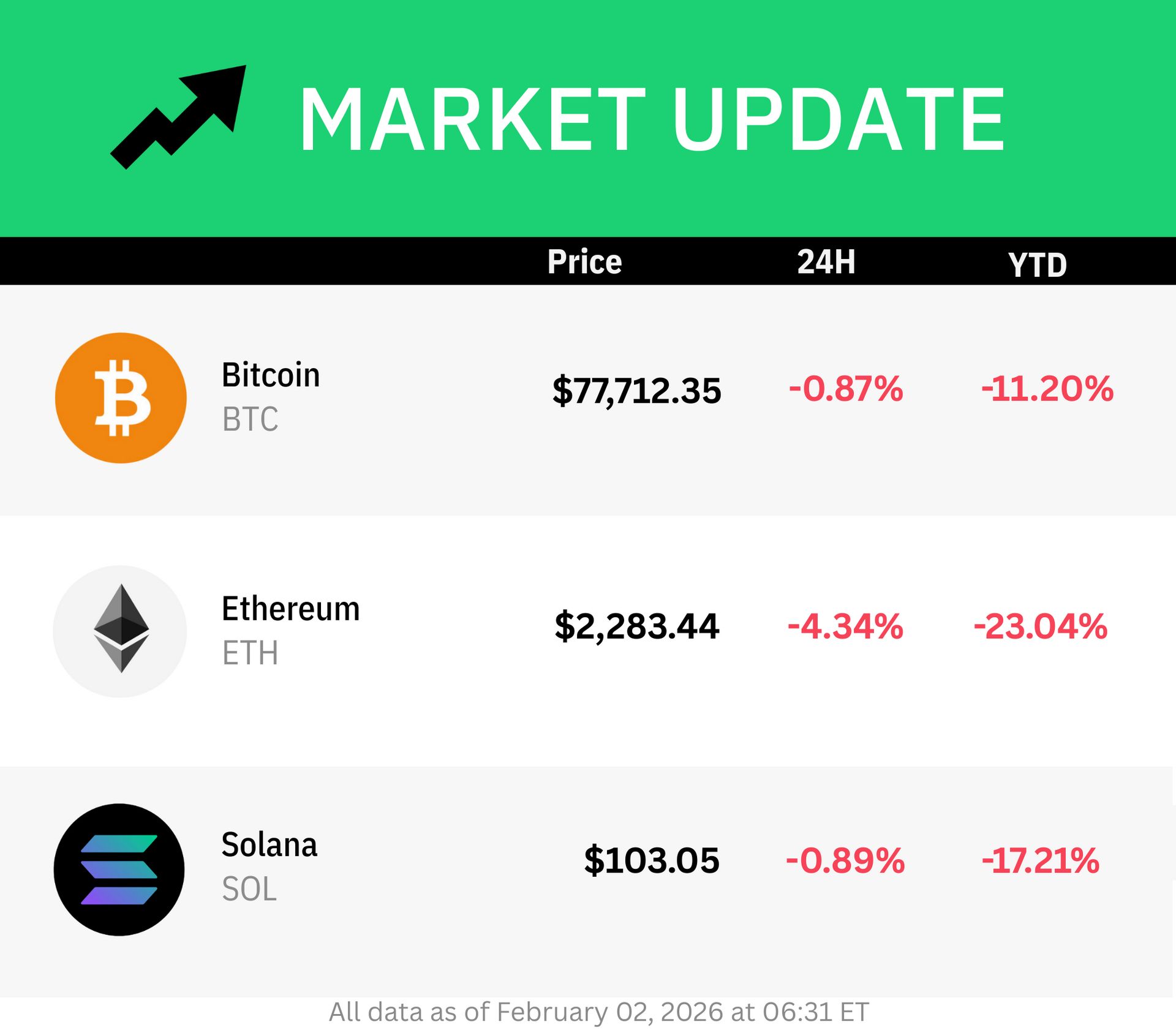

Bitcoin slid relentlessly through thin weekend liquidity, briefly dipping into the low $74,000s before clawing its way back toward $76,000. Ether saw even heavier damage, falling below $2,200 at one point, while most large-cap altcoins followed lower.

With traditional markets closed and institutional desks sidelined, shallow order books amplified every move, turning sell pressure into sharp air pockets.

