- Unchained Daily

- Posts

- Wintermute Warns: Crypto Liquidity Is Eating Itself

Wintermute Warns: Crypto Liquidity Is Eating Itself

Plus: 💸 Cathie Wood cuts BTC forecast by $300K, 📉 ETFs see $2B outflows, 🪙 Circle pushes equal rules for stablecoins.

Hi! In today’s edition:

🧊 Wintermute warns crypto liquidity is recycling, not growing

💰 Cathie Wood trims Bitcoin forecast by $300K as stablecoins rise

📉 Bitcoin ETFs bleed $2B in their second-worst outflow streak

🪙 Circle pushes for equal stablecoin rules under the GENIUS Act

By Ayesha Aziz

Wintermute Warns Crypto Markets Stuck in Liquidity Loop

Market maker Wintermute stated that the crypto market's current cycle is driven by recycled liquidity as inflows from three primary funding sources have slowed. The firm identified stablecoins, exchange-traded funds and digital asset treasuries as major liquidity conduits that have all reached a plateau.

Data shows that ETF and digital asset treasury assets rose from $40 billion to $270 billion since 2024, while stablecoin issuance doubled to approximately $290 billion. However, momentum has faded, leaving the market in a self-funded phase where capital moves between cryptocurrencies without fresh inflows entering the ecosystem.

Wintermute noted that aggregate money supply remained supportive and central banks started easing after two years of tightening. The firm pointed to high short-term rates and elevated Secured Overnight Financing Rate leading investors to park cash in US Treasury bills rather than crypto assets.

This creates a player-versus-player market where rallies are short-lived and volatility is driven by liquidation cascades instead of sustained buying pressure. Wintermute suggested that revival in stablecoin minting, new ETFs or increased digital asset treasury issuance could trigger the next liquidity wave.

Bitcoin Forecast Cut $300,000 by Cathie Wood as Stablecoins Steal Demand

ARK Invest CEO Cathie Wood reduced her long-term bitcoin price projection by $300,000, citing stablecoins as a competing force in emerging markets. Wood told CNBC on Thursday that stablecoins are scaling faster than anticipated and fulfilling roles previously expected for Bitcoin.

Wood initially forecasted bitcoin reaching $1.5 million by 2030, though ARK later raised this to $2.4 million in April. The firm now adjusts downward specifically due to stablecoin adoption. She maintains that bitcoin remains "digital gold" within a global monetary system, distinct from stablecoins representing tokenized cash on blockchain networks.

Standard Chartered projects dollar-pegged stablecoins could extract over $1 trillion from legacy banking systems in emerging markets by 2028. Venezuela exemplifies this trend, where 269% annual inflation drove millions toward Tether's USDT as a savings vehicle.

The combined supply of USDT and USDC has reached nearly $260 billion. Wood emphasized institutions are just beginning their bitcoin participation despite her adjusted forecast.

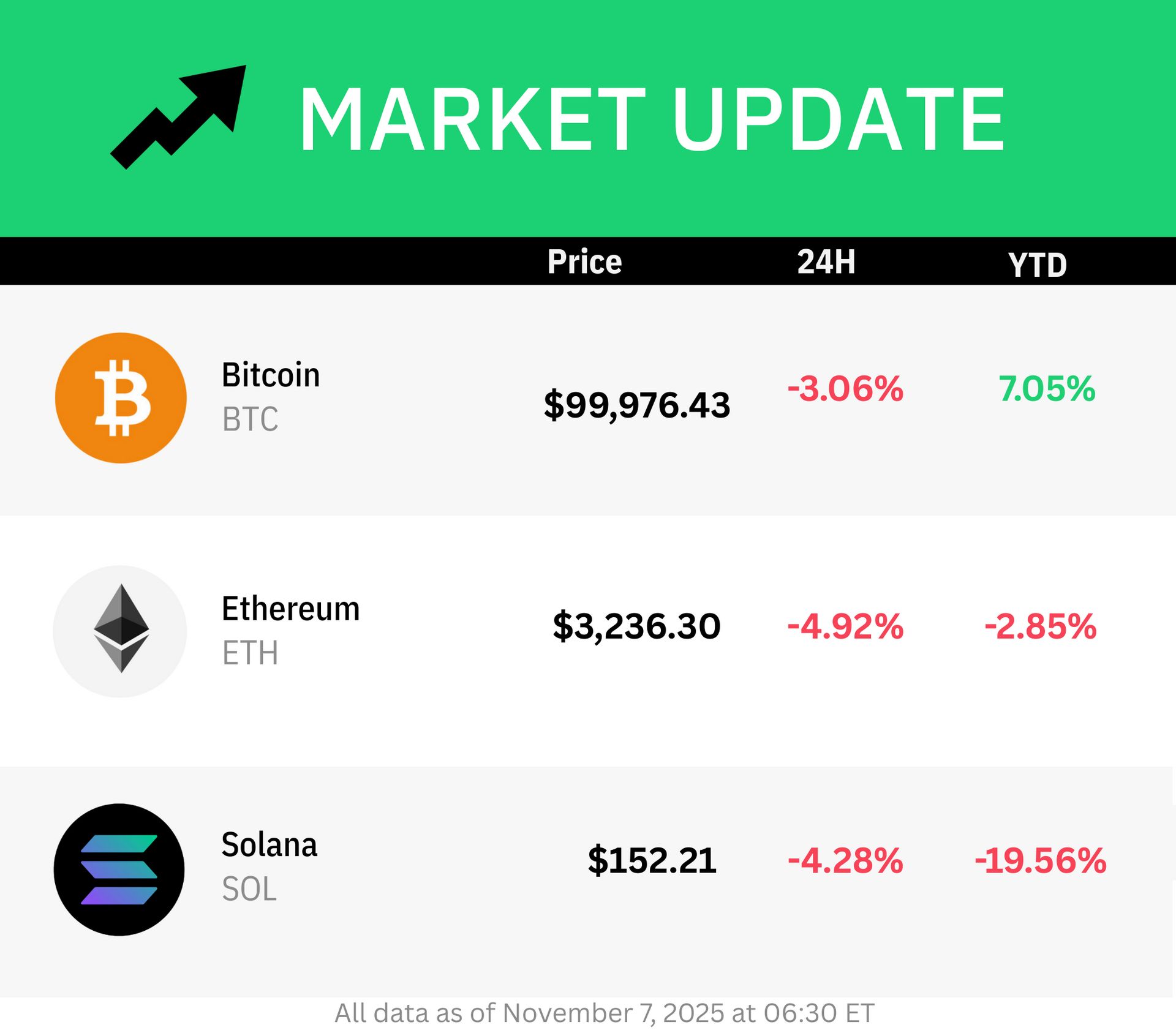

Bitcoin ETFs Lose Over $2 Billion in Second-Worst Outflow Streak

U.S. spot BTC exchange-traded funds recorded more than $2 billion in outflows over the past week, marking their second-worst withdrawal streak on record. The six-day redemption period began on Oct. 29 and has erased over $2.04 billion from the funds.

Wednesday alone saw $137 million in outflows, following heavier sessions earlier in the week. The largest single-day withdrawal occurred on Tuesday with $566 million, preceded by outflows of $470 million, $488 million and $191 million in prior sessions. The streak ranks second only to late February's sell-off, when funds experienced more than $3.2 billion in redemptions within one week.

However, the streak was broken on Thursday, with bitcoin ETFs recording $239.9 million in inflows.

Spot ether ETFs also faced sustained selling pressure, recording $118.5 million in net outflows on Wednesday. BlackRock's ETHA led the day's withdrawals with $146.6 million. Over six consecutive days, institutional investors pulled nearly $1.2 billion from ETH products, though cumulative inflows remain above $13.9 billion.