The liquidation tally tells the story. More than $2.5 billion in leveraged long positions were wiped out as clustered stops triggered one after another. QCP Capital noted that the break below $80,000 reignited deleveraging at a time when sentiment was already fragile from persistent ETF outflows and tighter financial conditions.

One psychological level didn’t hold. Bitcoin’s drop pushed it below the average cost basis of Michael Saylor’s Strategy, which sits near $76,000. For the first time in years, that widely watched line flipped from perceived support into resistance.

While Strategy faces no margin calls and isn’t forced to sell, the breach highlights how much thinner the buffer has become as its equity premium evaporates.

“Price action remains fragile. Momentum continues to point lower and upside remains constrained near recent resistance levels, leaving markets exposed to further liquidation-driven moves. In this context, selectively managing downside risk remains prudent,” QCP wrote.

Weekend Drama Rekindles Debate Over What Really Caused the October 10 Crash

Crypto Twitter lit up this weekend as old wounds reopened over what actually caused the October 10 liquidation cascade, one of the most violent crashes the market has ever seen.

The spark came from OKX CEO Star Xu, who argued that the crash stemmed from Binance’s handling of USDe, a yield-bearing token issued by Ethena. Xu said a high-APY campaign, combined with allowing USDe to be used as collateral like USDT or USDC, encouraged leverage loops that quietly built systemic risk. When volatility hit, he argued, USDe briefly lost its peg on Binance, setting off cascading liquidations that rippled across the market.

That framing was quickly challenged. Dragonfly’s managing partner Haseeb Qureshi pushed back hard, calling the Binance-centric explanation misleading. His core point: the timeline doesn’t fit. Bitcoin had already sold off and liquidations were underway well before USDe showed stress on Binance.

Just as importantly, USDe only diverged on one venue. A truly systemic trigger, Qureshi argued, would have shown up everywhere, as seen in events like Terra or FTX.

Adding weight to that view, Wintermute CEO Evgeny Gaevoy also rejected the idea that Binance was the root cause. He described October 10 as a macro-driven flash crash in an extremely leveraged market, made worse by thin liquidity, API outages, and liquidation engines that prioritize solvency over stability.

🏛️ An Abu Dhabi investment vehicle tied to UAE national security adviser Sheikh Tahnoon quietly bought nearly half of Trump-linked World Liberty Financial for $500 million days before the 2025 inauguration, a previously undisclosed deal that reshaped ownership and deepened scrutiny of foreign influence and crypto ties.

⚠️ Tron founder Justin Sun faces fresh market-manipulation allegations after a woman claiming to be his former partner accused him of coordinating trades through multiple Binance accounts to inflate TRX prices in 2017–2018, saying she holds messages and internal records she is willing to share with U.S. regulators.

📊 Tether generated more than $10 billion in net profit in 2025 as its USDT supply climbed past $186 billion, with most reserves parked in U.S. Treasuries and excess backing topping $6.3 billion, underscoring how the stablecoin issuer has become one of the world’s most profitable private firms.

🚨 Step Finance, a Solana-based portfolio tracking and DeFi analytics platform, are investigating a breach that drained roughly $29 million worth of SOL from its treasury wallets, triggering a sharp selloff in its token while leaving unanswered whether any user funds were affected.

🧩 Lido rolled out its stVaults feature on Ethereum’s main network, turning the liquid staking giant into a modular infrastructure provider by letting institutions, data firms, and layer-2 networks like Linea create customized staking setups while still tapping into stETH liquidity.

⚠️ CrossCurve, a cross-chain trading and liquidity protocol backed by Curve Finance’s founder, was hit by a roughly $3 million exploit after attackers spoofed cross-chain messages to unlock funds, exposing flaws in a bridge design meant to prevent exactly that kind of failure.

🟠 Justin Sun plans to add $50–$100 million worth of bitcoin to Tron’s blockchain holdings, contrasting with many crypto treasury firms that bought near peaks last year and now sit on deep losses, while Binance separately allocated $1 billion in bitcoin to its user protection fund.

🌊 Polymarket expanded onto Solana through an integration with Jupiter, a popular onchain trading app that aggregates exchanges, allowing users to trade event-based prediction contracts directly inside Jupiter as prediction markets push toward more mainstream crypto audiences.