Meanwhile, Solana ETFs bucked the trend with $9.7 million in inflows on Wednesday, extending their positive streak to seven days and bringing total net additions since launch to $294 million.

Circle Pushes Equal Standards for GENIUS Act Rollout

Stablecoin issuer Circle submitted recommendations to the U.S. Treasury Department on Tuesday regarding implementation of the GENIUS Act, advocating for uniform regulations across all market participants. The company urged equal treatment for banks, nonbanks, domestic and foreign stablecoin issuers under the framework.

Circle emphasized that payment stablecoins should maintain full backing with cash and high-quality liquid assets, separated from company funds and redeemable on demand. The firm called for transparent monthly audits and public reporting to verify backing assets remain available even during issuer failures.

President Donald Trump signed the GENIUS Act into law in July, establishing a federal framework for payment stablecoins. The legislation takes effect either 18 months after enactment or 120 days following regulatory approval of implementation rules.

Circle stressed that identical compliance requirements should apply regardless of issuer type, preventing regulatory shortcuts that could expose consumers to risk. The company also requested clear enforcement consequences and safe harbor protections for good-faith compliance efforts.

⚖️ Samourai Wallet developer Keonne Rodriguez was sentenced to five years in prison for running an unlicensed bitcoin mixing service that laundered $237 million, as a New York judge said his actions went far beyond privacy advocacy and directly aided criminal networks.

💳 Major blockchain firms including Solana, Fireblocks, Polygon, Stellar, TON, and Monad formed the Blockchain Payments Consortium to create unified standards for cross-chain payments, aiming to make stablecoin transactions as smooth and compliant as traditional financial transfers.

⚠️ The Central Bank of Ireland fined Coinbase Europe $24.6 million for anti-money laundering failures that left over 30 million transactions unmonitored between 2021 and 2025, later prompting 2,708 suspicious transaction reports to authorities.

📉 The synthetic stablecoin USDX crashed below $0.60 after losing its dollar peg, prompting DeFi platforms like PancakeSwap and Lista DAO to monitor risks as users faced liquidity stress and abnormally high borrowing rates tied to the troubled token.

💀 Elixir will shut down its deUSD synthetic stablecoin after losing $68 million in the collapse of Stream Finance, saying it has already redeemed 80% of holders and will repay the rest 1:1 in USDC once a new claims portal opens.

🏦 Japan’s financial regulator backed a new project uniting the country’s top banks to issue yen-based stablecoins through MUFG’s Progmat platform, aiming to modernize payments and boost productivity while ensuring customer protection.

⚖️ Bankruptcy filings from collapsed crypto exchange Bittrex revealed over $500 million in suspicious and possibly fake transactions, raising concerns that inaccurate data could distort creditor claims for the platform’s 1.6 million former users.

🔮 Google Finance will display real-time prediction market data from Polymarket and Kalshi in search results, letting users track event probabilities directly as both platforms hit record activity and billion-dollar valuations amid a surge in mainstream interest.

💼 A PwC survey found that 55% of traditional hedge funds now hold crypto—up from 47% last year—as Trump’s pro-crypto policies, including the GENIUS Act and friendlier regulators, encouraged institutions to invest more heavily in assets like Bitcoin, Ether, and Solana.

🚀 Cross-chain trading startup Fomo raised $17 million in Series A funding led by Benchmark after processing $700 million in beta trades and attracting over 120,000 users, promising to simplify crypto trading across multiple blockchains without the need for complex bridges or gas fees.

🔗 Crypto startup Sprinter closed $5.2 million in seed funding led by Robot Ventures to expand its crosschain “solving-as-a-service” tools, which help trading bots and apps execute faster swaps by offering collateral-free credit and liquidity rewards in its native SPRINT token.

OccupyAI: The Return of the 99% by Jeff Park

The Framework Behind Ethereum's Gas Limit Increases by Kamil Chodola